2013 Bond Market Outlook

Post on: 12 Июль, 2015 No Comment

Please refer to our privacy policy for contact information.

The 2014 Bond Market Outlook is now available here .

Full-year 2013 bond market performance overview, return data, and timeline: The 2013 Bond Market Year in Review is now available here .

Executive Summary

- While the odds are against a major bond market collapse in 2013, investors nonetheless need to temper their expectations given that low yields are creating a less attractive trade-off of risk and reward.

- The Federal Reserve’s low-rate policy remains a key pillar of support for the market.

- The potential for rising inflation and the possibility of destructive government policy are the largest risk factors in 2013.

Variables Abound in the 2013 Bond Market Outlook

Determining an accurate outlook for the financial markets is never an easy task, but the 2013 bond market outlook is even more challenging than usual. The reason? While nearly all of the factors that helped bond market performance in the past two years remain firmly in place, bond yields are at extremely low levels compared to history. This indicates that yields have less room to fall (and by extension, for prices to rise ) than was the case one or two years ago. At the same time, it leaves a greater latitude for yields to rise (and prices to fall) if one or more elements of the fundamental backdrop were to change. Fixed-income investors are therefore looking at one of two scenarios:

- The investment backdrop improves or stays the same. In this case, the overall bond market would likely deliver returns within one to two percentage points of its yield in 2013.

- The investment backdrop takes a turn for the worse. Under this scenario, bonds could have significant downside.

That’s obvious enough. The primary question, of course, is assigning probabilities to these two outcomes. While the first scenario is more likely to play out in 2013 than the second, investors still need to be aware that the balance of risk and reward is much less favorable now than it was coming into 2012. Bonds certainly can continue to provide safety. diversification. and modest levels of income – just don’t expect the same type of outstanding returns we witnessed in the 2011-2012 period. And if the investment backdrop is anything but ideal, fixed income investors could be looking at a very challenging year.

Keep in mind, however, that only very rarely do investment-grade bonds produce a negative return in a given calendar year. From 1980 through 2011, the Barclays Aggregate U.S. Bond Index finished in the red only once, in 1994. The record for high yield bonds is less impressive, but still positive with positive returns in 24 of the 29 calendar years through 2012.

With this said, what factors could help or hurt bonds in 2013?

Factors Supporting the Bond Market

Although the risk-reward tradeoff has become less attractive, there are still a number of important positive factors that reduce the odds of a major meltdown for the bond market in 2013:

1) The most important — Fed policy. The U.S. Federal Reserve has that it will not consider raising short-term interest rates until unemployment reaches 6.5% or inflation climbs above 2.5%. In addition, the Fed continues to pursue its quantitative easing program. The tremendous level of support from the Fed makes a major sell-off in U.S. Treasuries unlikely barring a major drop in unemployment or a jump in inflation, which in turn helps support the performance of other high-quality market segments.

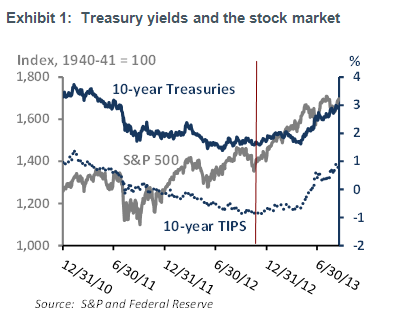

Update, June 11, 2013: Fed Chairman Ben Bernanke has altered the equation by stating that the Fed could begin tapering the pace of quantitative easing. which sparked a large sell off in bonds during May. Find out the implications of this shift in my June 2013 article The Bull Market in Bonds is Over .

2) Low inflation. Inflation remains low, and there is no sign of any inflation on the immediate horizon despite widespread concern that the stimulative policies of the Fed will lead to higher prices.

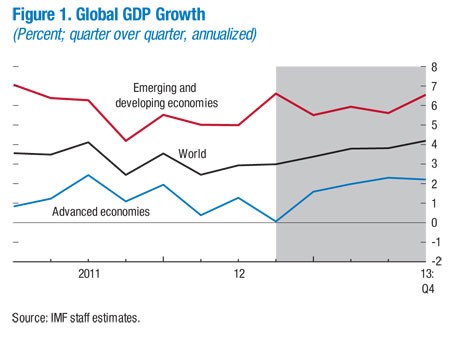

3) The slow growth environment continues. Economic growth remains thoroughly stagnant, and with higher taxes on tap for 2013 there is little to suggest that it will accelerate from its current rate in the 1-2% range. (Stronger economic growth makes the Fed more likely to raise rates, which hurts bond prices. while slower growth does the opposite).

5) Investors’ continued search for yield. The “spread sectors” of the bond market – in other words, the non-Treasury segments that trade based on their “yield spread ” (or advantage) over Treasuries – should continue to find support from investors’ search for higher-yielding alternatives to the safer areas of the market. This has been – and given the Fed’s low-rate policy – a positive factor supporting corporate. high yield. and emerging market bonds. At the same time, municipal bonds are likely to perform well in any environment since taxes are likely to go up no matter what the final outcome.

What Could Go Wrong for the Bond Market?

1) Higher-than-Expected Inflation. Of the five pillars of support laid out above, the one with the greatest likelihood of producing a negative surprise in 2013 is number two – inflation. While the current annual headline inflation reported by the government is fairly tame at about 2% or less, the Federal Reserve and other global central banks have been pumping money into the global financial system in recent years. The reason this could cause higher inflation is simple: a higher supply of money is chasing essentially the same amount of goods and services, which in theory should drive up prices. This scenario hasn’t yet played out due to sluggish economic growth, but there is a strong chance that it could in the coming years. Once it does, Treasury yields will begin to climb in anticipation of tighter Fed policy, and the bull market in bonds will likely unravel. If this happens sooner than expected, bonds will suffer accordingly. Again, this is not the most likely scenario, but rather the most important risk factor to consider.

2) Adverse Policy Developments. While the fiscal cliff has been resolved, U.S. lawmakers still have to vote to raise the debt ceiling .Investors expect the issue to be resolved – albeit at the last minute – and any failure to do so would cause higher-risk assets to decline in price, but it would likely boost Treasuries and Treasury Inflation-Protected Securities (TIPS) but cause corporate, high yield, and emerging market bonds to lose ground. Again, however, the likelihood of a worst-case scenario is small, and the issues should be wrapped up sometime in the first calendar quarter.

3) Unforeseen Risk Factors. The two issues above are “known unknowns,” as Defense Secretary Donald Rumsfeld once put it. This leaves the “unknown unknowns,” or risk factors that come out of the blue. Examples would be a sudden and surprising deterioration of the Chinese economy, a worst-case scenario emerging from the European debt crisis (such as a collapse of the eurozone), or a severe downturn in the global equity markets. Typically, these types of issues benefit U.S. Treasuries but weigh heavily on higher-risk market segments such as high yield and emerging market bonds.

Bonds Becoming Less Competitive Vs. Stocks

The other issue with the potential to impact the bond market is the flood of investor cash that has moved out of stocks and into bonds in recent years. Absolute yields are so low that it has become almost mathematically impossible for bonds to replicate their recent returns. Stocks, meanwhile, offer investors competitive dividend yields and the potential for earnings growth. As a result, an surprising improvement in the economic outlook could attract capital away from bonds and into equities — a concept that became known as the Great Rotation .

The Bottom Line

Naturally, nobody knows what surprises will emerge in the year ahead. But one thing is certain: with bond yields so low, the potential impact of adverse headlines is higher than usual as we move into 2013. Put it all together, investors should expect the following from the bond market in the year ahead:

- Continued low yields

- Higher volatility

- Lower price appreciation than we’ve seen in recent years, but with returns within one to two percentage points above or below current yields

Outlook By Asset Class

The outlook for each segment of the bond market differs based on individual factors specific to each. Below are links to specific outlooks for each of the major segments:

What the Experts are Saying

This section will be continually updated with new perspectives through year-end.

Below are some notable quotes regarding the bond market by fixed-income investment managers and financial-market experts. All were made in November-December, 2012, and they carry a distinctly negative tone. All parentheses are mine, inserted to eliminate as much jargon as possible:

Thomas Fahey, Loomis Sayles. The math of fixed income returns becomes more difficult with a steady decline in yields. Instead of high-single-digit returns on investment grade corporate bonds and even double-digit returns on high yield and emerging market bonds, investors need to adjust their expectations lower. Bonds can still generate positive returns, but going forward, a fixed income investor’s return should be closer to the yield a bond offers when it is purchased and should not incorporate much in the way of price appreciation.

Bill Gross. PIMCO Chief Investment Officer: “Investors should expect future annualized bond returns of 3% to 4% at best and equity returns only a few percentage points higher.”

Rick Rieder, Blackrock Chief Invesment Officer: Fixed-income is becoming an asset class with more risk to it, and I think people underestimate that. It would take very little in the way of a rate increase for investors to lose their total returns across many traditional fixed income sectors.”

Jeffrey Gundlach, Founder of Doubleline Capital: I would not be surprised to see some pressure on Treasury rates (i.e. rising yields) next year. We have to ratchet down our expectations for fixed income next year. I don’t think interest rates are about to explode higher. I think they can rise modestly.

Lloyd Blankfein, Goldman Sachs CEO: One of the big risks that’s looming is complacency. People are once again complacent about the low level of interest rates. At some point (economic) growth will come back. I think its going to come back sooner than people think. Now what’s going to happen when growth comes back (and) interest rates rise? That will have an effect on portfolios and people will have losses.

Fitch Ratings: The persistence of abnormally low interest rates and the inevitable reversion to higher levels is an issue with many dimensions, affecting financial markets, credit conditions, and economic growth. The timing, pace, and magnitude of future rate increases is critical to how these risks play out. If policymakers are able to manage a phased transition to higher rates, the potential bond bubble could deflate over time, enabling investors to adapt accordingly. A more sudden, severe rate increase would pose greater risks. Monetary policy will likely remain accommodative for the next several years, reducing the near-term likelihood of a rate increase. However, a continuation of current policies could exacerbate financial market imbalances and the ultimate risks to investors.

Michael Gavin, head of asset allocation research at Barclays: There’s been a 30-year bull market in bonds, and safe bonds have done almost nothing but go up in value. That’s all just about to be thrown into reverse. (Bond markets) are going to become wealth destroyers, and we think that will begin sometime in 2013.”

JP Morgan: “A stable macro(economic) backdrop, additional Fed stimulus, and an acute supply-demand imbalance in fixed income are all supportive of (non-Treasury) spread product in 2013. (Corporate bonds, mortgage-backed securities. and emerging markets) should perform well but generate lower returns than this year. With yields low, however, (overall debt levels are) set to increase, sowing the seeds for an ultimately weaker credit environment… We look for 10-year Treasuries to trade in a 1.50-2.0% range in 2013 as the year proves part of a longer-term transition between bull and bear markets.”

Gus Sauter, Vanguard Chief Investment Officer: We do think there’s a bubble in the bond market, not necessarily that it will burst in the next year or so, but at some point the bond market’s going to experience some difficulty.

John Mackay, Bond Strategist at Morgan Stanley Smith Barney. “Obviously the bull market in bonds will end at some point, but I don’t think it’s going to happen any time in the next year or so.”

Christine Thompson, Chief Investment Officer (CIO) of Fidelity’s bond group: “We don’t expect total returns in 2013 to match 2012. The market’s just not priced to deliver returns similar to this year.”

Andreas Utermann, CIO of Allianz Global Investors: “(The bond market)’s got to be the biggest bubble out there. The question is not only, can it burst — it must burst.”

Michael Sabia, Chief Executive of the money manager Caisse de dpt et placement du Qubec, quoted in the Financial Times: “Over the last three to four years returns on fixed income have been amazing – almost equity-like… our view on this is that the party is over, that therefore the eight to nine (percent returns) we were earning are going to be replaced with twos, threes, maybe fours.”

Michael Hoover, Portfolio Manager at Caprin Asset Management: “…And so we find the prevailing belief that, ‘I cannot lose money in bonds’ because that’s what history has shown. Even when investors buy bonds to earn 1.50% over ten years, they think only about the lower rate of interest they’ll receive, and not appreciate the emotional consequences of their ‘safe money’ possibly falling 7% in value. The successful financial advisor will want to help his clients avoid the angst that will come from an extended bear market in bonds. Just think about the $900 billion that has gone into bond funds in just four years. How much of that will stampede for the exits – at any price, ASAP — when emotions take over? Our bias is not to wait until after the train wreck to clean up the mess. We’d prefer to address risk and reposition portfolios before the bear market arrives.”

Marc Doss, regional chief investment officer at Wells Fargo Private Bank: We’re really worried about investors in bond funds. They don’t realize you’re going to lose 20 to 30 percent in those funds when you actually just normalize (interest) rates (from their current levels near zero). That transition won’t be easy.

Adam Parker, Managing Director. Morgan Stanley. In 2013, I would tell the average person not to worry about bond prices suddenly falling off (a cliff). The government is not going to let bond yields rise.

BMO Capital Markets: Despite periods of volatility, we expect the impact from the Fed (keeping short-term rates at zero) combined with heavy Fed purchases (via quantitative easing) to keep rates low in 2013.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.