Worthwhile Canadian Initiative Does the equity premium still exist And if not so what

Post on: 1 Май, 2015 No Comment

A mainly Canadian economics blog

Does the equity premium still exist? And, if not, so what?

Allegedly, stocks generate, on average, higher real returns than bonds, that is, there is an equity premium .

The equity premium can be observed over certain time periods. For example, during the 1950s stocks outperformed bonds by 19 percent .

But Ive never understood why there should be a large premium on equities.

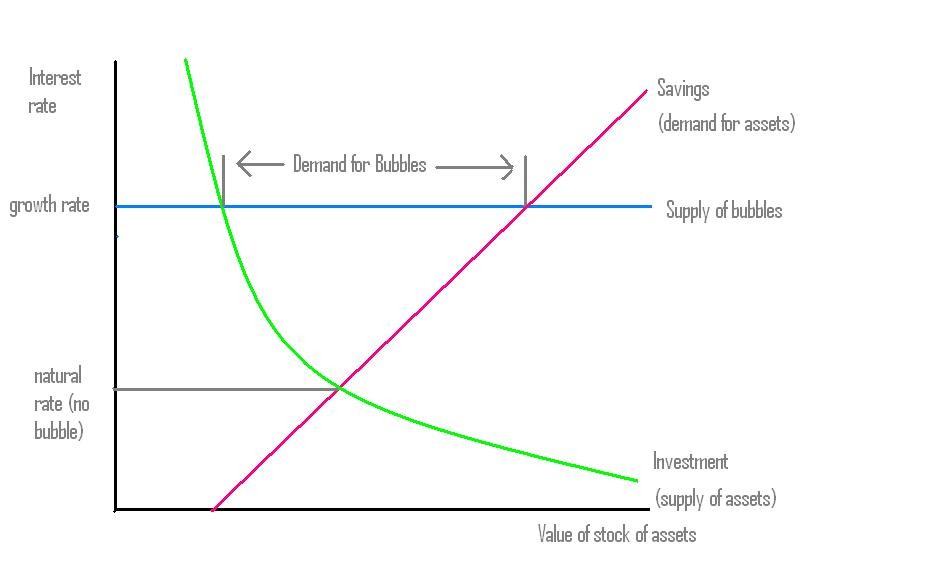

Supposedly the equity premium compensates shareholders for the risks that they bear. But large institutional investors are able to hold a highly diversified portfolio, so variance in the performance of individual stocks should have little effect on their overall rate of return. If stocks had a higher return, on average, than bonds, surely any investor large enough to diversify risk would buy mostly stocks. This would bring up the price of stocks up until, in equilibrium, the returns to stocks would be close to the return to bonds.

And its not as if bonds are risk-free, anyways. Bond issuers go bankrupt and default. Inflation happens. Interest rates go up and down.

It seems to me equally plausible that the equity premium was an artifact of the Great Depression, when the Dow Jones lost 89 percent of its value  over a three year period. The gradual recovery of those losses during the 1950s, 60s and 70s could explain the equity premium observed in the data.

Alternatively, perhaps new technology and the emergence of large institutional investors in the 1970s, 1980s and 1990s allowed people to figure out how to diversify portfolios and manage risks, creating an increased demand for stocks, running up the value of equities. But now were in a new equilibrium, with a much smaller, or non-existent equity premium.

Or perhaps its demographics — the stock market boom was created by the savings of baby boomers, and now that the first boomers are starting to hit retirement age, its all starting to fall apart (but it seems a bit early for that).

If the equity premium no longer exists, so what?

First, the standard investment advice — buy stocks when youre young, switch to bonds as you get older - would be wrong.

Second, if the return on stocks is no higher, or only very slightly higher, than the return on bonds, and the return on bonds is 1 or 2 or 3 percent a year, then every retirement plan that is based achieving a 4 or 5 or 6 percent real return each year has to go out the window.

To be quite honest with you, this is all just me talking off the top of my head. I know next to nothing about this subject. So this isnt so much a blog as a bleg. What do you think? Is there still an equity premium? Is the standard advice given to investors right or wrong? Are you buying or selling today? Or glued to a screen and watching the riots unfold? Or just watching cute animal videos on youtube?

Update: For a good non-technical introduction to the equity premium puzzle, see this survey piece by Brad DeLong and Konstantin Magin. They argue that degree of risk aversion needed to support the existing equity return premium seems extremely high — in other words, risk doesnt explain the equity premium. They discuss various other reasons (loss aversion, etc) why an equity premium might exist. Their article was written in 2008, right at the top of the market. At that time they predicted a continuing equity premium of about 4 percent. After the crash, they revised their prediction of the on-going equity premium upwards.

Such high returns on an on-going basis just seem to good to be true — and I would be astonished if the markets do indeed generate such high returns on equities.