3 Market warning signs predict 20% stock tumble

Post on: 8 Июль, 2015 No Comment

MarkHulbert

Shutterstock.com

Over the past 45 years, the stock market has lost more than 20% each time three warning signs flashed simultaneously.

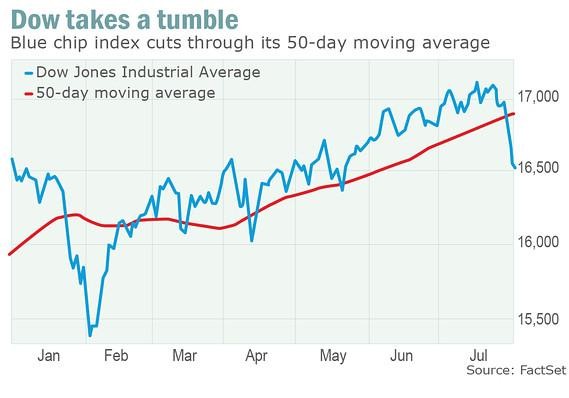

After a selloff this past week dragged the Dow Jones Industrial Average DJIA, -1.16% into negative territory for the year, it’s worth noting that all three are flashing today.

Are stocks due for a 20% slide?

Mark Cook, a veteran investor who called three previous market crashes, believes the U.S. market is in trouble, to the tune of a 20% pullback. He joins MoneyBeat to explain. Photo: Getty Images.

The signals are excessive levels of bullish enthusiasm; significant overvaluation, based on measures like price/earnings ratios; and extreme divergences in the performances of different market sectors.

They have gone off in unison six times since 1970, according to Hayes Martin, president of Market Extremes. an investment consulting firm in New York whose research focus is major market turning points.

Bear in the air

The S&P 500’s SPX, -0.95% average subsequent decline on those earlier occasions was 38%, with the smallest drop at 22%. A bear market is considered a selloff of at least 20%, with bull markets defined as rallies of at least 20%.

In fact, no bear market has occurred without these three signs flashing at the same time. Once they do, the average length of time to the beginning of a decline is about one month, according to Martin.

The first two of these three market indicators — an overabundance of bulls and overvaluation of stocks — have been present for several months. Back in December, for example, the percentage of advisers who described themselves as bullish rose above 60%, a level Investors Intelligence, an investment service, considers “danger territory.” Its latest reading, as of Wednesday, was 56%.

Also beginning late last year, the price/earnings ratio for the Russell 2000 index of smaller-cap stocks, after excluding negative earnings, rose to its highest level since the benchmark was created in 1984 — higher even than at the October 2007 bull-market high or the March 2000 top of the Internet bubble.

Three strikes and you’re out

The third of Martin’s trio of bearish omens emerged just recently, which is why in late July he advised clients to sell stocks and hold cash. That’s when the fraction of stocks participating in the bull market, which already had been slipping, declined markedly.