10 Money Mistakes to Avoid Homemade for Elle

Post on: 28 Март, 2015 No Comment

I have spent many years of my career in personal finance, so I have been a first-hand witness to some crippling money mistakes. I have also made some! I wanted to highlight a few of the ones I have seen that can be particularly detrimental to your financial health.

Payday Loans

As a general rule, if a company doesnt pull your credit before you get a loan, they are going to rip you off. Payday loans are awful. They have astronomical interest rates! Some are even as high as 911% for a one-week loan! Then they charge exorbitant extension fees if you cant pay it back on time, and you will be in a far worse position than you were when you borrowed the money. Instead, establish a budget so you have enough money to get you to the next pay period.

Title Loan Companies

(not to be confused with banks) are just as bad. They give you a loan for a tiny fraction of the value of your vehicle, and if youre late one month, say goodbye to your car and all of the equity in it. These companies are loan sharks. Theyre really really bad news. Avoid them at all costs. If you need a loan, try going to a national or community bank. They are heavily regulated and must comply with consumer protection laws, and are thereby required to practice ethical lending.

Cash Advances on Credit Cards

There are many reasons this is a bad idea. First, they frequently charge you a transaction fee right off the bat for the advance. Secondly, the interest rates on cash advances are extremley high, frequently they are twice as much as your regular APR for purchases. This also includes the handy checks that credit card companies send you in the mail it is considered a cash advance. Shred them as soon as you get them!

Using Your Credit Card to Buy Groceries (or other small purchases)

The main reason this is bad is because people tend not to actualize money when purchased on credit. Since the purchase isnt paid back for a month, or much longer, you dont fully feel the impact of the money you spent. People who buy on credit spend an average of 12-18% more per purchase. Keep it simple and use your debit card or cash to make everyday purchases.

Not Reconciling your Bank and Credit Card Statements

Yes, its paperwork, but it is crucial that you stay on top of your statements. First, it ensures that there are no fraudulent or unauthorized purchases coming out of your account. Many skeezy companies who get your permission to auto-draft once, have fine writing that allows them to draft monthly. If you dont reconcile or look at your statements, you would never know theyre taking money from you! Secondly, it is a great tool to help you budget and save money. If you review your purchases, you can find trends and spending patterns that you can alter to free up extra cash! It is easier now than ever to check your accounts online so setup a reminder once a week or at least once a month to review all of the transactions on your accounts.

Paying Late Fees or Over Limit Charges

This can be easily avoided by setting up a budget and checking your statements. These fees are crazy expensive, over $30 a pop, and theyre 100% avoidable if youre staying on top of your budgeting. Pay your bills on time, and never ever spend more on your credit card than you have available. It will be expensive, and ding your credit score.

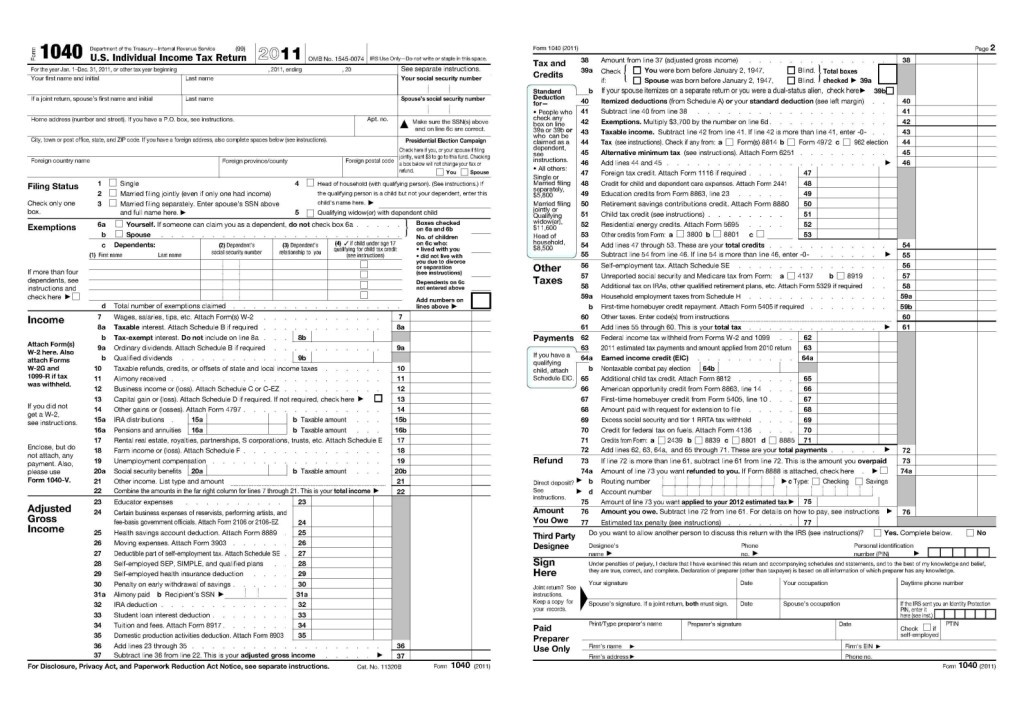

Cashing out your 401k Early

This mistake will cost you 35-55% of your 401k. Right off the bat, you are penalized with a 10% fee for early withdrawal. Then you are taxed federally and at the state level, at your current tax rate for all of the money you receive. Depending on your tax bracket, that can be a terrible burden come tax season. In addition, you need to consider the Future Value of Money. which is the value of the investment over time. Lets see an example of the Future Value of Money : Lets assume you can earn 7% a year in an IRA, 401k or Mutual Fund. Lets also assume youre investing $100 a month. Below you can see how much money you will have at retirement if you invest for 20, 30 or 40 years. Look at what a HUGE difference 10 years makes! This is a key reason to invest in retirement as young as possible and dont cash it out!

Skipping your Student Loan Payment

Nothing will ruin your credit faster than skipping your student loan payment. In addition, youll be hit with late fees and penalties, and the IRS can garnash your wages (which wont look good to your employer). If youre unemployed or having a tough time making the payments, call your lender to see if you can get a temporary reduced or deferred payment.

N ot Keeping a Balance in your Bank Account

Keeping a minimum balance in your checking account is a good idea. Dave Ramsey suggests that everyone have a $1,000 emergency fund, so if an emergency comes up, you won’t have to rely on a Payday or Title loan company. This is a great suggestion! I recommend keeping a few hundred dollars in your checking account that you don’t spend. That way, if an auto-draft payment comes through early or unexpectedly, you won’t be in danger of having your account overdraft (and getting a horrid fee).

Not Having Health Insurance

This can single handedly bankrupt you in a matter of days. If something major medical happens to you and it requires surgery or a hospital stay, you’re looking at a bill at least $20,000 and it can be much much more. Have you ever spent $100,000 in a single day? How long would that take you to pay back? If you don’t have health insurance, that could happen to you. Try to acquire health insurance through your place of work, or through independent insurance companies.

What other money mistakes do you avoid?

All material on this website is provided for your information only and may not be construed as medical advice or instruction. Posts may contain affiliate links, which helps me buy supplies to make more great posts to share! Please see my Disclaimer Section for additional information.