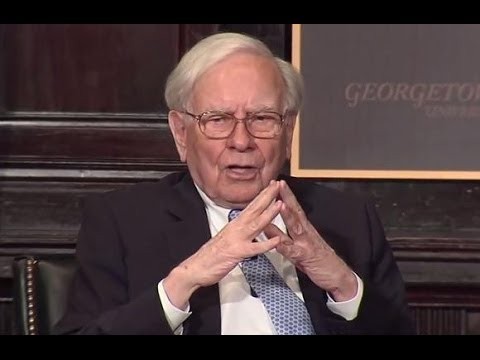

17 Awesome Quotes From One of Warren Buffett s Favorite Books (BRKA BRKB)

Post on: 21 Май, 2016 No Comment

To invest like Warren Buffett, you need to think like Warren Buffett. One way we can get closer to that investing nirvana is by reading what Buffett reads.

Fortunately, in his most recent letter to Berkshire Hathaway ( NYSE: BRK-A ) ( NYSE: BRK-B ) shareholders, Buffett highlighted one of the books that’s front and center in his investing bookshelf: [Phil Fisher’s] Common Stocks and Uncommon Profits. [is] a book that ranks behind only The Intelligent Investor and the 1940 edition of Security Analysis in the all-time-best list for the serious investor.

Of course if you pick up the Wiley Investment Classics edition of the book, you’ll see more of Buffett’s enthusiasm. A quote from him on the front cover reads: I am an eager reader of whatever Phil has to say, and I recommend him to you.

With that ringing endorsement in mind, let’s take a look at 17 of the best quotes from Fisher’s classic. (Nota bene. This does not mean you shouldn’t read the entire book!)

1. The reason why the growth stocks do so much better is that they seem to show gains in value in the hundreds of per cent each decade. In contrast, it is an unusual bargain that is as much as 50 per cent undervalued. The cumulative effect of this simple arithmetic should be obvious.

2. If the job has been correctly done when a common stock is purchased, the time to sell it is — almost never.

3. The amount of mental effort the financial community puts into this constant attempt to guess the economic future from a random and probably incomplete series of facts makes one wonder what might have been accomplished if only a fraction of such mental effort had been applied to something with better chance of proving useful.

4. Regardless of how high the rating may be in all other matters, however, if there is a serious question of the lack of a strong management sense of trusteeship for stockholders, the investor should never seriously consider participating in such an enterprise.

5. More money has probably been lost by investors holding a stock they really did not want until they could ‘at least come out even’ than from any other single reason.

6. Usually a very long list of securities is not a sign of the brilliant investor, but of one who is unsure of himself.

7. In what other line of activity could you put $10,000 in one year and ten years later (with only occasional checking in the meantime to be sure management continues of high caliber) be able to have an asset worth from $40,000 to $150,000?

8. The company that makes above-average profits while paying above-average wages for the area in which it is located is likely to have good labor relations. The investor who buys into a situation in which a significant part of earnings comes from paying below-standard wages for the area involved may in time have serious trouble on his hands.

9. The conventional method of timing when to buy stocks is, I believe, just as silly as it appears on the surface to be sensible. This method marshal a vast mass of economic data. From these data conclusions are reached as to the near- and medium-term course of general business.

10. [Once] a stock has been properly selected and has borne the test of time, it is only occasionally that there is any reason for selling it at all.

11. When do stockholders get no benefit from retained earnings? One way is when managements pile up cash and liquid assets far beyond any present or prospective needs for the business.

12. It is only in rare cases even among outstanding corporations that the opportunity for growth is so great that the management cannot afford to pay some part of earnings and still. obtain adequate cash to take advantage of worthwhile growth opportunities.

13. I believe that the economics which deal with forecasting business trends may be considered to be about as far along as was the science of chemistry during the days of alchemy in the Middle Ages.

14. Investors have been so oversold on diversification that fear of having too many eggs in one basket has caused them to put far too little into companies that they thoroughly know and far too much into others about which they know nothing at all. It never seems to occur to them, much less their advisors, that buying a company without having sufficient knowledge of it may be even more dangerous than having inadequate diversification.

15. The ability to see through some majority opinions to find what facts are really there is a trait that can bring rich rewards in the field of common stocks. It is not easy to develop, however, for the composite opinion of those with whom we associate is a powerful influence upon the minds of all of us.

16. [The] greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits far more than industry as a whole.

17. [Knowing] the rules and understanding. common mistakes will do nothing to help those who do not have some degree of patience and self-discipline. One of the ablest investment men I have ever known told me many years ago that in the stock market a good nervous system is even more important than a good head.

Wait, who was that?

To investors familiar with Buffett, the above quotes likely sound a lot like the Oracle. But there’s likely a good deal of the classic Buffett that’s actually Buffett channeling Fisher.

Fisher’s book was first released in 1958 — years before young Buffett even began buying shares of Berkshire Hathaway. If we consider how Buffett has invested for much of his Berkshire career, the influence of Fisher is unmistakable.

Buffett has proclaimed that Berkshire’s favorite holding period is forever. Stakes in Wells Fargo ( NYSE: WFC ) and Coca-Cola ( NYSE: KO ). both of which have been in Berkshire’s portfolio for decades and are likely set to stay for decades more, prove that out. And though Buffett started his investing career as more of a Grahamian value hunter, as with No. 1 above, he’s found that much greater gains can come from paying fair prices for truly great companies. The recent deal to acquire H.J. Heinz ( UNKNOWN: HNZ.DL ) could be considered an example of that.

In short, if you’re a Buffett fan and don’t have any Phil Fisher on your bookshelf, it may be high time to remedy that oversight.

Investing with Buffett

Thanks to the savvy of investing legend Warren Buffett, Berkshire Hathaway’s book value per share has grown a mind-blowing 586,817% over the past 48 years. But with Buffett aging and Berkshire rapidly evolving, is this insurance conglomerate still a buy today. In The Motley Fool’s premium report on the company, Berkshire expert Joe Magyer provides investors with key reasons to buy as well as important risks to watch out for. Click here now for instant access to Joe’s take on Berkshire!

Matt Koppenheffer owns shares of Berkshire Hathaway. The Motley Fool recommends Berkshire Hathaway, Coca-Cola, H.J. Heinz Company, and Wells Fargo. The Motley Fool owns shares of Berkshire Hathaway and Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .