Why you should avoid preferred stocks CBS News

Post on: 2 Июль, 2015 No Comment

(MoneyWatch) The low interest rates on government and high-quality corporate debt has meant that many investors can no longer generate the kind of income they need (or were used to). Faced with this dilemma, many seek higher yielding forms of fixed income. This search often leads to preferred stock, with the 30-day yield on the iShares S&P Preferred Stock Index Fund (PFF ) about 6.45 percent as of March 30. But what (if any) role should they play in your portfolio?

Preferred stocks are technically stock investments, standing behind debt holders in the credit lineup. Preferred shareholders receive preference over common stockholders, but in the case of a bankruptcy all debt holders would be paid before preferred shareholders. And unlike with common stock shareholders, who benefit from any growth in the value of a company, the return on preferred stocks is a function of the dividend yield, which can be either fixed or floating.

Preferred stocks are either perpetual (have no maturity) or are generally long term, typically with a maturity of between 30 and 50 years. In addition, many issues with a stated maturity of 30 years include an issuer option to extend for an additional 19 years. Investors considering purchasing a perpetual preferred should ask themselves: Would I purchase a bond from the same company paying the same interest rate with a 100-year maturity? The answer should be no, because the maturity is too distant.

The very long-term maturity of preferred stocks with a stated maturity also creates a problem. The historical evidence on the risk and rewards of fixed income investing is that longer maturities have the poorest risk/reward characteristics — the lowest return for a given level of risk. The long maturity typical of preferred stocks isn’t the only problem with these securities. They typically also carry a call provision.

Call provisions

U.S. government debt has no call provision (giving the issuer the right, but not the obligation, to prepay the debt). Thus, government debt (as well as all non-callable debt instruments) has symmetric price risk. A 1 percent rise or fall in interest rates will result in approximately the same change in the price of the bond (in the opposite direction). This isn’t the case with callable preferred stock:

- If rates rise, the price of the preferred stock will likely fall

- If rates fall, the issuer will likely call the preferred stock and replace it with a new preferred issue at a lower rate, conventional debt, or perhaps even common stock

Thus, you have asymmetric risk — you get the risk of a long-duration product when rates rise, but the call feature puts a lid on returns if rates fall. Thus, preferred stocks rarely trade much above their issue price. It’s important to note that almost all callable preferred stocks are callable at par. Thus, there’s extremely limited upside (virtually none if the call date is near) potential if the security is purchased at par.

Having protection from calls is important to income-oriented investors for another reason — callable instruments present reinvestment risk, or the risk of having to reinvest the proceeds of a called investment at lower rates. Through calls, investors lose access to relatively higher income streams. Thus, part of the incremental yield of preferred stocks relative to a non-callable debt issuance of the same company is compensation for giving the issuer the right to call in the debt should the rate environment prove favorable.

Credit quality

While not all preferred stocks are in the junk-bond category, they seldom are highly rated credits. Consider the holdings of PFF as of April 10. Only 3.2 percent were rated AAA/AA (the highest investment grades), and only about 13 percent was rated A or higher.

Why do companies issue preferred stock?

Given the lower cost of tax-deductible conventional debt (preferred stock dividends aren’t deductible), one has to ask why companies issue preferred stock, especially when traditional preferred shares are rated two notches below the issuer’s rating on unsecured debt. (A lower credit rating increases the cost.) The answer isn’t reassuring. They may issue preferred stocks because they’ve already loaded their balance sheet with a large amount of debt and risk a downgrade if they piled on more. Some companies issue preferred stock for regulatory reasons. For example, regulators might limit the amount of debt a company is allowed to have outstanding.

There might also be other regulatory reasons. In October 1996, the Federal Reserve allowed U.S. bank holding companies to treat certain types of preferred stocks (what are called hybrid preferred stocks) as Tier 1 capital — a key measure of a bank’s financial strength — for capital adequacy purposes. An additional reason for issuing preferred stock is that it can be structured to look like debt from a tax perspective and like common stock from a balance sheet perspective. Instruments structured in this manner are called trust preferred stocks.

Finally, you should be aware that preferred stock dividends are paid at the discretion of the company. Thus, preferred stock dividends could be deferred in times of financial distress — just when you need the dividends the most. On the other hand, bond interest payments represent a contractual obligation, and failure to pay sets reorganization in motion.

There’s another risk related to buying preferred stocks related to the call feature. The call feature is not only related to interest rate risk, but also to the risk of changes in the company’s credit rating. A company with low-rated credit and a high-yielding preferred stock will likely call in the preferred stock if its credit status improves — and replace the preferred stock with a now higher-rated conventional corporate bond (and its tax deductibility). Of course, if the company’s credit deteriorates, they won’t call the preferred stock, but the price of the preferred stock will fall due to the deteriorated credit. Again, asymmetric risk for the investor.

Investors can benefit from learning to think of things from the company’s perspective. Most companies with solid credit ratings don’t issue preferred stocks (except for regulatory reasons), since the dividend payments are not tax-deductible. Thus, preferred stocks are generally too expensive a form of capital for strong credits. Therefore, investors should wonder why companies would issue preferred stock paying a generous dividend when they could presumably issue debt securities with more favorable tax consequences. Investors seeking safe returns generally aren’t going to like the answer.

There’s another important point to cover. Longer-term maturities with fixed yields provide a hedge against deflationary environments. The problem with long-maturity preferred stocks is that the call feature negates the benefits of the longer maturity in a falling rate environment. Thus, the holder doesn’t benefit from a rise in price that would occur with a non-callable fixed rate security in a falling rate environment. If the issuer is unable to call in the preferred stock, it’s likely because of a deteriorating credit, putting the investor’s principal at risk. Given that preferred stock issuers are generally companies with weaker credit ratings, and distressed companies are the very ones most likely to default in deflationary environments, the benefit of the high-yielding longer maturity is unlikely to be realized by the holders of these callable instruments.

Reasons to buy preferred stock

Are there any good reasons to buy a preferred stock? Corporations receive favorable tax treatment on the dividends of preferred stock, with the vast majority of the dividend not subject to taxes. U.S. corporate holders can exclude up to 70 percent of the dividend from their taxable income provided they hold the shares at least 45 days. This favorable tax treatment creates demand for the product. Individuals get no such favorable tax treatment.

Overall, investors buying preferred stocks because of the higher yield, possibly combined with the fear of common stock investing, are taking on other risks. Since the market is efficient at pricing risk, higher yields must entail greater risk (something investors were likely seeking to avoid in the first place). These risks include perpetual life (or very long maturity), a call feature, low credit standing, deferrable dividends and (for traditional preferred stocks) depressed yield due to demand from corporations that receive favorable tax treatment.

There are some other reasons to consider avoiding preferred stocks. First, because of the need to diversify the risks, one shouldn’t buy individual preferred stocks. That means you need to buy a fund such as the aforementioned PFF and incur expenses of 0.48 percent. Since investors in Treasuries, government agencies or FDIC-insured CDs don’t need to diversify, they can eliminate the expense of a fund altogether. Or, for convenience purposes they can use funds with much lower expense ratios (such as those offered by Vanguard). Thus, some of the higher yield the market requires for preferred stocks will be spent on implementing the strategy. The result is that investors don’t earn the full risk premium the market requires. Second, if you buy individual issues, you have the trading costs, the lack of diversification and the need to constantly monitor credit ratings. Also, the typical lengthy maturity of preferred issues increases credit risk. Many companies might present modest credit risk in the near term, but their credit risk increases over time and tends to show up at the wrong time.

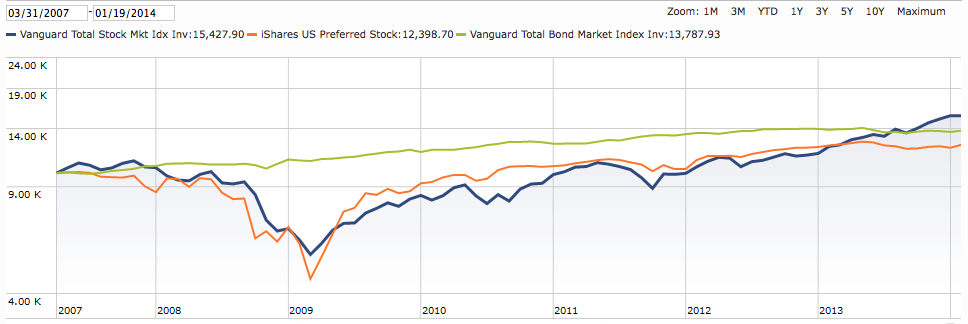

A study found that for the period October 2003-February 2011 period, the monthly return correlation between preferred stocks and common stocks was 0.57, demonstrating that preferred stocks have significant exposure to equity risks. You can see evidence of this in the following data. The changes in the NAV for PFF for the five quarters beginning in July 2007 (to capture the period around the latest financial crisis), were -3.8 percent, -9.2 percent, +3.3 percent, -4.1 percent, and -28.0 percent. Just when you need your fixed income assets to provide shelter from the storm, preferred stocks suffered large losses, similar to those experienced by junk bonds.

While the data is only available for a short period, it’s worthwhile to consider the following evidence. The annualized return for preferred stocks was 4.7 percent, just slightly higher than the 4.1 percent return on AAA-rated bonds, and below the 6.1 percent return on stocks. Since the monthly standard deviation of preferred stocks (6.4 percent) was higher than for either AAA-rated bonds (1.1 percent) or stocks (4.4 percent), preferred stocks produced the lowest monthly Sharpe ratio — 0.07 versus 0.09 for stocks and 0.15 for AAA-rated bonds.

Of even greater concern is that a five-factor regression shows that not only do preferred shares have significant exposure to equity risk (0.42 loading on the market factor) and significant exposure to value stocks (0.43 loading), but much greater exposure to default risk than high-yield bonds. The loading on default for preferred stocks was 1.5, as compared to the default loading for 1-10 year high-yield bonds of 0.54 and for 10-30 year high-yield bonds of 0.77. (All the figures are statistically significant.) In other words, preferred stocks had about three times the exposure to default risk as 1-10 year high-yield bonds and about twice that of 10-30 year high-yield bonds.

Finally, while fixed-rate non-callable Treasury debt makes an excellent diversifier for stock portfolios — because a weak economy, which can harm stock prices, generally leads to falling interest rates and rising bond prices — due to their call feature, preferred shares won’t benefit as much, or even at all.

The bottom line is that preferred shares’ high yields aren’t sufficient to justify investing in preferred stocks. If you want or need more risk than safe fixed income investments offer, take your risks on the common stock side where you can control them more effectively, diversify them more effectively and earn the risk premium in a more tax-efficient manner. And your costs for bonds will also be lower.

2012 CBS Interactive Inc. All Rights Reserved.