4 Investing Strategies For Uncertain Times

Post on: 30 Март, 2015 No Comment

JonnelleMarte

Investors, brace yourselves: A recent spate of negative economic news signals the market is surely falling. Or — wait! — the clearing clouds over Europe point to brighter days ahead. And look at all those tech IPOs. Surely that’s a sign of expansion — or another bubble.

Also See:

All these mixed signals are enough to make even the savviest investors dizzy. After a three-year bull run, the stock market lately seems stuck at a crossroads, not clearly headed up, nor clearly headed for the double-dip some have predicted. The bond market hasn’t crashed — but neither has the housing market come back. As a result, investors have embraced a wide range of strategies. The percentage of fund managers who were overweight in cash tripled to nearly 20% in June from May, according to Bank of America Merrill Lynch Global Research. Other investors have opted for bond funds, which attracted almost five dollars for every dollar that went into equity funds during the second quarter, according to EPFR Global, a fund-data provider. At the same time, the IPO market is hotter than its been in years, and emerging markets funds are starting to gather significant investor cash for the first time since the end of 2010.

What’s going on? Most markets have their bulls and their bears, but typically a consensus is built. Not so this time around. Market bears certainly have plenty of ammo: The unemployment rate rose to 9.2% in June and shows no signs of improving soon. Debt worries are clouding Europe’s outlook, Japan is still reeling from its earthquake disaster and the U.S. has yet to agree on how to handle its mounting pile of I.O.U.s. The concern is that things are going to get slower this year and decelerate next year, says Jon Fisher, portfolio manager of the large cap growth strategies team for Fifth Third Asset Management.

At the same time, there are reasons to be optimistic. Manufacturing in the U.S. has picked up. Commodity prices have fallen from their peaks, meaning lower costs for companies. And perhaps most importantly, U.S. companies are expected to report strong second-quarter earnings starting this week, which some investing pros say could provide a positive catalyst for stocks. The tide has turned and is starting to go up, says Oliver Pursche, president of Gary Goldberg Financial Services in Suffern, N.Y.

Fund Resources

But for bulls and bears alike, there are smart strategies for shaky times. Some will pay off quickly if the market continues to rise; others offer downside protection if it goes the other way. And none of them are market-timing bets – all can offer strong returns, over the long haul, for investors willing to hold on.

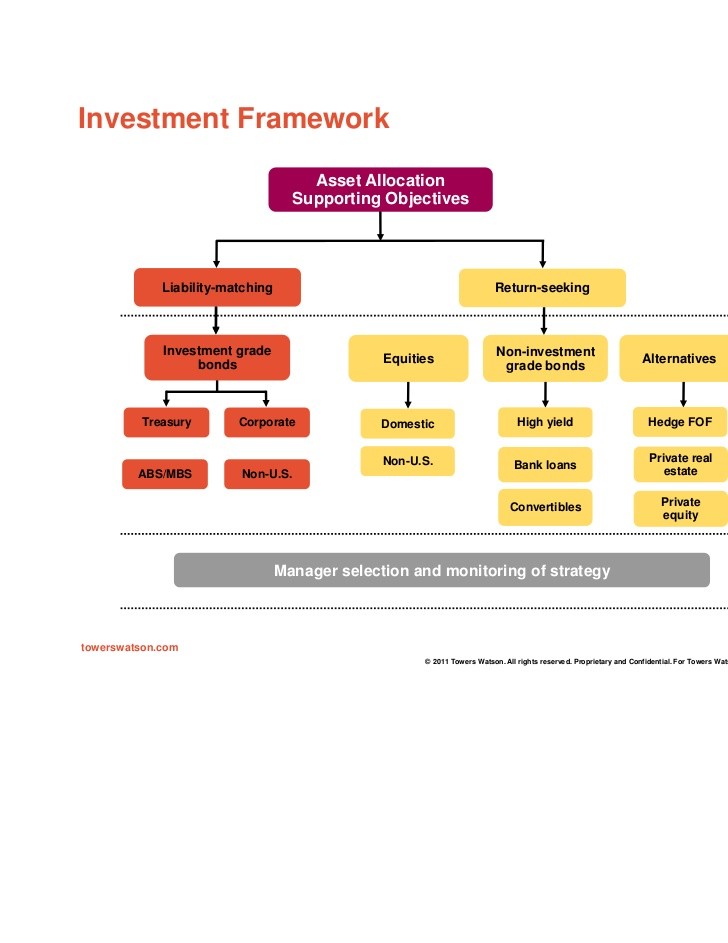

Pass the Buck

Unwilling to bet big on any one asset for the foreseeable future? Go with a fund manager with the freedom to move nimbly in and out of almost any asset class, anywhere in the world. These world allocation funds, portfolios that typically mix stocks, bonds currencies and other assets, have been growing in numbers and popularity, attracting $13.2 billion in new money so far this year, compared to the $9.8 billion over the same period last year, according to fund tracker Morningstar. Things move very quickly and it just gives them a lot of flexibility to move where the growth is, says Marilyn Plum, director of portfolio management at Ballou Plum Wealth Advisors. World allocation funds have gained an average 3.7% a year over the past three years, compared to an average 4.9% gain by moderate allocation balanced funds, according to Morningstar.

But that nimbleness can also backfire, advisers warn. The more things you can do in your portfolio the more chance you might get it wrong, says Christopher Wolfe, chief investment officer for the private banking and investment group of Merrill Lynch Wealth Management. For this reason, investors should cap allocation to these funds to roughly 20% of their overall stock portfolio, says Pursche. One option, says Michael Herbst, associate director of fund analysis for Morningstar: Pimco All Asset All Authority fund. which as returned an average 7% a year for the past three years, compared to a 4% gain by other world allocation funds. It charges .85%, or $85 for every $10,000 invested.

Bet on Quality

In uncertain times, cautious investors should up their standards, investing experts say. You want to stick to the higher quality names regardless of what investment choices you make, says Pursche. For stocks, that means large-cap, dividend-paying stocks from companies with healthy balance sheets, such as drugmaker LLY, +0.47% or wireless provider T, -1.12% says Pursche. Large-caps also tend to be very liquid and easy to sell. For fund investors, Todd Rosenbluth, a mutual fund analyst for Standard & Poor’s Equity Research, recommends the Invesco Diversified Dividend fund. which has returned an average 8.1% a year for the past three years compared to an average 4% gain by the S&P 500 Index. The fund charges .92%, or $92 for every $10,000 invested.

Fixed-income investors, on the other hand, should look for bonds rated AA or higher, which means they’re issued by stronger companies with less debt that are more capable of paying back bonds even in tough times, says Pursche. Bonds issued by riskier companies may pay higher yields, but have a greater chance of defaulting. The catch: High quality bonds typically pay lower yields than high yield bonds. Rosenbluth likes the Janus Flexible Bond fund. which invests 80% in investment grade corporate bonds, along with Treasurys. The fund has returned an average 9.1% a year for the past three years, compared to an average 6.8% gain for other intermediate investment grade corporate bond funds. It charges .7%, or $70 for every $10,000 invested.

Even though investors bailed from emerging markets following the unrest in the Middle East earlier this year, the growth potential in developing regions like Southeast Asia, South America and Eastern Europe remain strong as ever, experts say. And since the selloff, valuations are now more attractive. This global recovery is not being led by the U.S. and Europe, it’s being led by other countries around the world, says Ron Florance, managing director of investment strategy for Well Fargo Private Bank. If you’re not including emerging markets in your portfolio you’re missing half the economic opportunity. Some emerging market countries have also been more proactive about fighting inflation, a good sign for bond investors who worry rising prices will eat into their fixed payments, says Sara Zervos, a senior portfolio manager at Oppenheimer Funds.

Emerging markets are riskier than developed ones, thanks to the increase potential for political upheaval, less rigorous regulation of markets and currencies that fluctuate more often than the dollar, says Florance. He recommends allocating no more than 15% of your stock portfolio to emerging markets. One option: the Oppenheimer Developing Markets fund. which has returned an average 11.9% a year for the past three years compared to an average 4% gain by other emerging markets equity funds. The fund charges 1.35%, or $135 for every $10,000 invested.

Ride a Winner

Mid-sized companies have been on a tear so far this year, outperforming both their smaller and larger brethren. The S&P MidCap 400 Index is up 11.5% year-to-date, compared to the the S&P SmallCap 600’s gain of 10.9% and the S&P 500’s 7.6% increase. And many stock analysts and fund managers believe midcaps, defined as having a market value between $750 million and $3 billion, still have plenty of room to run. They point out that merger and acquisition activity is up 26% this year and expected to continue — a trend that tends to lift stocks, says Sam Stovall, chief investment strategist for S&P Equity Research.

Mid-sized firms also have higher potential for growth than larger caps. Earnings are expected to grow by 21% for mid-cap companies this year, compared to 17% for large-caps, according to S&P. And while smaller-caps can offer even higher growth, mid-sized firms’ returns are more stable. They’re kind of in an opportunistic sweet spot where they’re big enough to attract capital and they’re small enough to be entrepreneurial, says Florance, who increased his clients’ exposure to mid-cap stocks by 2 percentage points last month and recommends investing up to 10% of a portfolio in midcaps. For fund investors, Rosenbluth recommends the Vanguard Selected Value fund. which has returned an average 11.1% annually for the past three years compared to an average 8% gain for other mid-cap value stock funds. The fund charges .47%, or $47 for every $10,000 invested.