Why it s folly to follow investment fads CBS News

Post on: 9 Июнь, 2015 No Comment

Despite repeated warnings, many investors have increased their exposure to higher-yielding assets, thanks to the prolonged period of extremely low interest rates we’ve experienced. This is especially true for investors who rely on a cash flow approach, using dividends and interest income rather than a total-return strategy.

As a result, higher-yielding assets — such as high-dividend stocks, real estate investment trusts (REITs) and master limited partnerships (MLPs) — have seen a dramatic inflow of funds. The strong performance of these investments since 2009 has made them all-the-more alluring.

As the popularity of these investment fads increases, their short-term outperformance can become self-fueling. This, after all, is how bubbles occur.

However, investors who know their history are aware that such trends ultimately become self-defeating and often end badly. That’s because investors chasing the latest fad can cause valuations to rise, and the evidence is clear that the best indicators of future returns are valuation metrics.

With that in mind, let’s examine each of the three high-yield strategies and their current valuations. We’ll begin with REITs with a look at the performance of Vanguard’s REIT Index Fund (VGSIX ). For REITs, it’s important to consider dividend yield, which will allow us to forecast future returns using the dividend discount model.

According to Morningstar, the fund’s dividend yield was 3.4 percent as of Oct. 13. Historically, real REIT earnings have grown by a negative 1.5 percent a year. Thus, we can forecast future real returns to REIT investors of just 1.9 percent per year (3.4 percent — 1.5 percent). With long-term Treasury Inflation-Protected Securities (TIPS) currently yielding about 0.9 percent, that produces an expected risk premium for long-term investors of just 1 percent (1.9 percent — 0.9 percent).

To forecast nominal returns, we might add the current break-even inflation rate between 10-year TIPS and 10-year nominal bonds, which is about 2 percent. That produces a nominal return forecast of just 3.9 percent. One can only wonder how many REIT investors are aware that forecasted returns are now this low.

Of course, this low expected return is the result of strong performance, which in turn has led to high valuations. Since 2009, REITs have returned:

- 2009: 29.6 percent

- 2010: 28.3 percent

- 2011: 8.5 percent

- 2012: 17.5 percent

- 2013: 2.3 percent

- 2014 (through Oct. 13): 16.5 percent

Unfortunately, investors are all-too-often prone to buying yesterday’s winners when, in fact, the past isn’t prologue. The only thing possible for them to purchase is tomorrow’s returns.

Let’s turn our attention now to MLPs, specifically the Alerian MLP ETF (AMLP ). According to Morningstar, the fund’s price-to-earnings ratio (P/E) was 30.7 and its price-to-cash flow ratio (P/CF) was 12.7 as of Aug. 31. These are very high valuation ratios, much higher than they were before MLPs became popular.

Because this is a relatively new ETF, we’ll also look at the returns of the Alerian MLP Index. As of December 2013, the index’s 5- and 10-year annualized returns were 29.5 percent and 15 percent, respectively. Through Oct. 13 of this year, the Alerian ETF had returned an additional 12.9 percent.

These excellent returns, well above historical averages, have attracted investors and caused the P/E and P/CF ratios to rise to their current level. Note that, according to Morningstar, the dividend yield at the end of August was about 5.2 percent.

We now turn to the high-dividend strategy and look at the SPDR S&P Dividend ETF (SDY ). The fund uses a sampling technique to try to track the performance of the S&P High Yield Dividend Aristocrats Index.

The following table shows the valuation metrics (P/E, price-to-book [P/B], dividend-to-price [D/P] and P/CF) of SDY as of Oct. 10 compared with two value ETFs, the Vanguard Value (VTV ) and the iShares Russell 1000 Value (IWD ) funds. Assume that a high-dividend strategy is basically a value strategy.

The Madness of Crowds

As you can see, the dividend yield, or D/P, of SDY is just 0.1 percentage point higher than the dividend yield on VTV and just 0.2 percentage points higher than the yield on IWD. It also has much higher prices relative to each of the other three metrics. Plus, the earnings yield (E/P) for SDY is about 0.9 percentage point lower than it is for IWD and 1 percentage point lower than it is for VTV. Thus, the dividend discount model, which we used previously, would forecast SDY to earn the lowest returns of the three funds.

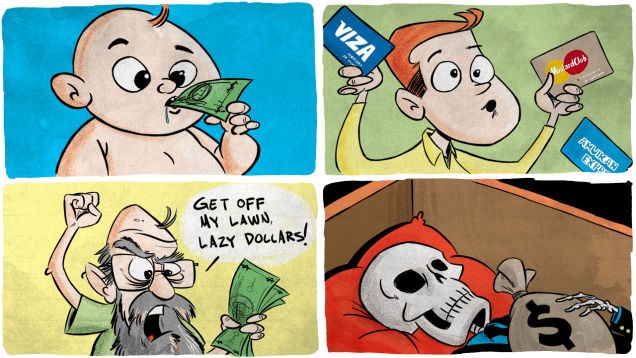

Psychologists have long known that individuals allow themselves to be influenced by the herd, or the madness of crowds. We see the same tendency in the fashion world, where trends like the length of a skirt or the width of a tie seems to come in and go out of favor with no apparent reason.

Given that fads affect social behavior, it follows that they can affect investment behavior as well. Author Charles MacKay put it this way: Every age has its peculiar folly: some scheme, project, or fantasy into which it plunges, spurred on by the love of gain, the necessity of excitement, or the force of imitation.

Unfortunately, when it comes to investing, perfectly rational people can be influenced by herd mentality. In investing, as in fashion, fluctuations in attitudes often spread widely without any apparent logic. But whereas changing the length of a skirt or width of a tie won’t affect your net worth in any appreciable manner, allowing your investment decisions to be influenced by the madness of crowds can have a devastating impact on your financial future.

The evidence presented here should help you overcome the hype surrounding these now-popular investment strategies. Ignoring this hype might be a wise decision because fads often most strongly influence investors who aren’t students of financial history and aren’t disciplined. Those same investors are most prone to fleeing as soon as the fad starts to fade.

History demonstrates that you’re much better off buying the assets that patient, disciplined investors who know their financial history hold.

If you do own assets such as REITs as part of a disciplined investment plan, don’t get caught up in the hype, either. Make sure you rebalance your holdings to their targets as planned. Keep in mind that you’ve been a beneficiary of the fad — and you want to be certain to lock in some of those gains.

2014 CBS Interactive Inc. All Rights Reserved.