Why the bond bears are wrong

Post on: 24 Июль, 2015 No Comment

This site uses cookies. Some of the cookies are essential for parts of the site to operate and have already been set. You may delete and block all cookies from this site, but if you do, parts of the site may not work. To find out more about cookies on the website and how to delete cookies, see our Privacy and Cookie Policy.

Why the bond bears are wrong

Bonds will not suffer a major sell-off over the medium term, according to Western Assets chief investment officer Ken Leech, who says naysayers will be proved wrong due to current low inflation and rising wages in the US.

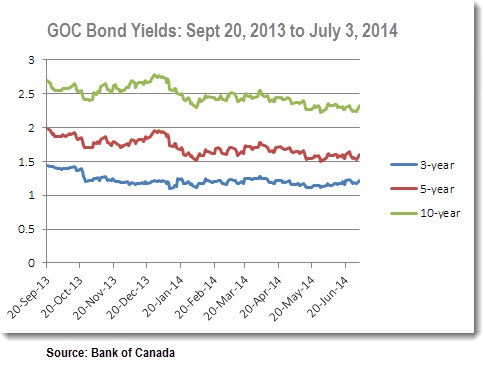

The fixed income world has been a difficult but dogged place to be invested in over the past year, with plenty of reasons to expect further strain such as a broad expectation of rising interest rates that has led many high profile managers to predict the end of a 30-year bull market.

The likes of Janus Capitals Bill Gross and JP Morgans Bill Eige n have even been predicting an Armageddon-like scenario for the asset class due to the end to loose monetary policy. They say a pronounced bond bear market will rock investments in fixed income and last for at least the medium term.

FE Analytics shows bonds have had a strong run over recent years, thanks to monetary easing around the globe and investors flight from riskier assets during several periods of crisis. Over some time frames, fixed income returns have exceeded the gains of equities.

However, many managers have recently pointed to rapidly rising downside risk.

Performance of indices since 2001

Leech, who heads up the $3bn Legg Mason Western Asset Macro Opportunities Bond fund, says while he is not very bullish, he expects central bank policy to tighten gradually and rising US wages to power the fixed interest market.

Most of us who have been immersed in the US markets for several decades look at todays interest rates as incomprehensibly low. But when we look at other developed countries around the world we see 10-year maturity bond yields that in many countries are fractions of 1 per cent, he said.

The major European periphery countries of Spain and Italy, deemed on the verge of collapse a little over three years ago, now enjoy yields substantially less than those in the US. And for a real head spinner, see Switzerlands negative interest rate.

Rather than being low, US interest rates are actually high in comparison to the rest of the developed world. Developed market participants who sell their bonds to buy US securities pick up a meaningful yield advantage and since the dollar has been appreciating, they get a currency boost as well. US bonds appear overpriced on domestic fundamentals, but they are a bargain based on global valuations.

Leech says while there have been risks to the bond market in the form of historically low yields, inflation and interest rates these will normalise over time.

It has been more challenging than expected and the big surprise last year was that the global inflation rate turned down because of the weakness in commodities prices, especially oil. This has caused a lot of concern in the market place and why we are getting two-way volatility.

However, growth is moderate and the low inflation will stop central banks being too aggressive [in raising rates]. This is why we remain optimistic. The recovery trade is still the right one and our basic theme is that yields, inflation and rates will normalise but it will take a very long time.

Wages are very important for both the US and UK because what happens to broader income levels will determine real economic activity, Leech says.

Wage growth is also important for inflation because if wages are going up prices go up too. Growth will be better in 2015 than last year and the US economy is doing reasonably well. Europe is the place where we have a lot of nervousness but the good news is that Mario Draghi is being very effective.

Leech is particularly positive on the US high yield space but says while there is plenty of value, some risk does remain in certain areas of the market.

We are underweight government securities tactically, but we have not undertaken any meaningful strategic negative duration stance, feeling there are other, better areas with the potential to add value, he explained.

Our decision not to undertake a decisive negative duration position despite the overvaluation of the government bond market could be ascribed to this extensive analysis. We believe there is no long-term value in current treasury prices, but we respect the cross currents that underpin current yield levels.

Leech oversees the entire $400bn of total fixed income assets under management at Western Asset, which was a recent beneficiary of several billion dollars of redemptions from Pimco funds following Bill Grosss 2014 exit from the company.

The Legg Mason Western Asset Macro Opportunities Bond fund was only launched in 2013 and so does not have a long term track record. However, since launch it has seen rapid inflows.

It has also outperformed its sector considerably, returning 17.07 per cent compare to an FO Fixed Interest sector average of 5 per cent, albeit with greater volatility.

Performance of fund and sector since launch

Daniel Lanyon was a guest of Legg Mason, Western Assets parent company, in New York.