Why mortgage rates are increasing as bonds hold steady Market Realist

Post on: 16 Март, 2015 No Comment

Recommendation: Watch for key releases during this eventful week (Part 4 of 6)

Why mortgage rates are increasing as bonds hold steady

Mortgage rates

Mortgage rates are the lifeblood of the housing market. This is why the Fed began quantitative easing (or QE) in the first place. Lower rates allow homeowners to refinance. Refinancing increases homeowners’ disposable income and helps stimulate economic growth.

Lower rates let first-time homebuyers move out of an apartment and into a house. This means higher consumption and benefits for home improvement retailers like Home Depot and Lowe’s. Consumption accounts for

70% of the U.S. economy.

Mortgage rates rise as the ten-year falls

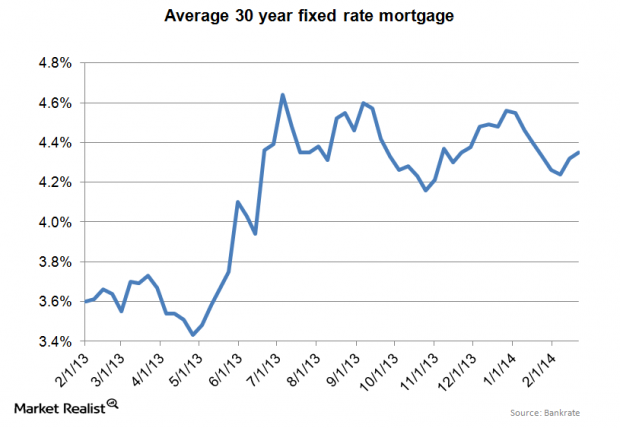

The average 30-year fixed-rate mortgage increased five basis points to close at 4.32%. The ten-year yield was flat and the to-be-announced (or TBA) market sold off slightly.

The increase in mortgage rates seems inconsistent with a decrease in overall interest rates. The issue may be that originators are beginning to extend credit to borrowers whom they would have turned down a year ago. Over the past year, the only loans that were getting done were conforming loans and high-quality jumbos.

Many originators are now beginning to originate stated income loans—not to be confused with liar loans of the subprime days. These loans will invariably have a higher interest rate than a generic Fannie Mae 30-year loan. So that could explain why mortgage rates increased. If this is the case, this could be the impact builders were waiting for. Tight credit has been a problem for builders for a long time.

Effect on homebuilders

Homebuilders, like Lennar (LEN ), Toll Brothers (TOL ), PulteGroup (PHM ), and D.R. Horton (DHI ), have been reporting decent earnings. But it appears that traffic is increasing in the previously dormant East Coast and Midwestern markets. The West Coast probably moved too quickly.

An alternate way to invest in the sector is through the S&P SPDR Homebuilder ETF (XHB ). Given that the economy could have depressed household formation numbers, there’s real pent-up demand for housing.

Housing starts have been below historical averages for the past ten years. With low mortgage rates and increasing demand—and a strengthening economy—homebuilders now have the momentum they need. The builders that have exposure to the booming West Coast market have been doing very well. For homebuilders, the top-down macro picture looks good.