2 Blue Chip Stocks With High Dividend Growth For Income Investors

Post on: 11 Апрель, 2015 No Comment

The strongest of all warriors are these two — Time and Patience. — Leo Tolstoy, War and Peace

When investing for income over the long term, one important characteristic to search for is dividend growth. To strike a balance of yield and safety, income investors generally diversify among several stocks to create a well-balanced equity asset allocation.

The Blue-Chip Dividend Growth Screener

To screen for dividend achievers that would qualify for an income portfolio, I created the following layers to ensure capital safety, dividend safety, dividend growth and capital appreciation.

1. Market Capitalization, $50 billion or lager

The benefit to the income investor with larger companies is capital safety. Large-cap stocks with a market cap over $50 billion tend to be more stable and less likely to experience dramatic growth or large declines.

2. Company Headquarters, U.S.

While operating out of the U.S. is no guarantee of safety, it offers U.S. income investors a lower dividend tax rate than foreign stocks.

3. Forward Yield, Over 2%

While 2% is a paltry yield, it does identify a corporate preference to pay dividends and attract dividend investors. Anything under 2% shows concern with distributing cash to shareholders.

4. Volume, Over $200 Million/Day (10-Day Average Volume)

With safety comes liquidity. A stock with over $200 million average volume per day is easily sold in the marketplace and can better withstand a sudden change in securities demand.

5. 5-Yr. Dividend Compound Annual Growth Rate, Over 15%

A company that has grown the dividend over 15% over the last five years showcases the importance of returning cash to shareholders at a growing rate. This leads to a higher probability of future dividend increases. Also, if a company continues to grow the dividend 15% per year, the dividend will double in five years’ time.

6. Forward P/E, Under 15

In order to sustain the dividend, a low forward P/E ratio is required as earnings must cover the payout ratio as well as future investments in growth.

7. 3-5 Year EPS Growth Est. Over 10%

For dividend growth to continue, revenue growth must follow suit. Those companies that value rewarding shareholders with dividends would likely keep dividend increases in line with earnings growth such that the dividend is covered.

8. Payout Ratio, 30-50%

With a payout ratio above 30% of earnings, the company defines itself as valuing shareholder payments. When the payout is over 50%, however, there is a risk to the dividend in the event of a downturn.

Companies that hold 50% or more of the profits for themselves likely are investing more proceeds into growth, which would reward shareholders with a potentially greater long-term total return. Finally, with a 30% to 50% payout range, the company has flexibility to increase the dividend faster than revenue growth by increasing the payout ratio.

The Two Blue-Chip Options

It may be surprising but with this screen there were only two companies that qualified. They represent the financial and technology sectors and are based in New York, NY and San Diego, CA.

1. BlackRock, Inc. (NYSE:BLK ), $307.61

BlackRock is the investment manager from New York that is also the world’s largest money manager. Total assets under management are $4 trillion (Q3 2013), while no other global asset manager has assets in excess of $3 trillion. State Street (NYSE:STT ), Vanguard Group and PIMCO round up the top four with $2 trillion each, while Fidelity Investments comes in fifth at $1.69 trillion.

Along with the S&P 500, BlackRock is at a lifetime closing price high at $307.61 per share. The company is valued at over $52 billion and yields 2.18% at current pricing. The 5-year dividend growth rate is 16.59% as quarterly distributions have grown from $0.78 per share to $1.68 per share.

BlackRock has a conservative payout ratio of 42% and estimates put the 3-5 year growth rate at 13.86%. The volume per day on the NYSE exceeds $214 million and S&P Capital IQ analysts give the company a perfect five star rating. The 12-month price target from S&P is $340 (as of October 21, 2013).

2. Qualcomm Incorporated (NASDAQ:QCOM ), $68.27

While the technology may be advanced, the business this San Diego, CA, company is as simple to understand as the sun and the beach. Qualcomm focuses on developing products and services based on wireless technology. In moving past chip and handset lingo, this $117 billion company has a 3-5 year projected earnings growth rate of 15.6% and also holds the coveted S&P five star rating. The S&P 12-month target price is $85.

QCOM is just under its 52-week high of $70.37 and is trading at 12.78 times forward earnings. The stock yields 2.05% and the compound annual dividend growth rate is 16.95%. The payout ratio is low at 37%, which shows room for growth. In March 2013, the company raised the quarterly dividend from $0.25 to $0.35, a 40% increase, while also announcing a $5 billion stock repurchase program. In September 2013, QCOM announced they had completed the March 2013 stock repurchase program and authorized another $5 billion buyback.

Earlier this month QCOM named Clark Randt to its board of directors. Randt served as Ambassador to China from 2001 to 2009 and has been consulting developing businesses in China since. With China such a large market, this development showcases QCOM’s ability to recruit top personnel for company growth prospects.

Qualcomm is listed on the Nasdaq and the average daily liquidity is over $530 million in shares traded.

Conclusion

A well-balanced, diversified income portfolio should have equity exposure to safe, proven dividend players with room for growth. While there is no sure thing in the market, using the above metrics gives the investor two excellent options to protect capital while offering exposure to both dividend growth and capital appreciation.

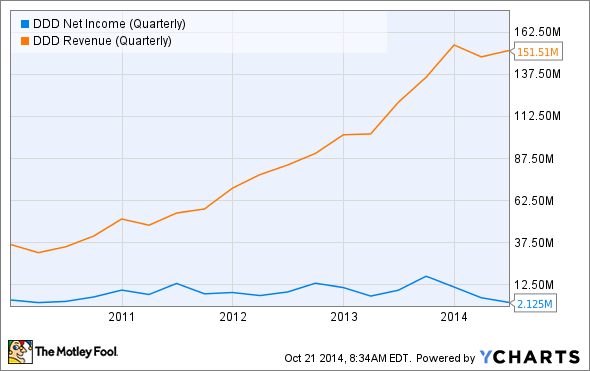

The following chart showcases the statistics shared above for BlackRock and Qualcomm. To calculate average daily liquidity, multiply the average daily volume by current share price.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.