20082009 Financial Crisis Causes and Effects

Post on: 22 Сентябрь, 2015 No Comment

The 2008 financial crisis is affecting millions of Americans and is one of the hottest topics in the Presidential campaigns. In the last few months we have seen several major financial institutions be absorbed by other financial institutions. receive government bailouts. or outright crash .

So what caused the financial crisis of 2008? This is actually the perfect storm which has been brewing for years now and finally reached its breaking point. Lets look at it step by step.

This video explains the economic crisis:

Market instability

The recent market instability was caused by many factors, chief among them a dramatic change in the ability to create new lines of credit, which dried up the flow of money and slowed new economic growth and the buying and selling of assets. This hurt individuals, businesses, and financial institutions hard, and many financial institutions were left holding mortgage backed assets that had dropped precipitously in value and werent bringing in the amount of money needed to pay for the loans. This dried up their reserve cash and restricted their credit and ability to make new loans.

There were other factors as well, including the cheap credit which made it too easy for people to buy houses or make other investments based on pure speculation. Cheap credit created more money in the system and people wanted to spend that money. Unfortunately, people wanted to buy the same thing, which increased demand and caused inflation. Private equity firms leveraged billions of dollars of debt to purchase companies and created hundreds of billions of dollars in wealth by simply shuffling paper, but not creating anything of value. In more recent months speculation on oil prices and higher unemployment further increased inflation.

How did it get so bad?

Greed. The American economy is built on credit. Credit is a great tool when used wisely. For instance, credit can be used to start or expand a business, which can create jobs. It can also be used to purchase large ticket items such as houses or cars. Again, more jobs are created and peoples needs are satisfied. But in the last decade, credit went unchecked in our country, and it got out of control.

Mortgage brokers, acting only as middle men, determined who got loans, then passed on the responsibility for those loans on to others in the form of mortgage backed assets (after taking a fee for themselves originating the loan). Exotic and risky mortgages became commonplace and the brokers who approved these loans absolved themselves of responsibility by packaging these bad mortgages with other mortgages and reselling them as investments.

Thousands of people took out loans larger than they could afford in the hopes that they could either flip the house for profit or refinance later at a lower rate and with more equity in their home which they would then leverage to purchase another investment house.

A lot of people got rich quickly and people wanted more. Before long, all you needed to buy a house was a pulse and your word that you could afford the mortgage. Brokers had no reason not to sell you a home. They made a cut on the sale, then packaged the mortgage with a group of other mortgages and erased all personal responsibility of the loan. But many of these mortgage backed assets were ticking time bombs. And they just went off.

The housing market declined

The housing slump set off a chain reaction in our economy. Individuals and investors could no longer flip their homes for a quick profit, adjustable rates mortgages adjusted skyward and mortgages no longer became affordable for many homeowners, and thousands of mortgages defaulted, leaving investors and financial institutions holding the bag.

This caused massive losses in mortgage backed securities and many banks and investment firms began bleeding money. This also caused a glut of homes on the market which depressed housing prices and slowed the growth of new home building, putting thousands of home builders and laborers out of business. Depressed housing prices caused further complications as it made many homes worth much less than the mortgage value and some owners chose to simply walk away instead of pay their mortgage.

The credit well dried up

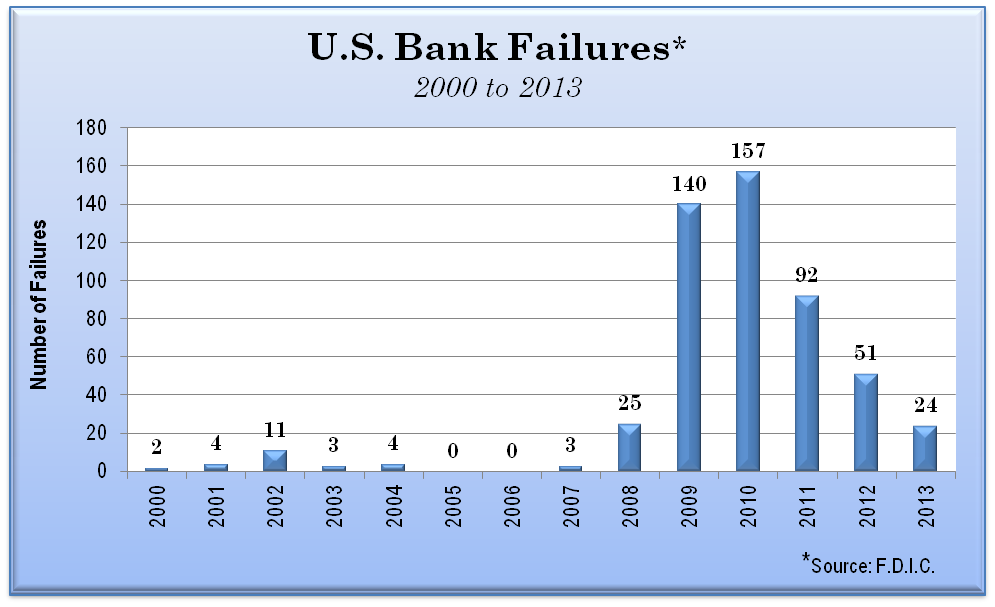

These massive losses caused many banks to tighten their lending requirements, but it was already too late for many of them the damage had already been done. Several banks and financial institutions merged with other institutions or were simply bought out. Others were lucky enough to receive a government bailout and are still functioning. The worst of the lot or the unlucky ones crashed.

The Economic Bailout is designed to increase the flow of credit

Many financial institutions that are saddled with risky mortgage backed securities can no longer afford to extend new credit. Unfortunately, making loans is how banks stay in business. If their current loans are not bringing in a positive cash flow and they cannot loan new money to individuals and businesses, that financial institution is not long for this world as we have recently seen with the fall of Washington Mutual and other financial institutions.

The idea behind the economic bailout is to buy these risky mortgage backed securities from financial institutions, giving these banks the opportunity to lend more money to individuals and businesses, hopefully spurring on the economy.

What? Credit got us into this mess! Why give more.

Ironic isnt it? Yes, it is true that credit got us into this mess, but it is also true that our economy is incredibly unstable right now, and being that it is built on credit, it needs an influx of cash or it could come crashing down. This is something no one wants to see as it would ripple through our economy and into the world markets in a matter of hours, potentially causing a worldwide meltdown.

As I previously mentioned, credit in and of itself is not a bad thing. Credit promotes growth and jobs. Poor use of credit, however, can be catastrophic, which is what we are on the verge of seeing now. So long as the bailout comes with changes to lending regulations and more oversight of the industry, along with other safeguards to protect taxpayer dollars and prevent thieves from not only getting of the hook, but profiting again, there is potential to stabilize the market, which is what everyone wants. Whether or not it works is to be seen, but as it has already been voted on and passed, we should all hope it does.

Want more opinions? Check out this article on the same topic: