4 Popular Types of IRAs to Consider for Your Portfolio

Post on: 19 Сентябрь, 2015 No Comment

Finding the Right Type of Individual Retirement Account for Your Needs

There are four popular types of IRAs that investors in the United States can use to build wealth for retirement either tax-free or tax-sheltered. Diane Macdonald / Photographer’s Choice RF / Getty Images

A common question among new investors who want to start saving for retirement is, What is an IRA contribution? I thought it would be useful to take a few moments to explain how different types of IRAs work, as well as provide a general overview of what IRA contributions are, how the limits are determined each year, and why you should seriously consider taking advantage of them if you want to build tax-sheltered, or in some cases, tax-free wealth.

A Brief Introduction to the Different Types of IRAs

In the United States, the term IRA stands for individual retirement account . An IRA isn’t a type of investment, is a type of account. If you open an IRA with a brokerage firm. you can deposit money into your IRA and use that cash to invest in stocks. bonds. mutual funds. real estate. and other asset classes .

There are many different types of IRAs, each which has its own unique pros, cons, tax rules, and quirks. The benefits are so fantastic, Congress wanted to keep them for the poor and middle class. To achieve this goal, it set IRA contribution limits that restrict the amount of new money you can add to the account each year. Otherwise, the super rich could shove their entire net worth into one of these accounts and avoid taxes entirely.

Some of the most popular IRA types include:

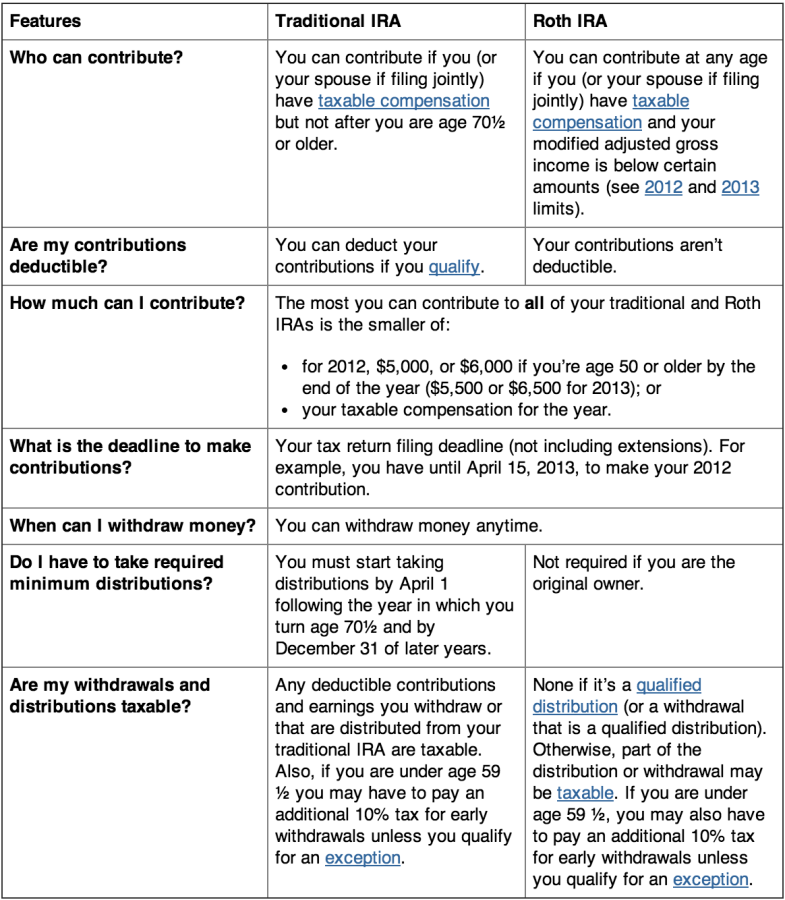

- Traditional IRAs . A Traditional IRA is the oldest type. You contribute cash and receive a tax deduction. The money in the account is sheltered from taxes until you withdraw it, possibly decades in the future. That allows you to retain your dividends. capital gains. interest income. and rents without having to send money into the IRS, resulting in more money working for you. When you take money out of the account, you pay taxes on it as if it were a paycheck. These withdrawals are known as IRA distributions. If you tap into your nest egg before you are 59.5 years old, you will have to pay a penalty tax of 10% on top of the other taxes due. You must begin taking out cash when you are 70 or older. The Traditional IRA contribution limit is set at $5,000 for tax year 2012 and scheduled to rise to $5,500 in 2013. Thereafter, it is indexed for inflation in $500 increments. Whether you can take advantage of the tax-deduction depends on your adjusted gross income. If you are 50 years or older, you can make additional contributions to an IRA above and beyond the limits. These extra deposits are known as catch-up contributions .

- Roth IRAs . Introduced in the Taxpayer Relief Act of 1997, the Roth IRA is a much better deal than a Traditional IRA. It allows you to contribute cash but you will not receive a tax deduction at the time of the contribution. However, the money grows in the account tax-free, and when you reach 59.5 years or older, you can begin taking withdrawals. The best part? Under current rules, you won’t owe a single penny in taxes on any of the wealth held in your Roth IRA. That means if you find the next Starbucks IPO and turn a $100,000 investment into $7,500,000. it’s all tax-free. The limits on the Roth IRA are identical to those on the Traditional IRA; for tax year 2012 it is $5,000, it is set to rise to $5,500 in tax year 2013, and will increase with inflation in $500 increments thereafter. As with the Traditional IRA, investors 50 years and older can deposit more money than their younger counterparts by taking advantage of the catch-up contribution limits. The downside? There are income limits to the Roth IRA. Not everyone qualifies. These change annually so make sure to check with the IRS.

- SEP-IRA : A SEP-IRA stands for Simplified Employee Pension Individual Retirement Account. The rules are much more complex and they are often used by self-employed business owners who have few or no employees. For the most part, a SEP-IRA boats the same general features as a Traditional IRA only with much higher contribution limits. Under the right circumstances, and with a high enough income ($250,000 to $500,000), a married couple who owned a successful business could make combined contributions of $100,000 or more in a single tax year. Money cannot be withdrawn early and you must start taking cash by the time you are 70 years old.

- Simple IRA : A Simple IRA is a type of retirement plan used by a lot of small business owners. As of 2012, the IRA contribution limit is $11,500 and those 50 or older can contribute an extra $2,500, bringing their contribution limit to $14,000. In terms of complexity, a Simple IRA falls somewhere between the Traditional and Roth IRA on one hand and the SEP-IRA on the other.

You Can Have More Than One IRA

The Traditional IRA and Roth IRA contribution limits are consolidated. That is, you can contribute $5,000 in total in tax year 2012 to any combination of a Traditional IRA and Roth IRA you desired but you couldn’t put $5,000 in each. It’s almost always better to fund a Roth IRA than a Traditional IRA if you qualify.

You can, however, have a SEP-IRA or a Simple IRA on top of your Traditional IRA or Roth IRA. You need to speak to a qualified tax accountant to calculate your contribution limits and discover the maximum amount of tax shelters for which you qualify.