25 Things Every Financial Advisor Should Know About Commodities

Post on: 24 Апрель, 2015 No Comment

Commodities are potentially very powerful investments, but they also come with their fair share of risks. In recent years, investors and advisors have begun to adopt commodities into portfolios, as many have seen the benefits of adding these low-correlated assets to a group of holdings. The launch of a robust lineup of exchange-traded products that utilize both physical commodities and commodity futures contracts has brought commodities to the masses; they’re no longer reserved for the largest and most sophisticated investors.

But as these assets have become more widely available, so too has the confusion on how to properly use them for clients without getting burned. While Commodity education must be an ongoing process, there are a number of basics that can enhance overall understanding, identify opportunities and limitations, and generally promote a better experience with these hard assets [see also The Ten Commandments of Commodity Investing ]:

1. Futures Do Not Equal Spot

This might seem like a very basic point, but it is of extreme importance for any financial professional considering the addition of commodities to investor portfolios. Just about every account of a commodity investment gone bad comes back to a failed understanding of this concept, which can have a huge impact on bottom line returns.

Many investors establishing positions in commodity-focused productswhether futures contracts, ETFs, or some other type of securitydo so because they believe that the spot price of that natural resource will rise. But its important to understand that the majority of commodity products do not offer exposure to the spot price of the underlying resourcethats only one of the factors that ultimately contributes to bottom line returns [see also Three Things Wall Street Journal Didn’t Tell You About Commodities ].

Most commodity ETPs, for example, utilize futures contracts to achieve their investment objectives. And futures-based strategies often deliver results that vary dramatically from hypothetical investments in spot commodities (which, in many cases, are not practical; it would be prohibitively expensive to take physical possession of livestock or natural gas ).

When investing in futures contracts, returns ultimately depend on three factors:

- Changes in spot price of underlying commodity

- Slope of futures curve

- Interest earned on uninvested cash

In many environments, factor #2 above can have a huge impact on returnsfrequently acting as a drag on performance.

Bottom Line: Its tough to invest in spot pricesand the closest alternatives often deliver very different returns.

2. Commodities and Dividends Can Align

Recent years have seen record low interest rates and investors starved for strong yields. As such, many have turned to the comfort of dividend-yielding securities to maintain a steady stream of income for their portfolios. While this method has generally been effective, it has caused investors to overlook some vital asset classes, like commodities. When most investors think of commodities, they think of futures contracts or ETFs that track said futures; nowhere in their mind is a dividend yield. But there are a number of more indirect plays on the commodity world that offer dividend yields that should not be overlooked [see also 12 High-Yielding Commodities For 2012 ].

To find these yields, investors and advisors will have to look to the equity side of the equation. This will typically involve miners or producers of commodities who still have heavy ties to the underlying asset, but are not necessarily a direct play on it. A great example comes from the Junior Gold Miners ETF (GDXJ ). This fund tracks a basket of small cap gold miners to allow investors to make an equity spin on this precious metal. But GDXJ also has another draw, its dividend yield is just north of 5%, allowing it to amass more than $2 billion in total assets.

The takeaway here is that investors searching for yield can still add the vital exposure of commodities to their portfolio, it simply requires a bit more research to find the securities that are a good fit for each portfolio.

Bottom Line: Commodity investments can still offer yield, you just have to look for them.

3. Watch Your Tax Rates

Theres nothing to ruin a stellar investment call like a huge tax billespecially when its unexpected. When it comes to investing in commodities through exchange-traded products or other strategies, there are a number of tax-related nuances that can catch investors off guard. Its worth the time to carefully research the tax implications of an investment before establishing a position, as the details of product structure can end up having a big impact on bottom line returns.

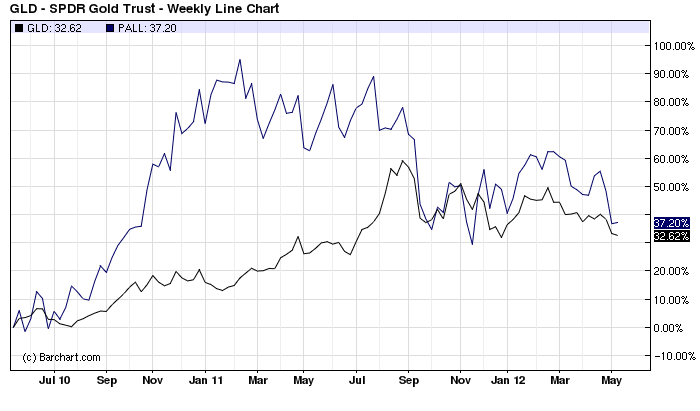

For example, physically-backed gold ETFs such as the Gold SPDR (GLD) are taxed at the collectibles rate of 28% regardless of the holding period, meaning that any profits earned from this precious metal will incur significant obligations to Uncle Sam [see The Best Gold ETF. Isn’t An ETF ]. Another nuance relates to products that use futures to achieve their objectives and structure themselves as partnerships (DBC, USO and UNG all fall into this category). These commodity ETPs will deliver a K-1 to investors at the end of the year, and will incur taxes at a blended rate of about 23% regardless of holding period. Moreover, tax liabilities are generally incurred on an annual basiseven if you didnt sell a position.