Year End Tax Planning Ideas for Investors

Post on: 11 Июнь, 2015 No Comment

MorePixels/ E+/ Getty Images

Investors have a number of tax planning tactics available to them throughout the year. At any point in time, investors can decide to sell off an investment, to make a new investment, or some combination of the two. These decisions are particularly relevant near the end of the year as investors begin to determine their net investment gains and losses and make any final investment decisions that will have an impact on their tax return.

Tax Planning Tips for the Year 2014

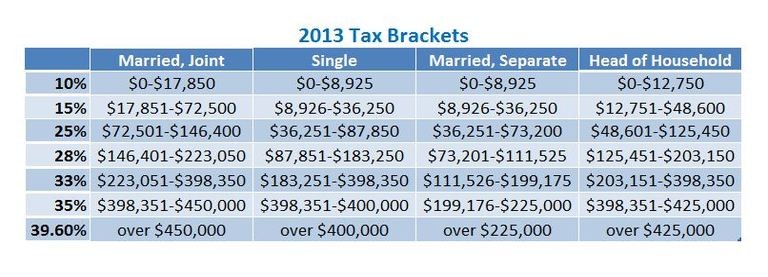

Before selling any investments, be sure you what tax rate or rates will apply to your investment income. For 2014, the following taxes are in effect

- Ordinary income tax rates for 2014 have have a top rate of 39.6%.

- Long term capital gains have a top tax rate of 20%. There are now three capital gains tax rates of 0%, 15%, and 20%. The 20% top rate applies for people who are in the 39.6% tax bracket.

- Qualified dividends are taxed at the long-term capital gains tax rates of 0%, 15%, or 20%.

- Investment income will be subject to the Net Investment Income Tax at a rate of 3.8%. This surtax tax on investment income will impact people who have adjusted gross income over $200,000 for unmarried persons or over $250,000 for married couples.

Combining both the income tax and the net investment income tax (NIIT), investors could face a marginal tax rate of 23.8% on long-term gains and qualified dividends (that’s 20% for the income tax plus 3.8% for the NIIT). Short-term gains, non-qualified dividends and interest, by contrast, could be taxed as high as 43.4% (that’s the top income tax rate of 39.6% plus 3.8% for the NIIT).

Check Your Cost Basis Reporting Settings in Your Brokerage Account

Brokerage firms have begun reporting the cost basis of investment products to the IRS and to account holders on Form 1099-B. In 2011, brokers began reporting the basis of stocks acquired in 2011. In 2012, cost basis reporting expanded to mutual fund shares and stocks purchased through a dividend reinvestment program if those shares were acquired during 2012. During 2013, newly acquired bonds, notes, commodities and derivatives were covered under the cost basis reporting requirements. Investors should review their cost basis allocation preferences on their broker’s Web site, as you may want to utilize a different method than the broker’s default methods.

Brokers may or may not have cost basis data for investments purchased prior to this time period. Compare your broker’s data to your own records to make sure you have all the basis data you need to prepare your 2014 tax return.

Consider Re-Balancing Your Portfolio by Type of Tax

If you’re rebalancing your investment portfolio, investments that produce ordinary income may fare better inside tax-deferred plans, and investments that produce long-term gains may produce more optimal tax results in taxable accounts, due to the lower tax rates that apply to long-term gains. This is part of a tax strategy called asset placement .

Selling off Losing Investments

This tactic accelerates losses into the current year. Capital losses offset total capital gains. and if you have a net capital loss for the year, up to $3,000 of capital losses can be applied to offset your other income. Any capital loss in excess of this annual limit carries over to the following year. Be aware that if you repurchase the same investment within 30 days (before or after) selling that investment at a loss, your loss will be deferred under the wash sale rules .

Sell off Winning Investments

This tactic accelerates income into the current year, and is ideal when an investor expects her tax rate in the current year to be lower than her tax rate in a subsequent year. Investors can also sell off profitable positions in order to absorb capital losses carried over from previous years. The downside is that accelerating income also accelerates tax. Investors in the 10% and 15% tax brackets may want to consider selling profitable long-term investments to lock-in the zero percent tax rate on capital gains. Investors who are in the 39.6% tax bracket though may want to consider the impact of the new 20% long-term gains tax rate and 3.8% surtax before deciding to sell.

Pairing Losses with Gains

This can be useful so that investors offset gains from some investments with losses from others. This tactic, known as loss harvesting. tries to minimize the total tax impact of selling investments at a profit by selling off investments with losses. This is a hybrid tactic that accelerates income and accelerates losses to create the smallest possible tax impact. This tactic not only reduces the net gains subject to the income tax, but also reduces net gains subject to the 3.8% net investment income tax.

Deferring Losses until Next Year

Generally speaking, taxpayers don’t need to defer losses on investment positions, since the tax code already has a provision for carrying over excess capital losses into a future year. Accordingly, the timing of selling off unprofitable investments can be driven by your investment strategy rather than tax considerations.

Deferring Gains until Next Year

Traditionally, holding off on selling a profitable investment can accomplish two tactics: it defers the income to another year, and you might be able to defer long enough to have long-term gain taxed at the preferred long-term capital gains rate instead of being taxed as a short-term gain at ordinary rates. Deferring gains can generate a smaller tax bill for taxpayers who expect a significant decrease in their income next year, since taxpayers in the 10% and 15% tax brackets have a 0% rate on long-term gains.

Tax Planning with Capital Loss Carryovers

Investors can use their capital loss carryovers to offset capital gains. Capital loss carryovers will become even more valuable for higher income persons subject to the net investment income tax. Investors may want to weigh the benefits of leaving some carryovers for 2015 and later years compared to a strategy whereby losses are absorbed as quickly as possible.