Your ‘safe’ moneymarket fund may be at risk

Post on: 7 Июнь, 2015 No Comment

RobertPowell

The Securities and Exchange Commission earlier this summer released new money-market mutual regulations that those saving for retirement might want to review, especially if they are among the millions who have invested on average anywhere from 2% to 6% of their 401(k) in such funds.

The new rules, which don’t go into effect until the fall of 2016, separate money-market mutual funds into two distinct groups: retail-money market funds, which will be allowed to keep the long-standing $1 per share value and institutional prime money market funds, which will have a floating net-asset value (NAV) that would fluctuate based on the under market-based value of fund assets. In other words, these funds can break a buck. Read SEC Adopts Money-Market Fund Reform Rules .

Jaffe: Many 2014 predictions missed

Marketwatchs Chuck Jaffe points out as the calendar is just hitting the home stretch for the year, it’s time to recognize that virtually everyone who made calculated forecasts for 2014 was wrong.

And those changes have retirement-plan experts such as Robert Lawton, president of Lawton Retirement Plan Consultants in Milwaukee, suggesting that plan sponsors that offer money-market investments in their defined-contribution plans should start talking with their investment advisers to evaluate their money-market strategy.

Plus, Lawton told PlanSponsor that “plan sponsors and (plan) participants look at money-market funds as savings accounts because they feel they can’t lose money, but that will change.” Read Lawton’s blog post, What Plan Sponsors Need to Know About the New Money Market Fund Changes. For more background, read Reform Calls for Evaluation of Money Market Fund Strategy and SEC releases new rules for money market mutual funds .

What’s in your money-market fund?

So what needs to change? Well, plan participants who invest in money-market mutual funds should check whether their funds will be among those that will have a floating NAV or a fixed $1 per share NAV. What’s more, they should check whether their money-market fund will have redemption fees and liquidation windows.

Next, plan participants will have to evaluate, if they have a floating rate money-market fund, whether they want so-called safe money to rise and fall in value, even if it’s only be a small amount.

And finally, the new regulations should give plan participants yet one more reason to review their retirement plan. “Changes to money markets offers plan participants an opportunity to re-explore what it is that they’re really trying to achieve with their 401(k) plan,” says Thom Shumosic, a certified financial planner with MidAtlantic Retirement Planning Specialists in Wilmington, Del.

Plan participants might also review the benefits of dollar-cost averaging in the wake of the SEC’s new money-market mutual fund regulation. “Unless you’re a ‘sky-is-falling’ guy, and yes, there are those participants in plans all over the place, one needs to reconsider one of the greatest benefits of a 401(k) plan — dollar-cost averaging,” said Shumosic. “Most plan participants with little or no real taste for market ups and downs would have been decently rewarded by dollar cost averaging into a conservative allocation fund or, in most cases, target-date funds.”

Consider: Over the past five years, the average moderate allocation fund has returned on average 10.8% a year and the average target date 2041-2045 fund has returned on average 12.6% a year, according to Morningstar. By contrast money-market mutual funds have returned on average just 0.05% a year. And, over the past five years, inflation has averaged about 2.5% a year.

Avoid money-market funds altogether

Meanwhile, there are those who say — new money fund regulations or not — that those saving for retirement should avoid investing in money-market funds altogether. “Our suggestion is that employees should consider avoiding the ownership of money-market funds within a 401(k) plan,” said Sean Ciemiewicz, a principal and financial consultant with Retirement Benefits Group, in San Diego.

Why so? “401(k)s are accumulation vehicles for retirement and money-market funds are not conducive to the concept of investing for a future retirement,” says Ciemiewicz. Money funds provide safety of principal, but not protection against the risks of inflation and the loss of purchasing power.

Ciemiewicz does, however, recommend that 401(k) plan participants who are risk averse — who don’t want to invest in investments that fluctuate in value such as bonds or stocks — consider investing in alternatives to money-market funds, such as a guaranteed interest account or a fixed-rate investment.

Others agree that plan participants should consider alternatives to money-market funds such as a stable value or guaranteed investment contract or GIC, and not for reasons having to do with the SEC’s new money-market mutual fund regulation. “We’ve been in an extended period where folks have not made any money at all in money markets, especially when you consider taxes and inflation,” said Shumosic.

To be sure, 401(k) plan participants are investing in GICs and stable value funds. For instance, plan participants have invested on average 3% to 15% of their plan’s money in GICs and stable value funds.

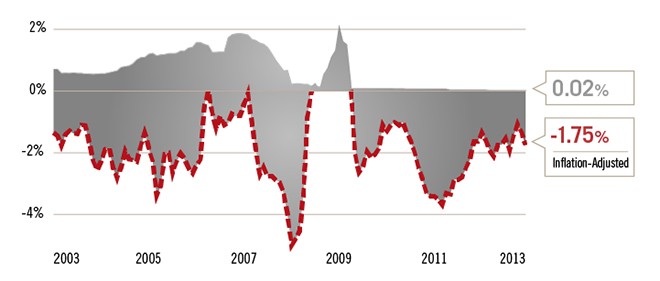

And we suspect it’s for good reason. GICs and stable value funds provide some of the same benefits as money-market mutual funds, safety of principal, but with a slightly higher return. According to BankRate.com, the average seven-day effective yield for taxable money-market mutual funds right now is 0.02%.

By contrast, stable value funds are earning on average 1.7% according to a Towers Watson report. And, over the past five years, stable value funds have earned on average 2.43% according to Hueler Analytics Stable Value Pooled Fund Universe. GICs, meanwhile, earned on average 0.8% over the past two years according to Hueler Companies data.

Robert Powell is editor of Retirement Weekly. published by MarketWatch. Follow his tweets at RJPIII. Got questions about retirement? Get answers. Send Bob an email here .