Your Mutual Fund Investment Portfolio How Many Funds Should You Own

Post on: 7 Май, 2015 No Comment

by Silicon Valley Blogger on 2010-01-15 8

Youve probably heard the diversification mantra for years and that it’s a major key to successful money management. And, as many unfortunate folks have recently learned, lack of diversification can mean the difference between a nice nest egg and possibly none at all. But, are you one of those investors who tinkers with stock charting tools and collects mutual funds in the same way that other people buy things at discount stores? If three are good, then six must be better?

Your Mutual Fund Portfolio: How Many Funds Should You Have?

Friends of mine have Excel spreadsheets with several accounts and even more investments spread across 5 to 10 stock brokers and financial institutions. Its easy to get into the rut of owning an overabundance of funds. You might have a few that you feel sentimental about and that youve owned for decades, and several more that you recently bought because they were listed in Forbes’ as a “must have” fund. You may even have some in your IRA that were rolled over from your 401(k) plans. But what has this accomplished? Could you possibly have diversified yourself to the point of diminishing returns and now have done more harm than good? Is your portfolio a cohesive unit working in synergy or a jigsaw puzzle scattered across your kitchen table?

So how many funds are too many? Theres really no magic number, and each investors situation is different. But think about how much time you spend monitoring your portfolio and keeping track of your paperwork. Mutual funds were meant to simplify investing rather than make it cumbersome and confusing.

Portfolio Rebalancing And Spending

Most good financial plans call for a specific balance of asset classes. And each year you make adjustments among your investments in order to maintain that balance so that your risk/reward profile does not get too out of hand. This means that you would sell part of the asset classes that have done well and buy more of the asset classes that have fallen behind. For those of you spending from your portfolios, you should use the same methodology provide income from asset classes that have done well and rebalance at the same time. The more funds you own though, the more complicated this becomes: oftentimes, people dont know how to rebalance and where to spend from because they are not sure what their actual holdings represent. So simplicity is key.

Are You Double Dipping?

What if two of your funds are large-cap and growth-oriented, and both have large holdings in the same stock? If that stock were to take a dive, both of your investments would suffer. Or worse, like a lot of funds in the same class, what if several of their top holdings are identical and they take a dive? How have you helped yourself by having two funds (or, in some cases, 3 or 4)? This duplication does not help you diversify. Rather, it is exposing a larger amount of your portfolio to similar risk. You really should be looking to hold funds that all have different characteristics and behave differently. Having near clones does not make one diversified!

After many years of investing, you may not be sure whether or not you own too many funds. This might be a good time to go over them and think about why you bought each one. Some questions to ask yourself:

- Would you still buy your mutual funds today?

- Have any of your mutual funds changed their investment style over the years?

- How might that impact your overall financial plan?

- Is there now overlap of investments within your funds that exposes you to greater risk?

Oftentimes, we own mutual funds that overlap and we don’t know it. Sometimes, funds suffer from “style drift”: it’s not uncommon for a small cap fund to change its characteristics and turn into a mid-cap or large cap over time. The same can be said for value vs growth funds.

If you are not sure, use a stock screener to find stocks (such as Morningstar.com ) to categorize your funds. This will help you understand where overlap may occur and see if any of your funds have changed. Also, look at the information and semi-annual reports presented to you by your mutual fund companies and online discount brokers. Do the same company names appear in the top ten holdings of several of your funds?

The Ideal Asset Allocation Mix

If you think that your basket of mutual funds has become too overwhelming to manage or there might be investment overlap resulting in less diversification and greater risk, then consider consolidating your investments and your accounts. Most people do not need more than one IRA (unless you have a Traditional and a Roth), one taxable account, and a retirement plan through work. Three accounts should serve you just fine. If you decide you need to consolidate your investment accounts, just watch out for capital gains tax possibilities and any potential fees you may incur before you start. But, the benefits of consolidation and simplification may outweigh some costs and taxes.

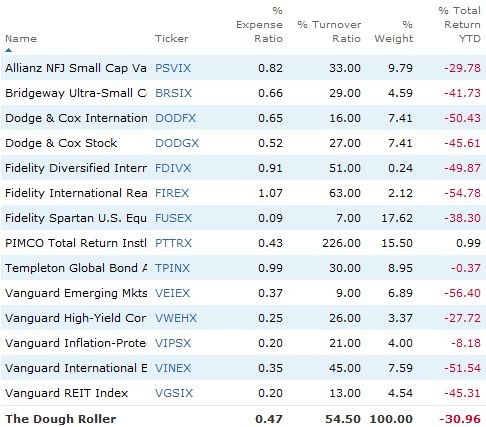

Many people may wish for a direct answer to the question how many mutual funds should you own? If you really pressed me on how many funds you would need to be diversified, I would say between 3 and 10. Personally, I see diversification as broad exposure across all sectors and all markets. For instance, a simplified low-cost portfolio may look like an appropriate mix between:

- Total US Stock Index (small, mid, large cap, growth, value, and sector representation)

- Total Bond Market Index (short-term, intermediate-term, long-term, high yield and mortgage backed bonds).

- Total International Stock Index (developed, underdeveloped, and emerging markets)

And yes, I left out sector funds, precious metals, real estate, etc. for a reason (although these asset classes are considered great diversifiers)! The stocks-and-bonds portfolio described above is a good starting point and serves as a pretty basic, diversified portfolio.

If you’re like me and find such a portfolio a tad bit too simple and you dont fancy the all index approach, you may want to mix it up by breaking up some of the categories a bit. Incidentally, this approach gives you more spending and rebalancing flexibility too, but it is a bit more complex to manage:

- Total US Stock Index Fund

- Large Cap Growth Fund

- Large Cap Value Fund

- Mid Cap Fund

- Small Cap Fund

- Short-Term Bond Fund

- Intermediate-term Bond Fund

- Long-term and/or High yield Bond Fund

- Total International Stock Index

Just remember, you really only need one ONE fund per category. Nothing more, nothing less. Do yourself a favor and keep it as simple as possible.

Contributing Writer: Todd Smith, CFP, of WebSafety .

Categorized under: Investment Written by SVB