2008 Financial crisis impact still hurting states

Post on: 4 Сентябрь, 2015 No Comment

Recession forced across-the-board spending in many states, hitting education and hiring.

Story Highlights

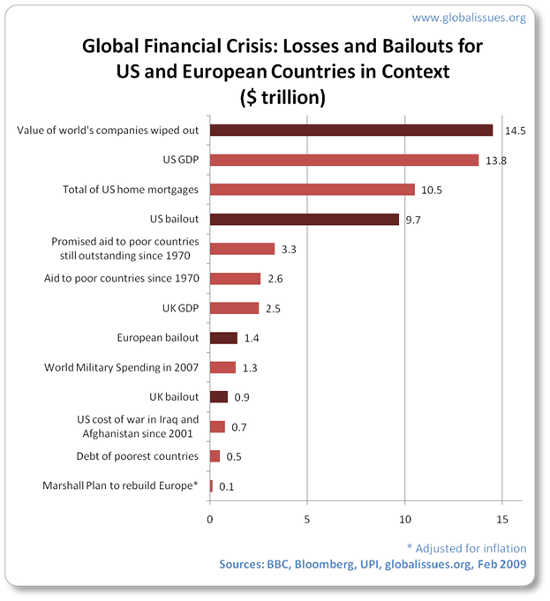

- One Federal Reserve estimate says USA lost a years worth of GDP — $14 trillion from 07 to 09 Homeownership rates continue to decline despite years of economic recovery Lackluster job growth has also outlived the downturn that followed 2008 financial crisis

The effects of the worst economic downturn since the Great Depression are forcing changes on state governments and the U.S. economy that could linger for decades.

By one Federal Reserve estimate, the country lost almost an entire year’s worth of economic activity – nearly $14 trillion – during the recession from 2007 to 2009.

The deep and persistent losses of the recession forced states to make broad cuts in spending and public workforces. For businesses, the recession led to changes in expansion plans and worker compensation. And for individual Americans, it has meant a future postponed, as fewer buy houses and start families.

Five years after the financial crash, the country is still struggling to recover.

In the aftermath of [previous] recessions there were strong recoveries. That is not true this time around, said Gary Burtless, a senior fellow at the Brookings Institution. This is more like the pace getting out of the Great Depression.

A lost decade in housing

For years, housing served as the backbone of economic growth and as an investment opportunity that propelled generations of Americans into the middle class. But the financial crisis burst the housing bubble and devastated the real estate market, leaving millions facing foreclosure, millions more underwater, and generally stripping Americans of years’ worth of accumulated wealth.

Anthony B. Sanders, a professor of real estate finance at George Mason University, said even the nascent housing recovery can’t escape the effects of the recession.

Home values may have rebounded, he said, but the factors driving that recovery are very different than those that drove the growth in the market in the 1990s and 2000s. Sanders said more than half of recent home purchases have been made in cash, which signals investors and hedge funds are taking advantage of cheap properties. That could freeze out average buyers and also means little real economic growth underpins those sales.

Those effects are clear in homeownership rates, which continue to decline. In the second quarter of this year, the U.S. homeownership rate was 65.1%, according to Census Bureau data, the lowest since 1995. In the mid-2000s, it topped 69%, capping a steady pace of growth that began after the early 1990s recession.

Reversing that will be a challenge, in part because credit has tightened and lending rules have been toughened in an effort to avoid the mistakes that inflated the housing bubble in the first place.

Credit expanded, and now contracted, and it’s going to be tight like this as far as the eye can see, Sanders said. We so destroyed so many households when the bubble burst, there’s just not the groundswell to fill the demand again.

Some are skeptical that the tight credit market and new efforts to regulate the financial markets, like the Dodd-Frank law, will prove lasting. Americans have often responded with calls for regulation after financial sector-driven crises and accusations of mismanagement, according to Brookings’ Burtless.

But eventually, those fires cool down, he said. It’s not as though this memory of what can go wrong sticks with us very long.

That can be seen in the intense efforts to water down Dodd-Frank’s regulations, Burtless said. Federal regulators have already made moves to relax requirements for some potential homeowners who were victims of the recent housing crisis.

Even those steps and an unlikely return to easy credit might not fuel a full housing recovery without economic growth to back it up. As Sanders, referring to the growth in low-wage and part-time employment, put it: At those wages, it’s tough to scramble together down payments and mortgages.

Turmoil in the housing market has already reshaped the makeup of households nationwide. Homeownership rates among people with children under 18 fell sharply during the recession, declining 15% between 2005 and 2011, according to Census Bureau data.

In some states it was far worse. For Michigan, the decline in homeownership was 23%, and in Arizona and California it was 22%.

Slow job rebound

Lackluster job growth has outlived the downturn. A study by the Economic Policy Institute showed wages for all workers, when adjusted for inflation, grew just 1.5% between 2000 and 2007. But the last five years wiped out even those modest gains—the study found wages declined for the bottom 70% of all workers since the recession began.

However, some areas have seen manufacturing jobs climb back from recessionary lows, and the energy sector has been a boon for some Midwestern states.

One hopeful sign for workers is the shift away from manufacturing growth in the typically low-wage South back toward the Rust Belt states, reversing a movement that was taking hold before the downturn. That trend is documented in a 2012 report from the Brookings Institution, Locating American Manufacturing: Trends in the Geography of Production.

From 2000 to 2010, both the Midwest and South lost manufacturing jobs at about the national rate of 34%. But the Midwest has seen nearly half of all manufacturing jobs gained since 2010, almost double the increase in the South. For Michigan, the growth was 19%; in Indiana, 12%.

Even with that growth, there are caveats. Autoworker unions have ceded ground with companies on wages and benefits, for example, allowing new hires to work for lower pay and fewer benefits than those who’ve held their jobs longer.

Unemployment remains stubbornly high in some states, and the jobs created have leaned heavily toward part-time and low-pay work. A study from the San Francisco Federal Reserve found the proportion of U.S. jobs that are part-time is high, as many of the jobs lost during the recession have not returned.

States slashed spending

The recession forced states to cut spending across the board, a reversal from a general trend of 1.6% growth each year, according to the National Association of State Budget Officers. States cut spending by 3.8% in fiscal year 2009 and by another 5.7% in fiscal 2010, the first such consecutive declines since the organization began tracking spending in 1979.

As NASBO found, the situation forced states to cut areas often considered politically sacrosanct, such as education, public assistance programs and transportation. It remains to be seen whether the losses will ever be recouped.

Education comprises a significant portion of state budgets. In the 2012-2013 school year, for example, 35 states had K-12 funding that was below pre-recession levels when adjusted for inflation, according to the Center on Budget and Policy Priorities (CBPP), a left-leaning think tank. Some states reeled from spending cuts% of almost 22% compared to 2008.

Higher education funds fell too. Nationally, states cut spending by more than 28% per college student from 2008 to 2013 when adjusted for inflation, according to the center. Arizona’s reductions topped 50%; 36 states cut by more than 20%. Only two states, Wyoming and North Dakota, didn’t reduce higher education funding.

Those cuts had different consequences for students. In colleges, it meant skyrocketing tuition, while in K-12, it often meant cuts to programs such as summer and after-school programs, along with bigger classes sizes. Some states cut enrollment for pre-K as well.

Michael Leachman, director of state fiscal research at CBPP, said both had the effect of stripping state education systems that are vital in preparing students and building feeders to the economy.

These are very deep and concerning cuts at a time when it’s recognized having a more educated workforce is crucial to the country’s future, he said.

Fewer state workers

The reductions also significantly shrunk public workforces. State and local cuts to public employees outlived the worst of the layoffs in the private sector.

State and local governments have shed 681,000 jobs since their peak in August 2008, by far the largest drop of any recession in the past half century, according to the Nelson A. Rockefeller Institute of Government.

State and local government wages grew by 1.1% in 2012, compared to 1.7% growth in the private sector, according to data from the Bureau of Labor Statistics.

Many states embraced significant labor changes, such as scaled back health and retirement plans along with pay freezes, salary cuts and furlough days.

The unemployment stampede crushed unemployment insurance funds. Jobless claims grew from an average of 321,000 per week in 2007 to almost 670,000 at the peak in March 2009.

States’ unemployment insurance trust funds were forced to borrow nearly $50 billion from the federal government to cover costs.

Many states have repaid those debts, but 17 still owe the federal government almost $20 billion and others have debt on the private market. Even those with less or no debt are still reeling: Some have razor-thin balances even today (Rhode Island’s is just over $500,000 with more than $162 million in debt).

Designed to ebb and flow with unemployment, the trust funds are meant to be flush during good times and drawn upon during downturns. Because of poor accounting and tax cuts, many states were unprepared for the recession and were unable to cover costs.

The debt has forced some states to cut jobless benefits to levels not seen since 1935 Social Security Act created the program. It could mean unemployment insurance, the safety net’s first line of defense against joblessness, may be missing in action when the next crisis hits.

Stateline reporter Pamela M. Prah contributed to this story. Stateline is a nonpartisan, nonprofit news service of the Pew Charitable Trusts that provides daily reporting and analysis on trends in state policy.