Why Leveraged ClosedEnd Muni Funds Appear Relatively Undervalued

Post on: 16 Март, 2015 No Comment

Introduction. This article suggests that leveraged closed end tax-exempt (municipal bond) funds (LCEFs for short) have become sufficiently underpriced that even traders who normally have no interest in any fixed income vehicle may want to look at them. There are two reasons for this belief:

1. Per Bloomberg.com statistics. muni bond yields have risen recently relative to Treasuries so that both complexes have similar yields, thus suggesting a degree of undervaluation of munis relative to Treasuries.

2. Unusually high trading prices to net asset value (NAV) that prevailed 6-9 months ago in LCEFs have suddenly given way to near-record discounts to NAV in many funds.

This asset class, or at least a large number of funds in this asset class, thus appears to have a double margin of safety: The underlying asset is cheap relative to its benchmark, and the funds are mispriced relative to their own recent trading history and the value of the assets the funds own.

In addition, the discounts to NAV suggest that these funds may also be good long-term buys here for appropriate accounts.

However, these are bond funds, make no mistake about it. People who believe that the bond complex in general is overvalued may be correct. This consideration is why the word relatively is in the title of this article.

Background. These funds are designated as leveraged because in addition to owning bonds with the capital allocated to the fund, they borrow money, generally via AAA-rated vehicles, to purchase longer-dated, higher-yielding bonds. These funding vehicles are over-collateralized with the bonds, giving them the very high credit rating. The fund value therefore moves both in relation to the value of the bonds they own and the price they have to pay for the funding sources. The funds are borrowing short- or intermediate-term to lend long. While this is risky, it is not risky the way a bank that does this is, because these are closed-end funds. That means that the amount of capital in them is fixed. ETFs do have this risk, but not closed-end funds. Under stressed conditions, the funding vehicles get protected either by being redeemed and not resold, or some bonds that the fund owns must be sold to generate cash. These funds are not susceptible to runs that can bankrupt them, though their trading prices and NAVs can decline sharply.

Over many years, these LCEFs have done well, but this has been a period of declining interest rates, and this is not surprising.

These funds had illiquidity problems with the auction rate securities (ARS) that until the 2008 crisis they had been using to finance the leveraged, additional bond purchases. Subsequently, they found other stable funding sources. So, I’m comfortable with Nuveen LCEFs (and probably all of the funds families), which handled the ARS crisis responsibly, but there is no guarantee that problems with current funding sources will not crop up again should yet another financial crisis occur.

LCEF’s use of very low-cost leverage is unavailable to virtually all of us, including most hedge funds. Variable-rate demand notes often are sold at a cost only a little above the Fed funds rate, far below margin interest rates paid by retail investors who want to use leverage. I believe that this point makes them interesting.

I use LCEFs to enhance a portfolio that is heavy with many individual municipal bonds, and find over the years that buying the dips and selling the rips in LCEFs has worked quite well. In other words, I trade against other retail investors.

I have also found that liquidity has improved compared to several years ago, at least for the Nuveen funds I have traded.

LCEFs as contrarian plays. Favoring a close look at the investment backwater of LCEFs is (my view) the rush to the speculative side of the investment boat that has reached near-record levels. Per Pater Tenebrarum :

. NYSE margin debt has made another new all time high. It is of course possible for margin debt to rise even further. The point of discussing new highs in margin debt is mainly that it creates structural weakness for the market. Once a decline gathers pace, very high levels of margin debt will cause forced selling.

In this context one must also keep in mind that exposure by both mutual funds and hedge funds to the stock market remains at extremes. For instance, the speculative net long position in all stock index futures combined has reached yet another new record high as of Tuesday last week. The mutual fund cash-to-assets ratio is a mere 30 basis points above its all time low, at currently 3.7 percent (this is still 70 basis points below the low recorded in March of 2000 when the Nasdaq bubble peaked).

Individual investors and fund managers may again have been chasing hot stocks after they have more than doubled, tossing away decent bond values while so doing.

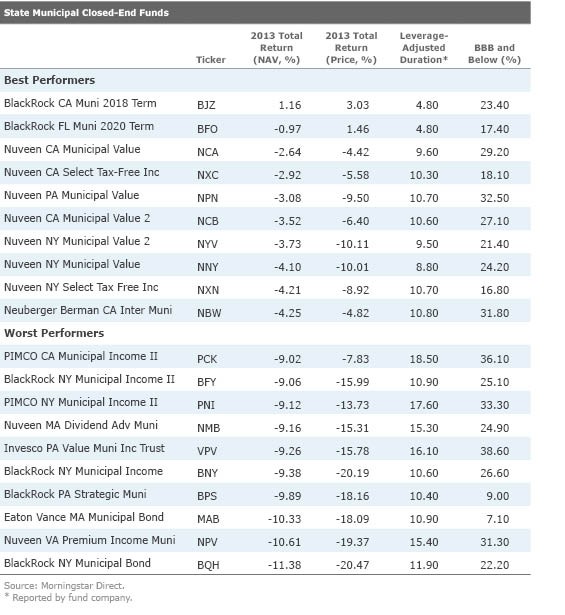

LCEFs — the case for undervaluation. Per CEFA. there are numerous families of LCEFs; this article focuses on Nuveen simply due to personal familiarity plus its well-organized website. There are several national Nuveen muni LCEFs. These differ in various ways, such as percentage of assets that are subject to the AMT; % callable within 6 years; distribution of assets; specific funding source; etc. They all share similar cost structures, which are reasonable for the industry. These are not low-cost funds, however.

This article does not compare one fund, or fund family, versus another.

Because of its large discount to NAV, I’m going to discuss one Nuveen fund in a little detail. This is not a recommendation for this one over any other fund, or for Nuveen over the many other LCEF tax-exempt bond funds available for purchase.

The Nuveen Dividend Advantage Municipal Fund 3 (NYSEMKT:NZF ) has had a striking recent change in investor perception, probably related to the dividend cut a few months ago and then by the continuing upward grind of interest rates. NAV has dropped a few percent. but the trading price has dropped a great deal more than a few percent from what was an over-exuberant high price relative to NAV. NZF is one of the less liquid LCEFs, and nothing herein is a recommendation to buy or sell anything, much less this specific fund. But I’m struck that this retail-oriented product has suffered what might be an emotional sell-off, perhaps triggered by the realization that its dividends go up and down from time to time.

Meanwhile, unleveraged muni bond funds have had much smaller drops in trading price relative to NAV. Yet all bond funds are subject to dividend cuts when interest rates drop, not only leveraged ones.

Larger LCEFs, such as the better-known Nuveen Municipal Opportunity Fund (NYSE:NIO ), have undergone similar price drops that exceed the drop in NAV and are better trading vehicles than are smaller ones such as NZF.

Risks. LCEF investments are not for timid bond investors. Rising short-term rates increase the cost of funding at the same time that rising long-term rates lower the value of the fund’s bonds. Leverage clearly cuts both ways. Nonetheless, the 2004-7 rising rate period was by no means a disaster for LCEFs.

Because variable dividends, both up and down, are inherent in LCEFs, they are unsuitable for people who prefer or require a predictable income stream.

A related risk may end up to be a potential trading positive. Sentiment on LCEFs began collapsing a few months ago when some Nuveen and perhaps other funds cut their monthly dividend payments a bit due to lower interest rates. In fact, one can look at a useful Nuveen web page that summarizes the degree to which current fund earnings do not equal dividend payouts (a few exceed them); click on 2nd link from the top to view. But the monthly payout ratio is not what determines the intrinsic value of these funds. Just as a common stock may get overpriced even while it is raising the dividend, so may a bond fund get underpriced even while it is cutting its payout.

Certain Nuveen and other municipal funds have exposure to Detroit. Whether these bonds are properly marked in view of what may be an upcoming bankruptcy filing is unclear.

Just a guess— a Detroit bankruptcy filing could provide a top-tier buying opportunity in LCEFs given how far they have already fallen, should munis in general sell off in sympathy.

Conclusion. While we all know that interest rates are low and bond prices therefore are high, the stock market knows it too and in response (for example) has priced the tracking ETF for the Russell 2000, BlackRock’s iShares Russell 2000 Index (NYSEARCA:IWM ) at over 25X trailing 12-month earnings. Meanwhile, many individual equities are reasonably valued.

Thus I believe that each asset, whatever class it is in, whether a stock or a bond, needs to be very carefully examined individually, and perhaps to a greater degree now than in some other periods.

In the case of many LCEFs, mere stability in interest rates could allow these funds to revert to historical discounts from NAV. If so, 4-5% price upside for many of them could occur quickly. Spare cash yielding nothing thus might be usefully allocated if this occurs.

If in fact interest rates actually drop in the near term, the upside from investing in depressed LCEFs could be yet larger.

Summary. No guarantees exist, of course, but many LCEFs now have a reasonable margin of safety that could make their purchase at current valuations attractive either for short-term traders or for long-term investors.

Disclosure: I am long NIO. NZF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not investment advice; I am not an investment adviser.