Yield Duration and Ratings of Bonds

Post on: 16 Март, 2015 No Comment

The yield of a bond is, roughly speaking, the return on the bond. The yield is expressed as an annual percentage of the face amount. However, yield is a little more complicated (and therefore more useful) than the coupon rate. There are several different measures of yield: nominal yield, current yield, and yield to maturity.

- Nominal yield is equal to the coupon rate; that is, the return on the bond without accounting for any outside factors. If you purchase the bond at par value and hold to maturity, this will be the annual return you receive on the bond.

- Current yield is a measure of the return on the bond in relation to the current price. For example, depending on how interest rates have changed, you could purchase a $1,000 par value bond that pays 5% coupon ($50) annually for $800. The current yield is the return on your interest payments based on your $800 investment, which would be 50/800 = 6.25%. As you can see, this can differ from the coupon rate.

- Yield to maturity is the overall return on the bond if it is held to maturity. It reflects all the interest payments that are available through maturity and the principal that will be repaid, and assumes that all coupon payments will be reinvested at the current yield on the bond. This is the most valuable measure of yield because it reflects the total income that you can receive. If you purchase the bond at a discount, yield to maturity will reflect the fact that at maturity you will have additional income because of the difference between the price paid and the principal returned. For example, if you purchase a $1,000 par value bond for $800, you have $200 extra in income at maturity. The calculation is slightly different if the bond is purchased at a premium, but it takes into account the extra amount paid for the bond.

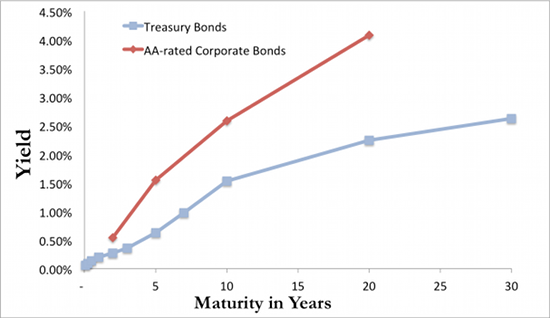

One other important concept related to yields is the yield curve. This is a graphical representation of the relationship between maturity and yield to maturity. With yield to maturity on the vertical axis and maturities increasing from left to right on the horizontal axis, the normal yield curve slopes upward because as maturity increases, yield usually increases. In other words, long-term bonds generally offer higher returns than short-term bonds. The reverse (an inverted yield curve) will occasionally happen, for example when a recession or high inflation is anticipated; but it is not very common.

Duration

Duration is a weighted measure of the length of time the bond will pay out. Unlike maturity, duration takes into account interest payments that occur throughout the course of holding the bond. Basically, duration is a weighted average of the maturity of all the income streams from a bond or portfolio of bonds. So, for a two-year bond with 4 coupon payments every six months of $50 and a $1000 face value, duration (in years) is .5[(50/1200)] + 1[(50/1200)]+ 1.5[(50/1200)]+ 2[(50/1200)] + 2[(1000/1200)] = 1.875 years. Notice that the duration on any bond that pays coupons will be below the maturity because there is some amount of the payments that are going to come before the maturity date. In this example, the maturity was 2 years. Investors use duration to measure the volatility of the bond. Generally, the higher the duration (the longer you need to wait for the bulk of your payments), the more its price will drop as interest rates go up. Of course, with the added risk comes greater expected returns. If an investor expects interest rates to fall during the course of the time the bond is held, a bond with a long duration would be appealing because the bonds price would increase more than comparable bonds with shorter durations.

Ratings

As discussed earlier, the yield of a bond will be influenced by the risk of default by the issuer. Naturally, there is far more risk associated with a small telecom companys bond than with the federal governments. Investors need to be compensated for the additional risk. Conveniently, there are bond rating services that do most of the legwork for you in determining the default risk for a given issue. The biggest names in bond ratings are Moodys Investors Services, Fitch IBCA, and Standard &Poors. These companies analyze each issuers financial position and assign a letter grade that ranks their likelihood of successfully repaying the debts incurred. The basic ranking system is as follows (each ranking system is a little different, but this should be a useful general guide):

Generally, the lowest grade bonds are all corporate bonds. Companies are at a far greater risk of default than a municipality or the federal government. However, some municipal, revenue, and income bonds also default, so it always makes sense to be aware of the rating on a bond you own or are considering buying. Ratings can change over time, which will impact the price of the corresponding bonds. If the issuers credit rating decreases, the price will decrease as well because the yield to maturity will need to increase in order to compensate for the increased risk of default. Of course, credit ratings can also increase if a companys financial picture improves, in which case the price will tend to increase.