3 Top Tech Stocks for Growth and Income in 2015 (CSCO INTC MSFT)

Post on: 9 Июнь, 2015 No Comment

Many investors in search of income tend to gravitate toward sectors like utilities, which historically have historically paid out consistent and growing dividends. While this makes sense for conservative investors, it should be noted that, tried and true dividend payers like utilities don’t do much in the way of long term growth for shareholders. Is it possible to have your cake and eat it too?

Thankfully, the answer is yes. There are a few companies out there that give shareholders a chance to benefit from both share price appreciation and industry-leading income. Even better, in order to get the best of both worlds investors need only look to tried and true names in the technology sector for some solid picks: Microsoft ( NASDAQ: MSFT ). Intel ( NASDAQ: INTC ). and Cisco ( NASDAQ: CSCO ) .

Batting lead-off

Up nearly 30% year-to-date, Microsoft shareholders have already enjoyed a nice 2014. After years of under-performing, new CEO Satya Nadella has Microsoft firmly entrenched as a leader in cloud-related solutions, an industry expected to explode in the coming years. Toss in the mobile leg of Nadella’s two pronged strategic initiative of building a mobile-first, cloud-first industry leader, and it’s no wonder investors are excited heading into 2015.

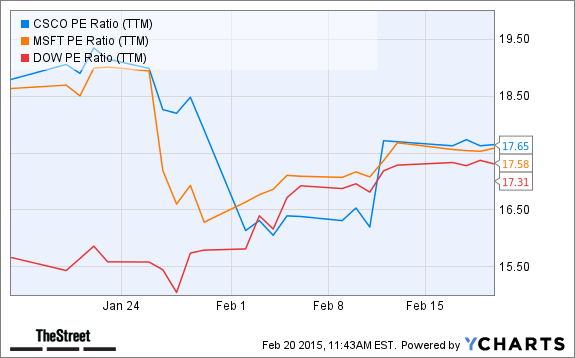

As for income, Microsoft once again boosted its dividend payout this past September — a fairly regular, annual occurrence going back several years — to $0.31 a share. Microsoft’s 2.56% dividend yield following its recent quarterly payout hike isn’t quite leading the industry, but it compares favorably with just about any tech stock. Not to mention that, with over $89 billion in cash and equivalents here in the states, you shouldn’t be surprised if Microsoft pays its shareholders even more next year.

With its cloud services unit hitting on all cylinders, a new form factor in the Surface Pro 3 pseudo-tablet, and Nadella’s willingness to open the mobile doors to the iOS and Android platforms, 2015 should be another banner year for Microsoft shareholders. And that 2.56% dividend yield? Icing on the cake.

Intel on deck

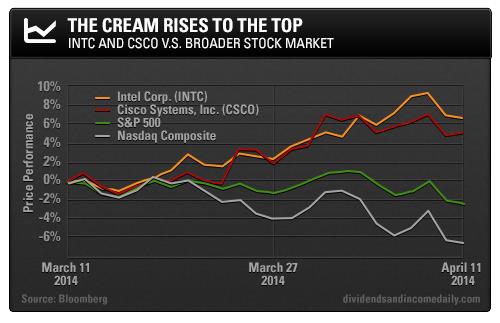

Long-suffering Intel shareholders were finally able to breathe a sigh of relief in 2014 following its stellar, 45% jump in share price. It appears investors have finally recognized that Intel, under what most agree is a solid management team led by Brian Krzanich, doesn’t need to have a chip inside every smartphone on the planet to drive increased revenues.

In fact, Intel has several tailwinds giving it a boost. Data centers to manage the ever-increasing amounts of data via cloud technologies and the Internet of Things (IoT), a stabilizing PC market, and margin improvements, led Intel to record revenues and a 20% jump in per-share earnings last quarter. To be sure, Krzanich will continue to push Intel into the next era, which includes energy efficient chips for smartphones, but its important to remember that stock performance doesn’t begin or end with mobile.

In fact, last quarter’s financial performance was so good, and the future so bright, Intel announced that it was increasing its already sound dividend payout to $0.24 a quarter beginning in 2015’s Q1. At Intel’s current share price, the increased dividend will bump its yield to 2.54%. Like Microsoft, Intel’s yield isn’t quite leading the industry, but at over 2.5% it’s nothing to sneeze at, either.

Last but not least

Similar to both Microsoft and Intel, CEO John Chambers is in the midst of shifting Cisco’s business focus to support growing markets, including cloud and IoT solutions, or the Internet of Everything (IoE), as Cisco refers to it. Cisco is also following in the other two growth and income leaders’ footsteps in that its efforts are beginning to pay off.

Cisco followed up an extremely strong fiscal Q4 2014 in August with another quarter of record revenue announced last month. Over 30% growth in server sales in this year’s calendar Q3 along with significant wins in bringing Cisco’s smart city solutions to communities around the globe were more than enough to get investors onboard, and rightfully so. Smart cities may sound like a futuristic dream, but thanks to Cisco, they’re already a reality in cities like Hamburg and Berlin, along with communities in India.

Considering smart cities are expected to become a $1.5 trillion industry over the next 10 years, and Cisco is positioning itself as a leader, there’s plenty of growth to be had. In addition to Cisco’s outstanding 2.76% dividend yield, it’s trading at a meager 12.8 times forward earnings according to estimates at S&P Capital IQ. making it a great value play as well. For investors in search of growth and income in 2015, Cisco should make your list.

1 stock that could be the Income Play of a Lifetime