Why the Federal Reserve Can’t Stop Printing

Post on: 3 Июль, 2015 No Comment

The strong jobs market report last week started the chatter again that the Federal Reserve would start to reduce the pace of its quantitative easing program. Some have said the Fed will reduce the amount of its asset purchases as early as December, while others are saying the quantitative easing will start to diminish by March 2014.

I have a different opinion: I believe the Federal Reserve can’t stop quantitative easing, because the market has become so dependent on it. If the Fed does go ahead with a pullback on money printing, the consequences will not be pleasant.

I made a very similar prediction last time when we heard a significant amount of “noise” about the Federal Reserve pulling back on its asset purchases. My predictions were right, and nothing has changed since then. The Federal Reserve continues to buy $85.0 billion worth of U.S. bonds and mortgage-backed securities (MBS) a month.

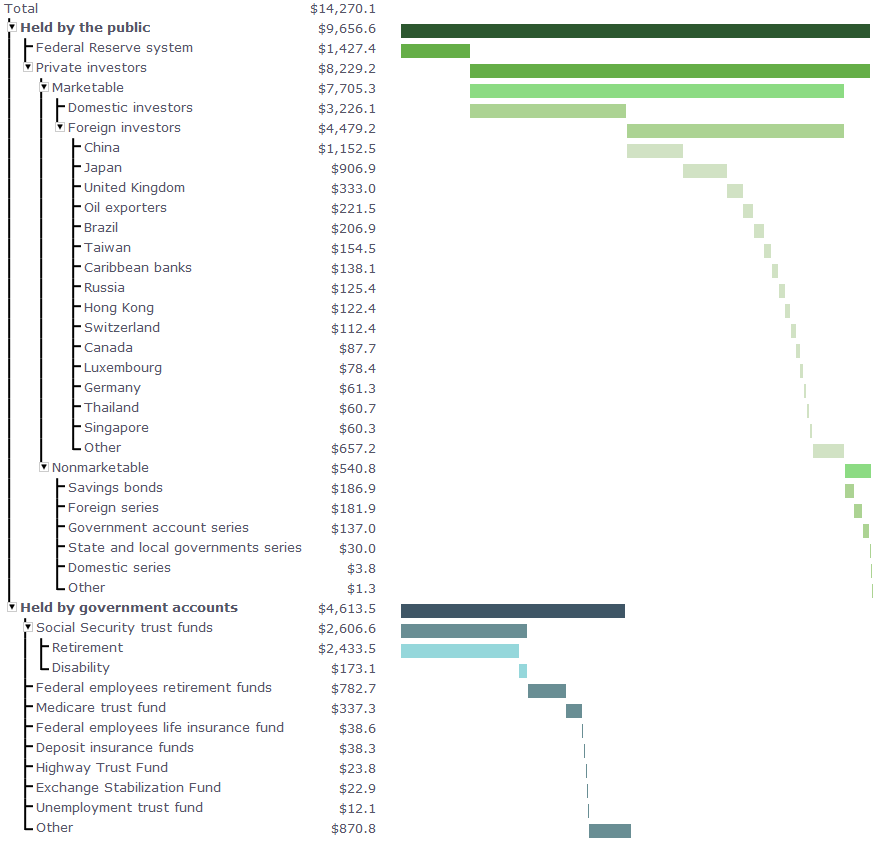

Please see the chart below to see why I believe the Federal Reserve just can’t walk away from quantitative easing without causing massive damage.

Chart courtesy of www.StockCharts.com

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

In May, when the Federal Reserve hinted it might be reducing the pace of its asset purchases, we saw a spike in bond yields with the 30-year U.S. Treasury rising from about 2.8% to as high as 3.9% in a very short period of time. Then we heard the Fed would not be tapering as was expected and bond yields settled and started trading in a range. Now, with the jobs market report perceived as good (first time we created over 200,000 new jobs in months), bond yields started rising again.

The issue is very simple: the Federal Reserve has become a huge buyer of. bonds through its quantitative easing program. Last time I looked at the Fed’s balance sheet, it was closing in on $4.0 trillion. And the Fed is still buying more U.S. bonds and mortgage-backed securities.

At the very core, the problem at play here is that as a massive buyer of both U.S. bonds and mortgage-backed securities (and it’s vastly known what the Fed holds in its portfolio), if the Fed tried to unload its holdings, this action could cause severe pressures on the bond market—prices will fall further and yields will soar, which will result in an increase in lending rates.

I remain very critical of quantitative easing; I think it has created more problems than benefits. Unfortunately, we will not know the outcome of those problems for months and maybe years to come. It’s a similar situation to the easy mortgage policies of 2004 to 2006, when it was so easy for home buyers to get a mortgage for a home they couldn’t really qualify for…and we know how that ended.