Why Is There an Inverse Relationship Between Bond Yield and Prices

Post on: 22 Май, 2015 No Comment

More Articles

Any time a bonds price changes up or down, the yield changes in the other direction. Understanding why there is an inverse relationship between bond yields and prices is important, because its a basic characteristic of the way bonds work. Its also useful to know what factors cause changes in bond yields and prices.

Description

A bond issued by a corporation or government pays a fixed rate of interest referred to as the coupon rate. For instance, a bond with a $1,000 face value might pay $60, or 6 percent. Face value is the amount the bond issuer must repay to retire the debt represented by a bond. Yields and prices fluctuate as bonds are traded on the bond market, and they typically are different than the coupon rate and face value.

Yield and Price

Yield is actually the result of a mathematical relationship between price and the coupon rate. The yield is the effective rate of interest and is calculated by dividing the coupon amount by the price you pay. When the price is equal to the face value, dividing it into the coupon amount gives you the coupon rate. If the price of a bond drops, you get the same coupon amount, but you invest less money. This results in a higher yield when you divide the coupon amount by the discounted price.

Suppose a $1,000 bond pays a $40 coupon, or a coupon rate of 4 percent. If the price falls to $800, dividing this price into $40 gives you a yield of 5 percent.

Conversely, if a bond is selling for more than face value, you pay more money, but you still receive the same coupon amount. When you do the math, the yield comes out smaller. If the bond goes up to a price of $1,250, dividing the price into a $40 coupon gives a yield of 3.2 percent.

Why Yield and Price Fluctuate

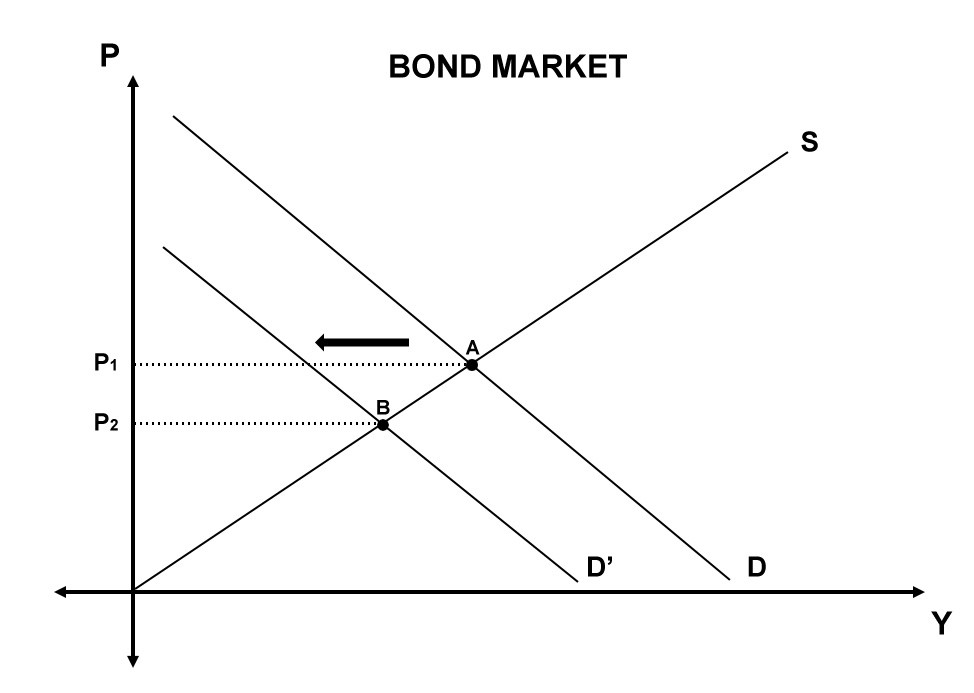

Investors bid bond prices up and down mainly in response to changes in interest rate and credit risk. If market interest rates fall, existing bonds become relatively better investments. Investors bid prices up, driving yields down until they are comparable to the new interest rates.

The reverse happens when interest rates rise. Demand for existing bonds drops, prices tend to fall, and so yields go up.

Investors also want to get their money back when a bond matures. If bond rating agencies downgrade a bond issuers credit rating, nervous investors go elsewhere. Demand drops, and the price of the bonds is likely to decline until the resulting rise in the yield attracts investors willing to take greater risks to get better returns.

Yield, Price and Maturity

As a bond approaches its maturity date, the price tends to get closer to face value and the yield approaches the coupon rate. Bond owners simply wont sell a bond near maturity at a large discount, because they soon would receive the full face value. Investors wont pay a large premium, because the bond soon would be redeemed and they would be paid only face value.