Why the Fed’s Decision to Stop Buying Bonds Is a Smart Move

Post on: 28 Июль, 2015 No Comment

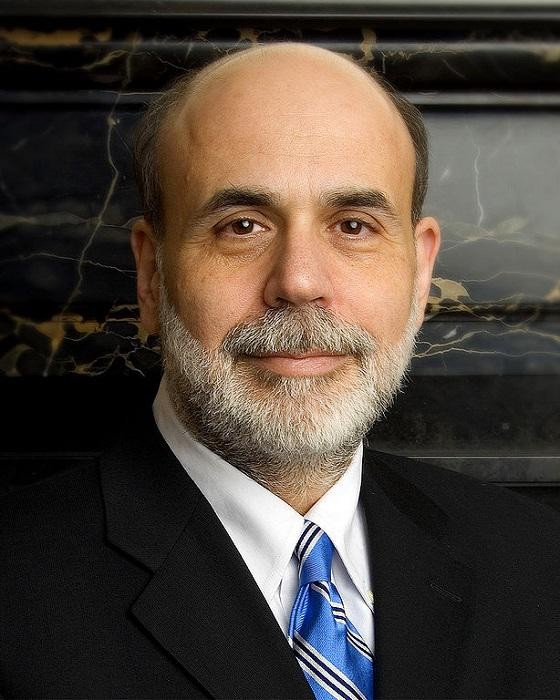

Well, Ben Bernanke finally had his wits about him when he suggested that the Federal Reserve might begin to taper its bond-buying program by the year’s end, and then end the program altogether sometime in 2014.

Of course, there was also the warning that the cuts would only happen if the economy continued to grow at a rate that met the Fed’s expectation. That may or may not happen.

Bernanke said he will look to taper the bond buying when the unemployment rate falls to around seven percent. They expect that to happen by the end of this year.

The news drove bond yields higher, which is bad for equities.

The reality is that Bernanke likely won’t increase interest rates until the end of 2014, or even until 2015. The Fed will leave interest rates intact until the unemployment rate falls to 6.5%, or if inflation rises to above 2.5%.

Unemployment could decline to 6.5% by the end of 2014 in the best-case scenario, according to the Fed, but the consensus among the Fed members is that higher interest rates will not surface until 2015.

Cheap money will likely be around until 2015; and even at that time, the move to increase interest rates will likely be gradual rather than sharp.

This means that those looking for cheap financing will continue to be able to. The cheap money will continue to drive consumer spending and the stock market until bond yields surge higher.

To me, that means we will have a few more years in which there will be very little incentive to save money in banks and more of a willingness to spend. The aftermath could be higher consumer inflation, but as long as it stays below 2.5%, the Fed may hold off on raising interest rates.

The problem that I have mentioned in the past will be the continued buildup of personal and commercial debt, which is fine in the current low-interest-rates environment, but a few years down the road, mounting interest payments on debt could wreak havoc for the economy.

For those seeking income from bonds, it will continue to be a difficult process given the recent record-low yields. And unless they bolt much higher, investors will likely still opt for dividend stocks.

For the time being, the money printing continues, but I believe the Fed’s decision to cut some of its stimulus by year-end makes sense. An exit strategy is in place, even though it’s not warmly accepted—based on the reaction of traders—despite the fact it was obviously a good play by the Fed.