3 Simple Steps to Build Your Wealth

Post on: 29 Март, 2015 No Comment

Share this:

Building your wealth takes time and the knowledge of how to make wise decisions with your money. Its not a get rich quick scheme. Its not about becoming a millionaire overnight. The aim is to make, save and invest money to accumulate more money over time and make your money work for you.

Here are three simple things you can do to build your wealth:

1. Evaluate your spending habits and your money mindset

Most people dont know their mindset can cause them to make decisions about money that are not in their best interest. From a very young age, we adopt ideas and beliefs about money from our family. If your parents said things like ‘I can’t afford it’, ‘I don’t have enough money’, ‘It’s hard to make ends meet’ or ‘Money doesn’t grow on trees’, it is likely you picked up on these beliefs and they became your own. You may have even catch yourself saying the same things to your kids as your parents said to you!

During adulthood, those beliefs continue to exist in your subconscious mind. If you’re not aware of it, you may not realise you are imitating the same money mistakes your family have made. For example, if you grew up with parents who were up to their eyeballs in debt and continued to use credit cards, you may develop the belief that its okay to be in debt and continue to borrow money from another source.

Your money mindset has a lot to do with how you make decisions. Take some time to reflect on your beliefs about money. What are they? Where did they come from? Are they your beliefs or someone else’s? Then take a close look at your spending habits. How and where you spend your money is the manifestation of the beliefs you hold about money.

If you want to change your relationship with money, find ways to help you reprogram your mind. Spend time with wealthy people, read books, listen to audio or attend seminars; whatever changes your environment and guides you toward better financial choices.

2. Track your expenses and create budgets

Knowing how much you are making, how much you are spending and how much debt you have each month will help you get a better idea of where youre currently at with your money. This information will also assist you in making financial goals and show you where you can save more money. Find ways to trim the fat and save or invest the extra money to build your wealth.

For instance, do you really need to buy a coffee every day, or can you save the $4? It might not seem like much, however it adds up over time. If you buy coffee every day for a year, it will cost you around $1460. If you spend $10 on lunch every day, that’s $3650 per year. If you switch to making your own lunch, not only would you save a significant amount of money, you would probably be eating healthier too!

Create a realistic budget for your expenses and stick to them. Budgets are designed to help you make better decisions about money and encourage you to save money. Measure the difference between your budgeted figures and your actual figures and fine tune your budget as needed over the next couple of months.

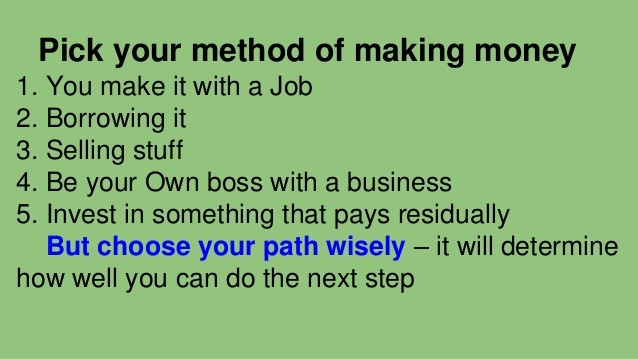

3. Bring in extra income with a small business

If you have a full-time job, you can start a small business on the side. Write a list of all the possible business ideas you can think of. Put everything down on paper, even if it seems totally wacky. Then choose a couple of your best ideas for a short list. Make sure your business is something you enjoy doing, or you won’t be motivated to do it in your spare time.

Conduct some market research on the industry and the target market. Find out who will buy your product or service, where can you find them and how much they are willing to pay for it. Then figure out how you will deliver your product or service profitably and get some clients! The extra income will help pay your expenses and the bonus cash flow can also be used to build your wealth faster.