Widening breakevens show the bond market is playing catchup with the Fed

Post on: 10 Июль, 2015 No Comment

JosephAdinolfi

NEW YORK (MarketWatch) — The 10-year Treasury breakeven, the spread between the 10-year note’s yield and that of its inflation-protected counterpart, has widened by about 20 basis points since mid-January — an indication that the bond market is looking past any short-term effect falling commodity prices have had on inflation.

The widening in the spread is a sign that the bond market has come around to the Fed’s views on inflation — namely, that the pressure on inflation caused by the sudden decline in the price of oil should clear up by the end of 2015.

The spread between the two yields, inflation-protected yields and nominal yields, is equivalent to the market’s expectation for the average rate of inflation during the life of the bonds, explained Erik Norland, an economist at CME Group. “And now the bond market appears to be looking past the temporary dip in inflation as well,” he noted.

The spread has been widening since mid-January, increasing from 153 basis points on Jan. 13 to 172 points in intraday trading Tuesday.

The Treasury Department offers inflation-protected bonds as a hedge against rising prices, by guaranteeing that the principal amount will grow alongside inflation but the yield on the notes also offer clues about bond-market sentiment.

In it is December monetary-policy statement, the FOMC said it “expects inflation to rise gradually toward 2 % as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.”

In her testimony before the Senate Banking Committee Tuesday, Janet Yellen reiterated the view expressed in December, saying that she expects inflation to return to the Fed’s 2% inflation target in the medium term.

“The Federal Reserve appears to view the decline in inflation as temporary, which is in line with our view,” said Norland.

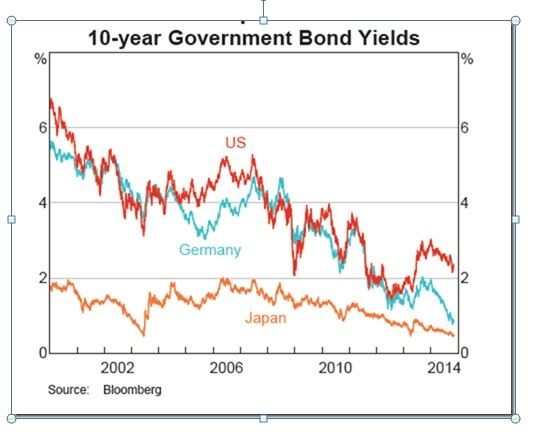

The yield on the 10-year TIP was at 0.266% in recent trade, while the yield on the 10-year TMUBMUSD10Y, +0.21% was at 1.990%, down 6.7 basis points on the day as the included chart illustrates.

While the rise in the 10-year break-even rate reflects rising inflation expectations, David Keeble, head of interest-rate strategy at Crédit Agricole, said many leveraged players, including hedge funds, had been betting that the breakevens would rise in the second half of 2014, before falling oil prices forced them to unwind their positions.

“The 10-year breakevens have dropped so dramatically that this isn’t all to do with inflation expectations,” Keeble said. “A lot of [the move] is due to the fact that the market is normalizing after a bit of a shock that happened after the oil price collapsed.”

Investors will have greater clarity on inflation in a few days when the Bureau of Labor Statistics releases January’s consumer-price index — the most widely-cited measure of inflation — on Thursday. Economists polled by MarketWatch forecast just 0.1% growth in so-called “core” CPI, a measure that strips out volatile sectors like food and energy prices. They’re also forecasting a 0.7% contraction in the headline number.