Why You Shouldn t Automatically Reinvest Dividends

Post on: 6 Июль, 2015 No Comment

Over the past several weeks, Ive spent a lot of time streamlining our finances. As part of this process, I went into our taxable investment account and shut off the automatic dividend reinvesting feature.

I know, I know Dividend reinvestment makes up a huge percentage of investment gains. On top of that, Im a big fan of automating your finances. So what gives?

To be fair, we still automatically reinvest dividends in our tax advantaged (retirement) accounts. But out in the taxable world, there are several good reasons why you should have your dividends paid to cash and then reinvest them manually.

Simplifying your records

One of the biggest reasons that I made this change is that I want to simplify our record keeping. In a taxable account, whenever you purchase shares of an investment, you generate a tax lot a chunk of shares whose price needs to be tracked for tax purposes.

When you automatically reinvest dividends on an ongoing basis, you generate a small new tax lot every time an investment holding pays a dividend. Since most investments pay dividends more than once a year, and since most investors hold multiple investments, your record keeping burden can grow fast.

Lets say you hold three different mutual funds that pay quarterly dividends. If you automatically reinvest, youll create three additional tax lots per quarter. If you reinvest manually, you can take the dividends from all three funds and reinvest them in just one, creating 1/3 as many tax lots.

More efficient rebalancing

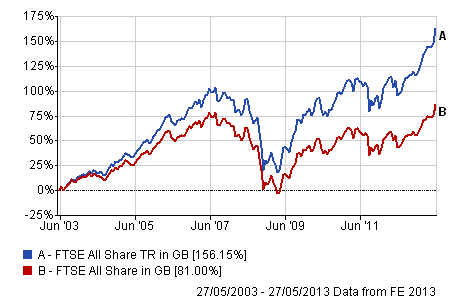

As nice as it is to simplify your record keeping, an even bigger reason to manually reinvest dividends is that it can save you a nice chunk of change on taxes when it comes to rebalancing your portfolio.

Inevitably, your asset allocation will get out of whack over time and youll need to rebalance. In essence, this involves selling some shares of the investment that is over-represented in your portfolio and buying more of whatever investment happens to be under-represented.

In retirement account, this is a no-brainer. Just sell one and buy the other. There are no tax consequences. But in a taxable account, selling your winners can generate capital gains, which means youll have to pay taxes. While your dividends may not be enough to keep your portfolio in check, you can minimize shares sales when rebalancing by directing your dividends toward your laggards.

For example, lets say that youre shooting for a 60/40 mix of stocks and bonds, but your stocks have been outperforming your bonds over the past year or so. As your dividends are paid on all investments in your taxable account (both stock and bonds), simply gather them up and buy more bonds.

Avoiding wash sales

Finally, when the market is down, many investors engage in something known as tax loss harvesting. Heres how it works

Suppose you’ve invested in a certain mutual fund, and the price has tanked. Assuming that this is an investment you want to hold for the long term, you might be inclined to sit tight.

Instead, you might consider selling your shares to book that loss so you can take advantage of your bad luck at tax time. Now that you’ve locked in your loss, however, you don’t want to miss out on a possible rally, do you? So the next question is How soon can you buy back in? This is where the wash sale rule comes in.

The wash sale rule requires that an investor wait at least 31 days after selling a security for a loss before repurchasing the same security, or a substantially identical investment. If you buy back in within 30 days, the IRS will treat it as if you never sold in the first place, and youll lose the ability to claim a loss.

The IRS also treats it as a wash sale if you make a purchase within the 30 days before the sale of your downtrodden shares. Thus, if you buy more shares in that 60 day window centered on the date of the sale, whether intentionally or via dividend reinvestment, you will generate a wash sale.

If this happens due to dividend reinvestment, all is not lost. The occurrence of a wash sale doesnt invalidate the entire tax loss harvesting maneuver. Rather, you will just lose the ability to claim a loss on the number of shares that you repurchases within that window.

Regardless, if youre at tax savvy investor, you can avoid this complexity by manually reinvesting your dividends. Either direct them to an investment other than the one that youre harvesting, or hold onto them until youre outside the wash sale window.

Is manual dividend reinvestment right for you?

Above, Ive outlined three good reasons to suspend automatic dividend reinvestment in your taxable accounts, but Should you really do it? As with most things, the right answer depends on you.

For example, if youll be tempted to spend your dividends, or if youre concerned that youll never get around to manually re-investing them, then you may want to continue with automatic reinvestment. But if youre disciplined, manual reinvestment can streamline your record keeping and reduce your tax bill.

Another consideration, brought up in the comments by a reader named Tom is that you can sometimes save on transaction costs by using automatic reinvestment. That is, if you have to pay a fee to make normal purchases (like buying Vanguard funds at Fidelity, or buying stocks through a broker), you should check to see if automatic reinvestment is free. If it is, then switching to manual reinvestment could cost you.

Published on January 26th, 2011