4 ETF plays now that the dollar has its mojo back

Post on: 9 Апрель, 2015 No Comment

JonathanBurton

Bloomberg News

SAN FRANCISCO (MarketWatch) — Your dollars now buy more — outside of the U.S. that is.

The U.S. dollar is building strength against ailing rival benchmark currencies including the euro, the Japanese yen and the British pound. The gain reflects improvement in the U.S. economy, a sea-change in Japan’s economic plan, and overall weakness in Europe that goes deeper than the recent Cyprus crisis.

As a result, dollar-based investors have some new ways to pad their wallets. Here are a few timely strategies to consider, using inexpensive, index-tracking exchange-traded funds:

1. Bank on the dollar

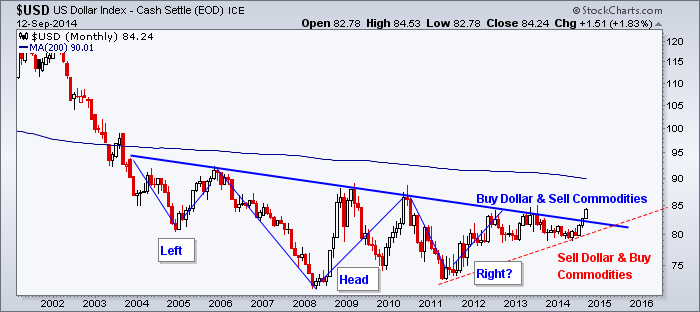

The U.S. dollar index DXY, +0.14% is up more than 3% so far this year. That’s a healthy gain in just a few months, but don’t give the currency full credit.

“It’s not that the dollar has been particularly strong,” said John Kicklighter, chief strategist at DailyFx.com. “The dollar has been advancing specifically because its alternatives have been doing worse — much worse.”

Kicklighter predicts the dollar will maintain an advantage through this year against the euro EURUSD, -0.28% the yen USDJPY, +0.16% and perhaps the Canadian dollar USDCAD, +0.28%

Why copper’s predictive role is tarnished

Copper is usually a good indicator for economic trends and equity markets. MarketWatchs Jim Jelter explains why that has changed. (Photo: AP)

Underpinning this view is his belief that both the Bank of Japan and the European Central Bank will embrace easy-money policies to stimulate their economies, weakening their respective currencies. Meanwhile, analysts at Bank of America Merrill Lynch see the euro at 1.25 by the end of 2013, down substantially from around 1.30 currently.

Kiron Sarkar, a London-based investment adviser to wealthy families, is pounding the table for the dollar because of its role as a safe haven. Sarkar expects China’s economic engine to slow significantly and the euro-zone’s fortunes to slump further, fueling U.S. dollar demand. Read more: 10 cheap global markets for investors who can handle the risk.

The mainstream ETF to play dollar strength is PowerShares DB US Dollar Index Bullish Fund UUP, -0.53% This portfolio pits the greenback against six foreign currencies: the euro; British pound; yen; Canadian dollar; Swiss franc USDCHF, +0.33% and Swedish krona.

Currency ETFs are not essential portfolio holdings, but can be used to offset the toll an appreciating U.S. dollar takes on non-dollar investments, or to speculate on the strength or weakness of a particular monetary unit. And keep in mind that currency funds aren’t geared to long-term holding, given the volatile nature of the foreign exchange markets.

2. Put cash into high-quality U.S. stocks

The strong dollar cuts the U.S. economy two ways. U.S. exporters have a tougher time competing on price in global markets, while U.S. importers and companies with primarily domestic business reap a benefit.

Companies with the highest foreign exposure are in the technology and materials sectors. U.S. multinationals with international operations and business across faster-growing emerging markets certainly have tools to handle currency risk; nonetheless many companies likely will experience pressure on profit margins from the stronger dollar.