2 Stocks With Yields That Could Double Your Money In 5 Years Chimera Investment Corporation (NYSE

Post on: 2 Апрель, 2015 No Comment

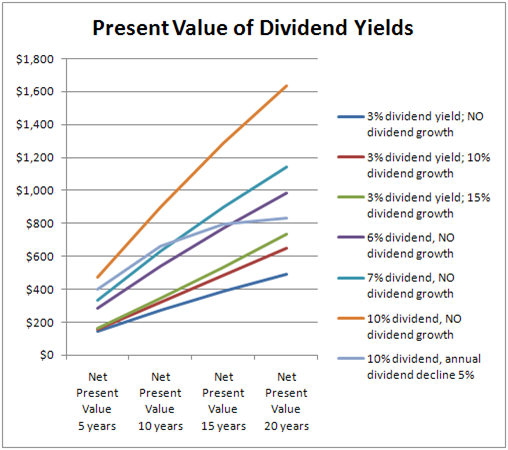

Interest rates are so low that money market and savings accounts now yield less than even half of 1% per year, in many cases. While this might feel safer than buying stocks, the reality is that the effects of inflation and taxes could mean investors are actually losing money, in terms of buying power. Considering that a savings account with a yield of .5% will lead to total returns of just about 2.5% in 5 years, and 5% over 10 years, it’s very hard to make a case for keeping money in safe places for a long period of time.

By contrast, there are some very high-yielding stocks that could lead to spectacular gains over the next 5 years. For example, if you invest in stocks with an average yield of about 14% to 15%, your portfolio will double in value in about five years. To make calculations for individual stocks you can use this investment calculator. Here are 2 stocks whose dividend yields could double your money in about 5 years:

Resource Capital Corp (NYSE:RSO ) is set up as a mortgage real estate investment trust (REIT) company. It is focused on investing in real-estate related assets such as commercial mortgage-backed securities, residential mortgage-backed securities, syndicated bank loans, equipment leases, and other related investments. The company recently reported solid financial results. It announced adjusted funds from operations of 26 cents per share and 49 cents per share diluted. GAAP net income came in at 20 cents per share and 37 cents per share diluted. The shares are trading at a slight premium to book value which is $5.44. The company has a solid balance sheet with about $110.2 million in cash as of June 30, 2012. This stock has been trending higher, so buying on dips could be the right strategy, along with collecting yields that could double your money in about 5 years.

Here are some key points for RSO:

Current share price: $5.79

The 52 week range is $4.20 to $6.12

Earnings estimates for 2012: n/a on Yahoo Finance

Earnings estimates for 2013: n/a on Yahoo Finance

Annual dividend: 80 cents per share which yields 14.2%

Chimera Investment Corporation (NYSE:CIM ) is another popular stock for income investors, although it has faced challenges recently. Chimera is a mortgage real estate trust and it invests in residential mortgage backed securities, and commercial and residential mortgage loans. It is managed by Fixed Income Discount Advisory Company, which is a wholly-owned subsidiary of Annaly Capital Management (NYSE:NLY ), another company in this sector, which also offers a high-yield of about 13%. When compared to Annaly, Chimera appears to trade at a discount in a number of ways. Not only does Chimera offer a higher yield at about 15.5%, it also trades below book value, which is about $3.03 per share, while Annaly trades above book value, at around $16.23 per share. This valuation gap appears to have been caused by a restatement issue at Chimera. However, the shares look undervalued and the company recently gave some reassurance to the markets, and it stated :

The restatement is not expected to affect the Company’s previously reported GAAP or economic book values, actual cash flows, dividends and taxable income for any previous period.

With Chimera shares below book value and offering a yield of over 15%, this dividend-payer could double your money in about 5 years.

Here are some key points for CIM:

Current share price: $2.41

The 52 week range is $1.81 to $3.16

Earnings estimates for 2012: 45 cents per share

Earnings estimates for 2013: 45 cents per share

Annual dividend: 36 cents per share which yields 15.5%

Data is sourced from Yahoo Finance. No guarantees or representations

are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial

advisor.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.