Why Your Pension Plan Has Sovereign Debt in It

Post on: 16 Март, 2015 No Comment

If you have a pension plan, it may give you a pleasant sense of security, but you may know very little about what happens to your contributions when you pay them in. In fact, the fund has to invest wisely in a diversified range of assets, in order to ensure that it can meet all its contractual obligations. This is the main reason why your pension plan has sovereign debt in it.

Why Your Pension Plan Has Sovereign Debt in It

Sovereign debt, also called public debt or national debt, is the amount owed by the government of a country to its creditors, and represents the governments deficit, that is, the excess of government spending over its revenues. Governments usually finance their debt by issuing bonds in their countrys currency, an example being US Treasury Notes issued in US dollars. Governments pay interest on the bonds, to give investors a return on their money, and the more secure that countrys bonds are perceived as being, the lower the interest rate paid.

Up till recently, sovereign debt was the one asset class that investors, particularly institutional investors like pension funds, could count on as a source of secure and predictable income, particularly when issued by a government with an investment-grade credit rating. This has changed to some extent in the last few years, with sovereign debt crises in several European countries. Despite this, especially in countries with their own currency, institutions still feel reasonably safe in investing in sovereign debt, since governments control their own revenues, and a growing deficit often leads to economic growth.

There are two main reasons why sovereign debt is an attractive prospect for pension plans. One of course is the safety aspect. With much of the governments deficit spending going on boosting demand and growth, investors feel confident that they will be repaid with interest.

The other reason is that purchasing government bonds denominated in the countrys currency helps ensure the funds liabilities are matched by its assets. It would in fact be easy in theory for an actuary to determine the size and duration of the funds liability, and fund this completely by buying government bonds in matching quantities and with matching maturity dates. In practice, pension funds never do this, partly because of regulations that limit their investments in each asset class, and require diversification. This means some pension fund investing is in higher-risk asset classes, and is less secure than it could be if it was 100% in sovereign debt.

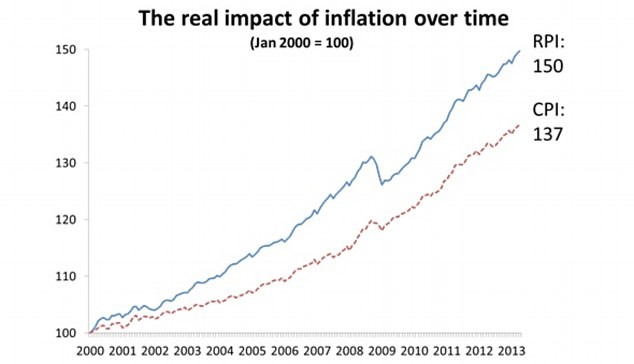

Not all experts agree that investing in sovereign debt is the best thing for pension funds. Government bond yields have already been pushed down by monetary policy in developed markets, and are already negative in real terms. As a flood of money into the markets leads to inflation, and a compensating rise in interest rates, this could get worse.

However, most industry leaders consider that government debt still makes sense for pension funds, despite the low returns. Sovereign debt may not be totally risk-free any longer, but it is the nearest to being risk-free that most investors will find. This is the main reason why your pension plan has sovereign debt in it, and will have for the foreseeable future.