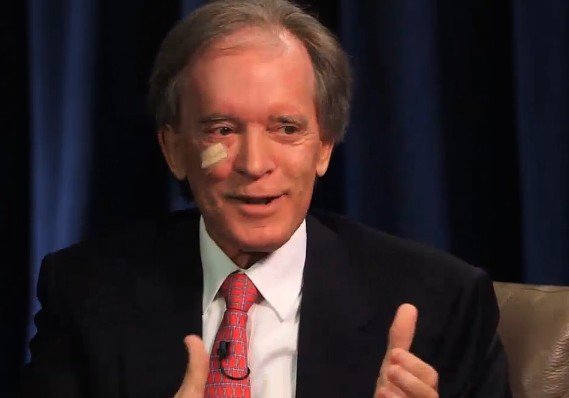

You don’t need Pimco’s Bill Gross or his bond fund

Post on: 30 Июнь, 2015 No Comment

ChuckJaffe

BOSTON (MarketWatch) — At the Morningstar Investor Conference in Chicago last week, Pimco’s Bill Gross — the world’s most famous and influential bond-fund manager — suggested that investors looking for good yields give up on Treasurys, consider foreign bonds and, notably, high-quality, dividend-paying stocks.

The message wasn’t exactly new, but the takeaway was different.

Our Trading Deck has been home to a spirited debate over whether were in for a crash.

And he’s right, because looking at Pimco Total Return PTTAX, -0.19% there’s a strong case to be made that it’s the Stupid Investment of the Week.

Stupid Investment of the Week highlights conditions and characteristics that make a security less-than-ideal for the average investor. While it is hard to imagine that the world’s preeminent bond manager is suddenly going to turn stupid relative to his peers — and this column is not intended as a sell signal — there’s a strong case to be made that investors would be better off going elsewhere, even in the bond-fund world.

Great past, unclear future

That said, there is no denying Gross’s greatness. Since he started Pimco Total Return in the middle of 1987, it has an annualized average return of more than 8%, roughly a full percentage point ahead of its benchmark, the Barclays Capital U.S. Aggregate Bond Index. In the income-generating space, that difference — for a quarter century — is huge.

Also, there’s no evidence that Gross has lost his touch over time, either, as the spread between the fund and the index has been even wider over the last five years.

While recent results have been below par — the fund is below average and trailing the index year-to-date — the real problem here is not the past, but the future.

There, Gross’s success actually creates a bit of a problem.

According to investment researcher Morningstar Inc. Pimco Total Return now has $245 billion in assets spread over all of its share classes. That makes it the world’s largest mutual fund, bigger all by itself than a number of the bond-market sub-categories that it invests in. Pimco manages an equivalent sum across more than five-dozen public and private pools, the best known being Harbor Bond Fund HABDX, -0.08% a fund I like enough to have once recommended it to my father.

That’s roughly $500 billion invested in this one strategy, and Gross is about to open an exchange-traded fund version of Pimco Total Return. It won’t be a perfect match for the fund’s current strategy — as an ETF, there are some derivative strategies Gross uses in the fund that will not work under the new structure — but it is likely to swell the assets by a few more billion pretty quickly.

The price of success

At this point, the problem with Pimco Total Return is that it’s too big. With Gross having shown his disdain for Treasurys — though he is heavily invested in mortgage-backed securities, which functionally is a distinction without much difference — and trying to seek yield elsewhere, size is, well, a giant problem.

Where Gross might once have added value by finding the best bond deals and executing them better than the competition, today even the best deals are too small to have much impact on the fund.

Think of it as if your town suddenly floated a great bond issue, and Gross was ready to take the whole thing for the fund; if the float is $100 million — enough to solve a lot of financial issues in most municipalities — it would still represent just 0.04% of Total Return’s portfolio. In short, Gross could make a killing on the deal, but it would be too little to truly notice when absorbed into the fund.

Steve Goldberg of Tweddell, Goldberg Investment Management in Silver Spring, Md. noted that if Gross can’t use his unique gifts for identifying undervalued bonds as a way to outperform the competition, his ability to stay a step ahead will depend entirely on his macroeconomic market forecasts being right.

“Pimco has done better than any other firm in getting its bond calls right,” Goldberg said, “but every market cycle makes someone look like a genius, only to lose it and look like a fool in the next cycle. … It’s tough to make a living – or a mutual fund that is better than all the others — when your only way to add value is to have every market call be right because no one — not even Bill Gross – is right all the time.”

Goldberg also noted in a story he wrote for Kiplingers.com that “with the fund so big, the natural tendency is to play not to lose. After all, if you give investors decent performance, they probably won’t bail out, even if they can do better elsewhere.”

And the biggest point is that, going forward in the bond space, investors most likely will be able to do better elsewhere, by picking lower-cost funds run by managers who are doing the things now that made Bill Gross’s fund famous in the first place. Pimco’s expense ratios for Total Return are no better than average, which seems ridiculous for a fund so large, and its prospects are worse.

You buy this fund for Bill Gross but, at its current size, Gross can’t actually do much to impact performance.

“He talked at Morningstar about entering a period when interest-rate duration plays are not going to make it, so if you want to make money in bonds, you will have to make plays on credit risk,” Goldberg said. “But the days when he can turn those plays into something that really makes Pimco Total Return continue to beat the average bond fund by so much are gone.”

With that in mind, you might want to follow Gross’s advice — and diversify into bonds from Brazil, Canada, and Germany, and into high-quality dividend-paying stocks — but you don’t want to diversify your holdings by owning his Total Return Fund.