1 Chapman Machine Shop is considering a 4year project to improve its production efficienc

Post on: 18 Апрель, 2015 No Comment

The home of custom (FRESH), non-plagiarized papers

1 Chapman Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings. The press falls in the MACRS 5-year class, and it will have a salvage value at the end of the project of $84,000. The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,600 in inventory for each succeeding year of the project. The inventory will return to its original level when the project ends. The shops tax rate is 35 percent and its discount rate is 11 percent. Using the NPV decision rule should the firm buy and install the machine press?

2 Heer Enterprises needs someone to supply it with 225,000 cartons of machine screws per

year to support its manufacturing needs over the next 7 years, and youve decided to bid on the contract. It will cost you $1,170,000 to install the equipment necessary to start production; youll depreciate this cost straight-line to zero over the projects life. You estimate that in 7 years, this equipment can be salvaged for $75,000. Your fixed production costs will be $360,000 per year, and your variable production costs should be $12.75 per carton. You also need an initial investment in net working capital of $112,500, all of which will be recovered when the project ends. Your tax rate is 32 percent and you require a 13 percent return on your investment. What bid price per carton should you submit?

3 ABC Inc. is considering a new 4-year expansion project that requires an initial fixed asset investment of $3 million. The fixed asset will be depreciated straight-line to zero over its 4-year tax life, after which time it will have a market value of $231,000. The project requires an initial investment in net working capital of $330,000, all of which will be recovered at the end of the project. The project is estimated to generate $2,640,000 in annual sales, with costs of $1,056,000. The tax rate is 31 percent and the required return for the project is 15 percent. What is the net present value for this project?

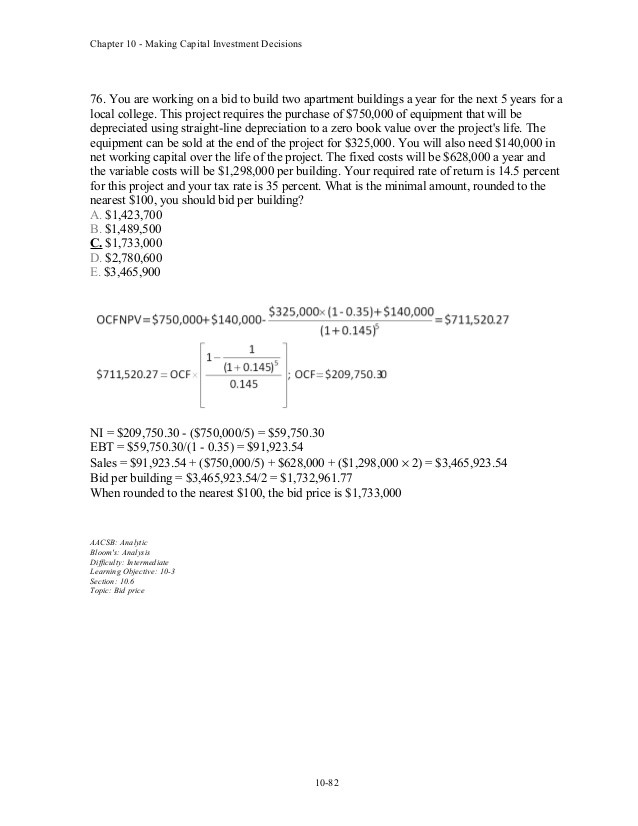

4 You are working on a bid to build two city parks a year for the next three years. This project requires the purchase of $180,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the 3-year project life. The equipment can be sold at the end of the project for $34,000. You will also need $20,000 in net working capital for the duration of the project. The fixed costs will be $16,000 a year and the variable costs will be $168,000 per park. Your required rate of return is 15 percent and your tax rate is 34 percent. What is the minimal amount you should bid per park? (Round your answer to the nearest $100)

5 Webster & Moore paid $139,000, in cash, for a piece of equipment 3 years ago. At the beginning of last year, the company spent $21,000 to update the equipment with the latest technology. The company no longer uses this equipment in its current operations and has received an offer of $89,000 from a firm that would like to purchase it. Webster & Moore is debating whether to sell the equipment or to expand its operations so that the equipment can be used. When evaluating the expansion option, what value, if any, should the firm assign to this equipment as an initial cost of the project?

6 The Fluffy Feather sells customized handbags. Currently, it sells 18,000 handbags annually at an average price of $89 each. It is considering adding a lower-priced line of handbags that sell for $59 each. The firm estimates it can sell 7,000 of the lower-priced handbags but will sell 3,000 less of the higher-priced handbags by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced handbags?

7 Mason Farms purchased a building for $729,000 eight years ago. Six years ago, repairs were made to the building which cost $136,000. The annual taxes on the property are $11,000. The building has a current market value of $825,000 and a current book value of $494,000. The building is totally paid for and solely owned by the firm. If the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building?

8 We are evaluating a project that costs $854,000, has a 15-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 154,000 units per year. Price per unit is $41, variable cost per unit is $20, and fixed costs are $865,102 per year. The tax rate is 33 percent, and we require a 14 percent return on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within±14 percent. What is the worst-case NPV?

9 Last year, T-bills returned 2 percent while your investment in large-company stocks earned an average of 5 percent. Which one of the following terms refers to the difference between these two rates of return?

A. risk premium

B. geometric return

C. arithmetic

D. standard deviation

E. variance

10 Which one of the following best defines the variance of an investments annual returns over a number of years?

A. The average squared difference between the arithmetic and the geometric average annual returns.

B. The squared summation of the differences between the actual returns and the average geometric return.

C. The average difference between the annual returns and the average return for the period.

D. The difference between the arithmetic average and the geometric average return for the period.

E. The average squared difference between the actual returns and the arithmetic average return.

11 Standard deviation is a measure of which one of the following?

A. average rate of return

B. volatility

C. probability

D. risk premium

D. 1.13 percent

E. 1.21 percent

17 West Wind Tours stock is currently selling for $48 a share. The stock has a dividend yield of 2.6 percent. How much dividend income will you receive per year if you purchase 200 shares of this stock?

D. $362.00

E. $249.60

18 One year ago, you purchased a stock at a price of $47.50 a share. Today, you sold the