Your Dividend Stocks Could Be Riskier Than You Think

Post on: 16 Март, 2015 No Comment

With bond rates at historical lows, dividend stocks have become a haven for income investors. Since fixed income is providing just minimal returns, as yields on 10-year treasuries are below 2%, investors have turned to dividend stocks as a way of ensuring a steady stream of cash.

The resulting shift has lifted the stock market as a whole, providing superior returns since the recession. Historically, the S&P 500 has traded at a P/E of 15, but that valuation has gotten pumped up to 19 in large part because of low interest rates.

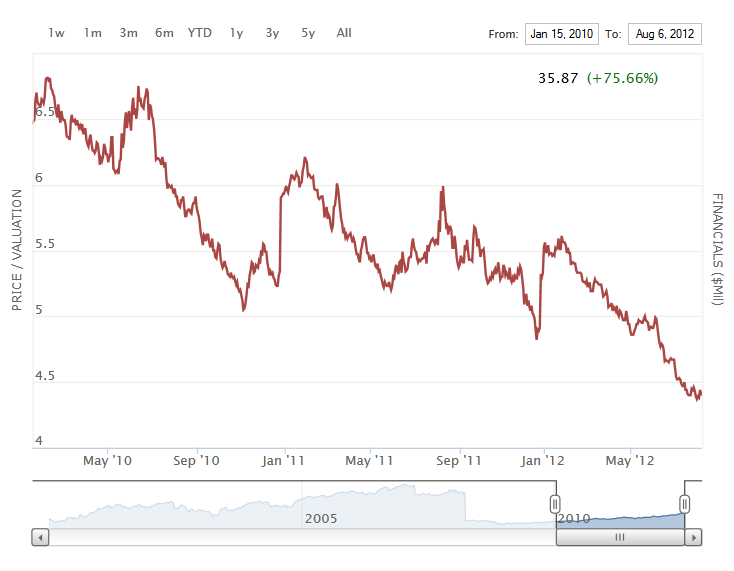

Dividend-paying, defensive stocks have been favorites of investors during this period, and the household products sector is a prime example. Companies like Procter & Gamble ( NYSE: PG ). Colgate Palmolive ( NYSE: CL ). Kimberly-Clark ( NYSE: KMB ). and Clorox ( NYSE: CLX ) have all seen their earnings valuations get inflated as investors pile into these types of stocks. The chart below shows their rise:

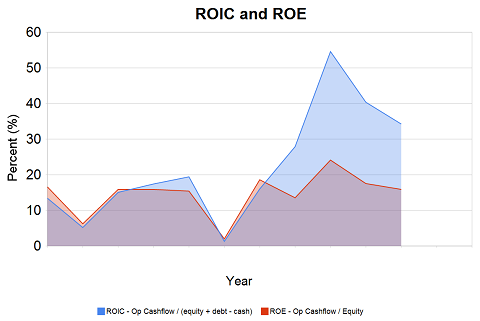

Meanwhile, earnings per share for three out of the four companies has actually fallen over the last five years:

That’s partly due to recent currency headwinds, but the decline means the share appreciation over the past five years is almost entirely due to multiple expansion, or simply because investors have moved into stocks that offer a solid dividend.

Interest rates and dividends

As the market’s recent rise should indicate, there is a strong correlation between interest rates and the stock market’s performance. In the late 70s and early 80s, with interest rates in the teens, the S&P 500’s P/E ratio was under 8. Since bond rates were much more lucrative, investors needed a greater incentive to buy stocks, but today that trend is the opposite.

The federal funds rate, set by the Federal Reserve’s Open Market Commitee, has remained between 0 and 0.25% since the recession began in 2008 to encourage borrowing. This rate applies to overnight loans maintained at the Federal Reserve made from one financial institution to another, and it is key in underpinning all other U.S. interest rates since it serves as a base lending rate for the big banks.

As the American economy has improved and the unemployment rate has fallen below the Fed’s target of 6%, the central bank has signaled it is likely to raise the funds rate this year. In a survey of economists earlier this January, the consensus expected the Fed to lift the borrowing rate to a midpoint of 0.29% by June, and 0.89% by the end of the year. Next year, they project a rate of 1.63% by June and 2.31% by the end of 2016.

In other words, less than two years from now, interest rates could be more than two percentage points higher than they are today. That would likely make dividend yields of 3%-4% much less desirable than they are today.

Of course, there are other factors influencing treasuries and other bonds, especially the comparative safety of the U.S. dollar, but a rise in the federal funds rate should also lead to an increase in bond yields.

For investors in dividend stocks like Procter & Gamble and the other ones above, this could pose a problem. As bond rates become more appealing, investors are likely to move out of these stocks just as they moved into them when yields on fixed income fell. The stock market as a whole is also likely to lose some air.

As this shift takes place, P&G and the others will need to find ways to grow income again if they hope to keep shareholders happy. Otherwise, the stocks will fall, making share buybacks more affordable and raising dividend yields, which would again make the stocks attractive to a new round of dividend investors.

1 great stock to buy for 2015 and beyond

2015 is shaping up to be another great year for stocks. But if you want to make sure that 2015 is your best investing year ever, you need to know where to start. That’s why The Motley Fool’s chief investment officer just published a brand-new research report that reveals his top stock for the year ahead. To get the full story on this year’s stock — completely free — simply click here .