Yield To Maturity Bond Yield YTM Formula

Post on: 20 Апрель, 2015 No Comment

This is a bond’s total rate of return during the full life of the investment. The yield to maturity factors in the nominal rate or coupon, the price paid and the length of the maturity.

The YTM is the most important yield indicator for a bond investment. It factors in the nominal yield. bond price and length of maturity held.

When investors buy bonds, the coupon rate is important, but if the bond price is higher than par — the rate of return to maturity will be lower. If the bond is bought at a discount, the yield to maturity will be higher.

The nominal yield (coupon) is a fixed rate that is only paid to par value. All bonds redeem at par as well. So, if the investment is purchased below or above par, the yield will be different.

Yield To Maturity Formula

Calculating yield to maturity under the rule of thumb method is not difficult. The concept with it is the YTM is based on the Nominal Yield, Price and the years to maturity. So, the formula or calculation is based on that.

Premium bonds have a lower yield to maturity vs. the nominal rate. That is because the nominal yield only pays to par value. Thus if the bond was bought above par, the premium amount does not earn interest and the premium is not paid at maturity. The investor is losing the above par amount at the end of the term. If the investment was sold beforehand at a profit — the cost would be a profit.

Example

A 5% bond was purchased at $1150 and the maturity is 15 years. Calculating YTM would be based on all of this information. The total premium amount is $150 — divided over 15 years would give you $10 per year. That is the amount that is basically lost each year on the price — if held to maturity.

The way the formula is calculated is you take the yearly real interest — which is $50 and then subtract the lost above par yearly price of $10. This leaves you with a real yearly return of $40. Then divide $40 by the average price of the bond during it’s life. Since par ($1000) is the redemption price and $1150 was the price that was paid — the median price would be $1075.

So $40 divided by $1075 would be the YTM = 3.72%

Discount bonds are calculated the same way — except the yearly discount is added on to the nominal interest payments. This would result in a higher YTM.

Premium and Discount

The YTM is actually the current interest rate on a particular bond or similar bonds. If a 7% bond is availale, but interest rates are actually only 5%, the broker or the market will price that bond higher (premium) — to reflect the current interest rate environment. The broker is not going to sell a 7% bond at par when interest rates are 200 basis points lower. A premium will be the market.

If the interest rate climate on these bonds is 5%, the security will be priced for a yield to maturity of around 5%. So, the investor is really getting a 5% overall rate of return on this bond, if held to maturity — even though the nominal yield is 7%. Interest is never paid to a premium or discount. It is only paid to par.

If an investor is seeking higher current income, having a higher coupon rate is important. The yield to maturity is not a paying rate, it is an overall rate of return of the investment.

If a person is not seeking current income, they can choose a below market coupon debt and buy it a discount. Doing this will allow the investor to pay less and earn less interest, but the overall yield to redemption or maturity will be higher.

Formula and Calculating Conclusion

YTM uses all the components of a bond investment to come up with a true overall yield on the security. The formula and calculation is based on the bond reaching maturity. As with most bonds, default is rare, so the real risk lies with the following:

- Is the bond callable?

- What price is it callable at?

- When are the call dates?

- Interest rates rise and bond is sold (result in loss in most cases)

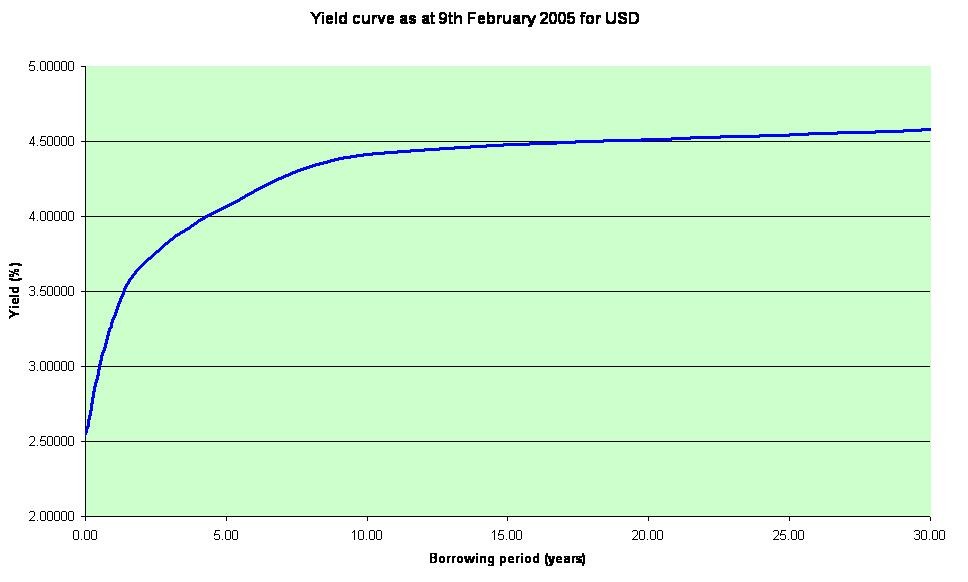

- How long is the maturity? — A bond with a Yield of 4% for 2 years is usually better than a length of 10 years in a normal or upsloping yield curve.

If a bond is a Callable bond. it may never reach it’s yield to maturity.

Calculate Bond Yield and Blog — View example with user comments and questions. Feel free to add to the post with your questions.

Are you studying for the Series 7 exam? Need help on Options or other topics?

Options Trading Coach — Teacher, Guru — you are there! Amazing System recommended by American Investment Training

Watch a live stream of our professional trader every day in HIGH QUALITY with full audio so you can learn as you trade!. many many more benefits. a LOT of testimonials.