11 Derivative assets and liabilities Legal General Annual Report and Accounts 2012

Post on: 27 Апрель, 2015 No Comment

Notes Navigation:

Financial Statements

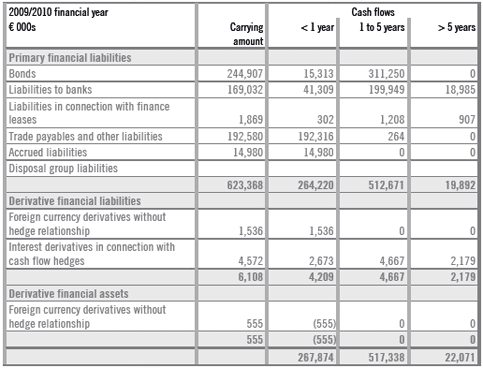

The Groups activities expose it to the financial risks of changes in foreign exchange rates and interest rates. The Group uses derivatives such as foreign exchange forward contracts and interest rate swap contracts to hedge these exposures. The Group uses hedge accounting, provided the prescribed criteria in IAS 39 are met, to recognise the offsetting effects of changes in the fair value or cash flow of the derivative instrument and the hedged item. The Groups principal uses of hedge accounting are to:

(i) recognise in shareholders equity the changes in the fair value of derivatives designated as hedges of a net investment in a foreign operation. Any cumulative gains and/or losses are recognised in the income statement on disposal of the foreign operation;

(ii) defer in equity the changes in the fair value of derivatives designated as the hedge of a future cash flow attributable to a recognised asset or liability, a highly probable forecast transaction, or a firm commitment until the period in which the future transaction affects profit or loss or is no longer expected to occur; and

(iii) hedge the fair value movements in loans due to interest rate and exchange rate fluctuations. Any gain or loss from remeasuring the hedging instrument at fair value is recognised immediately in the income statement. Any gain or loss on the hedged item attributable to the hedged risk is adjusted against the carrying amount of the hedged item and recognised in the income statement.

The relationship between the hedging instrument and the hedged item, together with the risk management objective and strategy for undertaking the hedge transaction, are documented at the inception of the transaction. The effectiveness of the hedge is documented and monitored on an ongoing basis. Hedge accounting is only applied for highly effective hedges (between 80% and 125% effectiveness) with any ineffective portion of the gain or loss recognised in the income statement, within other expenses, in the current period.

Certain derivative instruments do not qualify for hedge accounting. Changes in the fair value of any derivative instruments which do not qualify for hedge accounting are recognised immediately in the income statement.

Where the risks and characteristics of derivatives embedded in other contracts are not closely related to those of the host contract and the whole contract is not carried at fair value, the derivative is separated from that host contract and measured at fair value, with fair value movements reflected within investment return, unless the embedded derivative itself meets the definition of an insurance contract.