Yen likely to weaken as BOJ continues QE

Post on: 15 Июнь, 2015 No Comment

DavidMarsh

European markets columnist

TOKYO (MarketWatch) — Japan seems likely to tolerate a further weakening of the yen as U.S. monetary policy gradually tightens over the next 12 months and the Bank of Japan maintains its large-scale purchases of domestic government bonds well into 2015.

This scenario seems the most likely outcome, accompanying the Japanese authorities’ resolve to press on with anti-deflation reforms in the face of recent signs of a slowdown in progress towards the 2% inflation target set by Haruhiko Kuroda, the BoJ governor.

Prime Minister Shinzo Abe has accelerated supply-side restructuring measures, including changes in corporate governance, corporate taxation and pensions investments that officials say should significantly improve the economic landscape in the next few years.

Getty Images

Japanese Prime Minister Shinzo Abe

Core inflation on a year-on-year basis, excluding the effects of the April increase in consumption tax, was 1.3% in June, faltering after 1.4% in May and 1.6% in April (a six-year high). The slowdown, officials say, was largely due to the “base effect” of relatively high year-ago numbers. These effects will become progressively less important towards the end of the year.

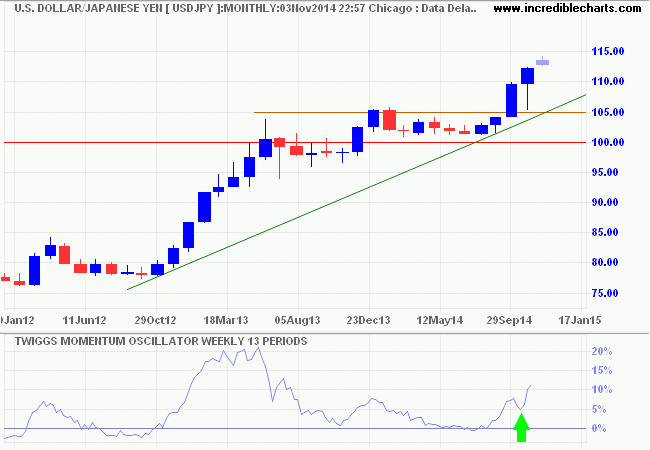

An important reason for the overall rise in inflation towards the 2% target since 2012 has been a weakening yen USDJPY, +0.15% , which fell 20% in 2013 in trade-weighted terms. Weak Japanese exports in recent months, the continued Japanese trade deficit, the phasing out of QE in the U.S. and the need for further anti-deflation momentum all point to yen weakness beyond the present 102 to the dollar in coming months.

Officials say central-bank purchases of Japanese government bonds (JGBs), at present around 7 trillion yen a month, equivalent to 70% of regular issuance since the latest quantitative easing (QE) program started in April 2013, are likely to continue beyond the two-year cut-off of April 2015 that some had seen as a possible exit date.

Core inflation is likely to pick up towards the 2% level from the fourth quarter, in line with more buoyancy in the economy. But the BoJ says it will not end asset purchases until inflation expectations are stabilized around 2% on a sustainable basis — something that appears unlikely for at least 12 months.

The government is encouraged by last week’s upgrade of the International Monetary Fund’s Japanese growth outlook to 1.6% this year from 1.3%, even though the U.S. forecast was cut to 1.8% from 2.2%. The euro-area outlook was seen unchanged at 1.1%.

Ministry of Finance (MoF) officials are stepping up efforts to market JGBs to central banks and other foreign public-sector investors, part of a wider effort to reap investment benefits from “Abenomics.” However officials accept that foreign purchases of JGBs will take off only after a rise in longer term interest rates from present levels below 1%.

A return to more normal JGB interest rates of above 3% — which will prove loss-making for present holders such as the BoJ — is not likely for at least two years. Part of the BoJ/MoF strategy of encouraging Japanese private-sector portfolio shifts away from JGBs into equity-type assets is that the BoJ can bear such a losses far more easily than other investing institutions.

One of the most important moves concerns redeployment of assets held by the $1.2 trillion government pension investment fund (GPIF), where decisions are imminent on investing more in domestic equities rather than government bonds.

Asia Pacific: World’s Epicenter for Hepatitis

GPIF officials are due to report by the end of next month how the fund can shift towards domestic equities as well as international bonds, mirroring allocation patterns of foreign pension funds such as in Canada. According to a MoF briefing paper, the GPIF has 60% of its holdings in domestic bonds, against 12% each in foreign and domestic equities, and 11% in foreign bonds. The Canadian Pension Fund Investment Board, by contrast, has 55% in foreign equities, 30% in domestic bonds, 10% in domestic equities and 5% in foreign bonds.

Takatoshi Ito, the Tokyo university professor who led a panel of experts advising Abe on pensions reform, has argued that the domestic bond share should fall to 35%. Yasuhiro Yonezawa, from Waseda University, the new chairman of the GBIF investment committee, said that Ito’s recommendations go too far, but the 60% domestic bond weighting is “a little too high.”

The GPIF shake-up is part of a broader rebalancing that has seen private-sector domestic institutions move out of government bonds and into more entrepreneurial investments to take advantage of the BoJ’s role as backstop JGB purchaser. The BoJ increased its government bond holdings by 55.5 trillion yen to 183.4 trillion yen in the nine months to December 2013, while private-sector financial institutions reduced their holdings by 35.3 trillion yen to 599.8 trillion yen.

The authorities want the GPIF and other conservative investment institutions to use changes in corporate governance rules and move into equity sectors that reward risk-taking, return on equity and shareholder activism. The government will expand the GPIF’s budget so it can hire more and better qualified investment staff — a process that will produce better results only over an extended period.

Also read these stories on MarketWatch: