Will the Federal Reserve Raise Interest Rates

Post on: 16 Март, 2015 No Comment

Federal Reserve Chairwoman Janet Yellen. sounding upbeat about the economy, laid the groundwork for interest-rate increases later this year.

“The employment situation in the United States has been improving on many dimensions,” Ms. Yellen told the Senate Banking Committee on Tuesday, her first of two days of semiannual testimony before lawmakers. Spending and production had increased at a “solid rate,” she added, and should remain strong enough to keep bringing unemployment down.

If the economy continues to strengthen as the Fed anticipates and officials become more confident that low inflation will rise toward their 2% goal, she said, the central bank “will at some point begin considering an increase in the target range for the federal funds rate.”

Hmmm. At some point, begin considering an increase in interest rates. At some point. And even then, begin considering. Definitely maybe, perhaps.

There’s a lot of talk and speculation that the Federal Reserve is preparing to raise interest rates in 2015. Bolstering this speculation is the ongoing myth that Janet Yellen is some kind of hawk, which is absolutely ridiculous; Yellen will by far be the biggest dove of them all, when all is said and done.

Will the Federal Reserve raise interest rates soon? Let us examine the most recent Federal Open Market Committee press release:

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progressboth realized and expectedtoward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.

Hmmm. Patient. I see. How vague. How unquantifiable. Such wiggle room.

The title of the aforementioned Wall Street Journal article is “Janet Yellen Puts Fed on Path to Lift Rates. ” This is complete nonsense. There’s absolutely no proof that the Fed is on any sort of path to raise rates. By Janet Yellen’s own admission, the Fed will not even “begin considering” an increase in interest rates until “some point” in the future, which they are being “patient” for.

I don’t know about you, but this sounds to me like that person we all know who continually claims they’re going on a diet; that is, rather hard to believe that it’ll ever happen. I’ll believe it when I see it actually happening before my eyes.

But that’s not even the major issue. Real talk: I actually don’t think the Federal Reserve can increase the interest rate at all, even if it wants to. The Federal Reserve wants everyone to believe that they can. But I wouldn’t be so sure.

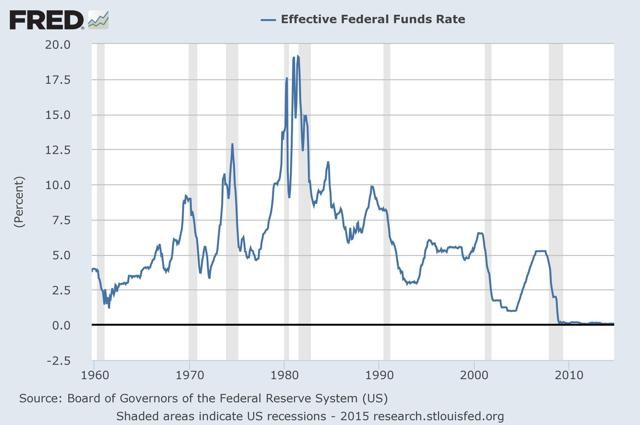

One way the Federal Reserve influences the short-term interest rate is by increasing or lowering the Federal Funds rate, which is the rate at which banks can lend money to other banks overnight. A high Fed Funds rate makes it more expensive for banks to borrow from each other, which is bad for overextended banks in danger of collapse. A low Fed Funds rate makes interbank loans cheaper, which is conversely better for banks in danger of collapse. Currently, our Fed Funds rate is the lowest it has ever been: barely 0.25%. Examine the chart below:

So, bank-to-bank overnight loans are cheaper than ever.

Here’s the problem: Nobody is looking for these loans anymore. After 2008, banks no longer need these loans. The Federal Reserve kicked the money machine into high gear after the Great Recession. Currently, the monetary base in America is the largest it has ever been, nearly 300% higher than it was pre-recession:

Most of this money is not actually in circulation. It is in the form of numbers in digital vaults. The money could theoretically be spent into circulation at any time. Let’s be thankful it hasn’t: if all the money depicted in this chart were to leave the vaults and enter daily use, we would unquestionably see hyperinflation.

The majority of this money lies in what are called “Excess Reserves” held by banks at the Federal Reserve. Think of the Fed as the banker’s bank in this situation. Deposits held as excess reserves receive a small interest rate, presently: nearly 0.25%. Similar to the monetary base, the level of excess reserves are some of the highest ever:

There is $2.6 trillion held as excess reserves by the commercial banking system. Everyone has basically all the money they need. None of the major banks important to the economy are in any danger of running out of money. They don’t need to borrow from each other.

If the Fed stops creating new money, short-term interest rates will rise. It will stop buying any debt, whether government debt or otherwise. This will cause short-term rates to rise, but long-term rates will likely fall. When long-term rates go below short-term rates, this gives us the inverted yield curve: bad news. If we see an inverted yield curve, prepare for recession.

These days, the Fed Funds rate is near 0%, at barely 0.25%. This introduces another possibility for experiencing an inverted yield curve: if long-term rates, such as those on 30-year T-bonds, go beneath 0%. Believe it or not, negative interest rates are possible. By that same token, the Fed Funds rate could go up a little, and T-bond rates could go beneath the FF rate but still over 0%. Either way, the impact is the same.

Will the Fed Funds rate go up? How would the Federal Reserve achieve this? The only way they can do this is to pay higher rates of interest on excess reserves. But it ain’t free. They have to pull this money out of Federal Reserve profits. When they do this, it increases the federal debt. This is because Federal Reserve profits are usually turned over the Treasury to pay off federal debt; but when those profits are used to pay excess reserve interest rates instead, then that is that much less that the federal debt will be paid off.

Since 2008, the Federal Reserve has been paying for excess reserves out of its profit. This is why rates are so pathetically low: because the Federal Reserve needs them to be. They cannot afford higher rates. They cannot afford to pay rates much higher than 0.25% out of their profits alone.

When our next recession strikes, which I believe to be soon, the Federal Reserve is going to want to lower interest rates to ostensibly encourage borrowing and spending. But rates are already basically at zero. Lowering rates by measly hundredths of a percent is not going to have an impact. They’re going to have to get rid of excess reserve payments and actually drive the rate below zero, in which case it will actually be a penalty. The Fed will penalize banks for holding money in excess reserves in order to encourage them to remove the money and spend it.

In response, commercial banks are going to buy T-bills and whatever else they think will get them a safe return on investment. I think only a minority of this will go to the private sector. The private sector is at peak debt, which I have discussed before. Americans have learned their lesson about drowning in debt. The Federal Government, however, know no peak debt. Public debt has no limit. The Government will take on debt until it disintegrates, if it has to.

So if the Fed starts penalizing banks to hold money in excess reserves, the banks will start lending money into circulation, partially through loans but mostly through the purchasing of T-bills – lending to the government. The Federal Government, in turn, spends the money into circulation. This is bad news: the fractional reserve banking process will begin again. Banks will once again be highly levered-up with little to cover it in the bank vaults. And when the money starts going into circulation, that when inflation kicks into high gear. Probably not hyperinflation, but mass inflation; enough to significantly hurt.

My entire point is this: The Fed is completely hamstrung. Monetary policy seen as liberating after the 2008 recession has become a straitjacket. If they attempt to raise rates, they risk recession. They will increase the federal deficit. More banks will probably try to hold excess reserves, if the rate goes up: this means the Fed has to pay out way more in interest. They simply cannot afford to do this.

How else can they raise short-term interest rates? They can ask everyone nicely. They can put on ceremonial garb and do an interest rate-dance. Neither of these will do anything.

The Fed is kicking the interest rate can. That is why they are “patient”. That is why they will not even “begin considering” an increase in rates until “some point” in the indeterminable future.

In six weeks, Janet Yellen will delay a rate hike again.

Six weeks later, she’ll do it again.

Six weeks later, she’ll do it again.

Six weeks later… you know the rest.

I’m sure the Wall Street Journal and other Keynesian cheerleaders would love to imagine that Janet Yellen and the Federal Reserve are stalwart geniuses with a plan for raising interest rates and returning the economy to normal. I say, prove it. Show me she means it.

They can’t prove it. She doesn’t mean it.