Why You Should Start Investing From a Young Age

Post on: 16 Март, 2015 No Comment

Why You Should Start Investing From a Young Age

Singaporeans nowadays are faced with rising prices in terms of housing, transport, raising a family, and just life in general.

Young couples who are just starting out in their careers and who are building a family, have to surmount even higher pressures as they might have very little savings in their bank accounts to begin with. In a January 2014 survey conducted by Singapore Polytechnic, it was found that the rising cost of living in Singapore is a major bugbear for the youngsters here. What are the young to do?

The Eighth Wonder of the World

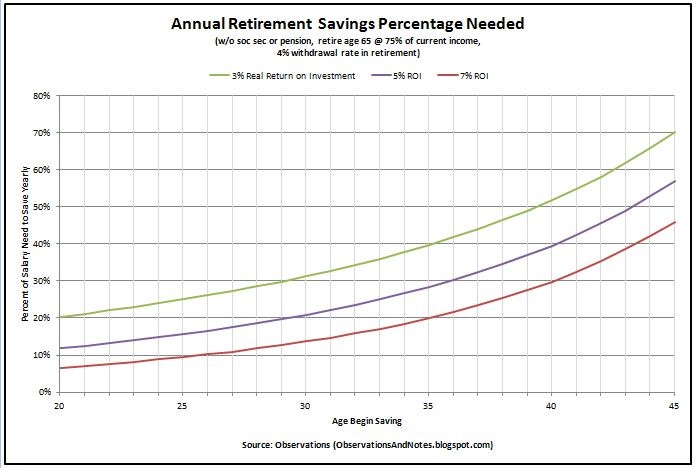

One sure way to cope with inflating prices is to invest early with a long time horizon. Here at the Motley Fool Singapore, we advocate long-term investing strongly as one powerful effect of such investing is that it allows the effects of compounding to take place.

The famous scientist Albert Einste was believed to have once said that compound interest is the eighth wonder of the world. It may or may not have been an apocryphal tale, but the veracity of the source of the quote takes nothing away from how powerful compound interest is.

Compound interest is the interest that accumulates on an initial principal and the accrued interest thereafter. Compound interest is what allows a principal amount to grow at a faster rate than simple interest. If we combine compound interest with a long time horizon, a formidable force is formed. Let me illustrate with the formula for compound interest shown below:

FV = PV × (1+R) N

where FV = Future Value; PV = Present Value; R = annual interest rate; N = number of years

As seen, the larger the number of years, the more compounding can occur, creating a bigger ending amount. To give some sense of scale to the abstract formula, let’s take a present value of $10,000 and an interest rate of say, just 5%. If the number of years is 20, the future value of the $10,000 would become $26,550. If we just stretch the number of years to 25 however, the ending value would grow to be just below $34,000. The difference between S$26,550 and S$34,000 is not exactly trivial!

Doing better than 5%

If the interest rate (the R in the equation) were to be bumped up higher, the ending value can become much greater. And truth be told, you do not have to be a genius investor or rocket scientist to be able to achieve an annual interest rate higher than 5%.

Let’s take for instance, the SPDR STI ETF (SGX: ES3). It’s a plain-vanilla index tracker whose aim is to mimic, as closely as possible, Singapore’s share market benchmark the Straits Times Index (SGX: ^STI). It’s quite possibly the simplest tool available in our financial markets here which allows an investor to buy “the Singapore share market” as a whole. Since its inception on 11 April 2002, the SPDR STI ETF has delivered a compounded annualised total return (where gains from reinvested dividends are included) of 8.65% up till 31 July 2014.

A yearly return of 8.65% means that an investor can double his money every nine years or so. This is not a bad deal at all. Socking money in our trusty bank account might give us an interest rate of as low as 0.05% per annum. For us to double our money with the bank at an interest rate of 0.05%, we’d need to give ourselves 1,440 years. I don’t know about you but I don’t think I will live that long!

Experience is key

As the young invest, they gain experience in the market too. Yogi Berra, a famous baseball player, once said, In theory there is no difference between theory and practice. In practice there is.”

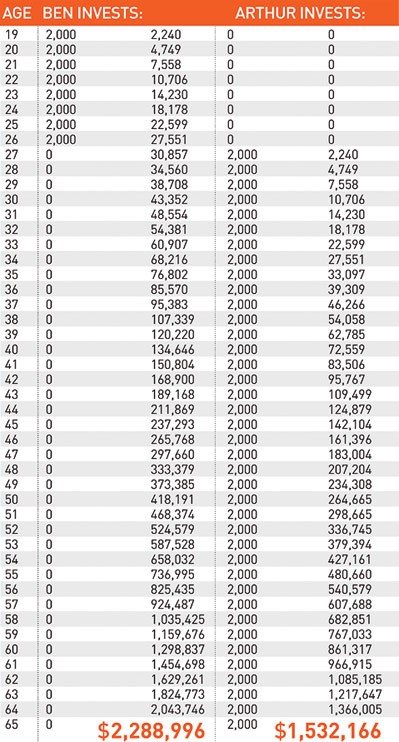

By investing early, the youths would have an upper-hand over many of their peers who do not start young. Let’s take Peter and John, two investors of the same age who only started investing at the ages of 21 and 33 respectively. When both reaches 35 years of age, Peter would have very likely seen at least one full market cycle and (hopefully!) learnt from his mistakes. John on the other hand, would not have that much experience.

Therefore, Peter would very likely make better investing decisions going forward that will help him to increase his returns as compared to John. When you combine superior experience with the power of a larger ‘N’ in the compound interest formula, Peter will be miles ahead of John when both hit the retirement age of say 65.

Growing as an individual along with their companies

There’s another interesting by-product of investing which is often not discussed. And that is, investing early can help a person become a better individual and widen his or her horizons. When analysing companies, you will be looking at how management runs the business and slowly be able to discern good practices from the bad. Such insights on good management can help mould an individual along the way.

Also, communication and networking skills can be cultivated when a youngster goes around meeting the various stakeholders of the businesses he or she is interested to invest in. For example, when young people attend Annual General Meetings of the companies they’re vested in, they can network with people from all walks of life and widen their perspectives.

All these will come in handy when they start working in the corporate world. They would have a better understanding of how businesses are run and what makes a business tick. They would be able to communicate well with peers, subordinates, and superiors alike in an informed manner. Such skills can make a person a very valuable employee.

Foolish Takeaway

The Oracle of Omaha, Warren Buffett, started investing at a young age of 11 and even then, he has said he regrets not starting earlier. By investing as a youngster, we can allow the magical effects of compounding to take place and allow us to reach financial stability much faster. There are other benefits that come along with investing young, such as gaining experience in the market and improving oneself beyond the confines of a book.

To help you make sense of the share market and to get you on the front foot as quickly as possible, we’ve prepared a special FREE report titled What Every New Singapore Investor Needs To Know . Click here now to get your copy!

Get FREE Issues of TAKE STOCK

By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms of Service .

The information provided is for general information purposes only and is not intended to be personalised investment or financial advice. Motley Fool Singapore contributor Sudhan P doesn’t own shares in any companies mentioned.

Singaporeans nowadays are faced with rising prices in terms of housing, transport, raising a family, and just life in general.

Young couples who are just starting out in their careers and who are building a family, have to surmount even higher pressures as they might have very little savings in their bank accounts to begin with. In a January 2014 survey conducted by Singapore Polytechnic, it was found that the rising cost of living in Singapore is a major bugbear for the youngsters here. What are the young to do?