Why Invest in International Small Cap Stocks

Post on: 16 Март, 2015 No Comment

Reasons to Invest in Small Global Companies

You can opt-out at any time.

Small cap stocks are commonly defined as those with market capitalization of $300 million to $2 billion. Unlike large cap and mid cap stocks, these companies are often off limits to large institutional investors and stock analysts, creating a potential opportunity for investors. In this article, we’ll take a look at why investors may therefore want to consider small cap stocks for their portfolios, in order to maximize their risk-adjusted returns.

Studies Support Small Cap Growth

Small cap stocks may seem riskier than large cap stocks for many reasons — they often have less capital, higher cost of capital. and may face greater competition. But, several academic studies have shown that they tend to outperform large cap stocks over the long-term. The rationale behind this tendency is relatively simple — the law of large numbers says it’s easier to double $100 than $1,000, while a lot of the extra risk can be eliminated through diversification .

Between 1926 and 2006, small cap stocks beat large cap stocks by an average of 2.3% per year, according to a study by Ibboston Associates. These studies further suggest that value outperforms growth when it comes to small cap stocks, with the 20 best performing small cap funds between 1992 and 2007 being classified as value funds. And combined, these studies suggest investing at least a portion of a portfolio in small cap value stocks.

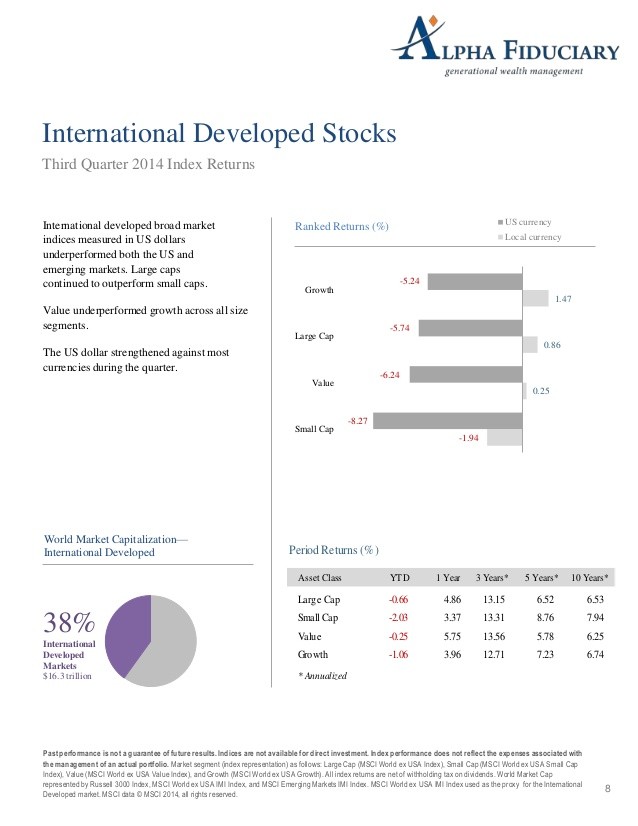

Case for International Small Caps

International small cap stocks experience similar dynamics, with a tendency to outperform international large cap stocks, with the added benefit of international diversification. As a result, investors may be able to further enhance their portfolio’s risk-adjusted returns by investing in international small cap stocks, as opposed to either international large cap stocks or domestic small cap stocks, according to some research on the subject.

For instance, a 2006 study comparing diversification between international large cap funds and international small cap funds found that a fully diversified international large cap and small cap portfolio entails nearly two-thirds less risk than just a diversified international large cap portfolio. More specifically, the study showed that small cap funds have relatively low correlations not only with large cap funds, but also with each other.

Finding & Investing in These Funds

Investors looking to capitalize on international small cap stocks and their numerous benefits have a number of different options. Exchange-traded funds (ETFs) and mutual funds are perhaps the easiest options, while investors looking for more specific exposure may also want to consider American Depository Receipts (ADRs) or direct investment on foreign exchanges — although this may result in some important tax consequences.

Those look for broad global exposure may want to consider ETFs like the SPDR S&P International Small Cap ETF (GWX). With 838 holdings in 15 different countries, as of February 2013, the ETF holds no more than 1% in any single company and offers excellent diversification. However, investors should be aware that it’s somewhat heavily weighted towards Japan (31.39%), Canada (11.9%) and the U.K. (11.72%), as well as the industrial (22.04%) and financial (18.84%) sectors.

Individual international small cap funds include:

- IQ Canada Small Cap ETF (CNDA)

- IQ Australia Small Cap ETF (KROO)

- Guggenheim China Small Cap ETF (HAO)

- Market Vectors Brazil Small Cap ETF (BRF)

- SPDR Russell/Nomura Small Cap Japan (JSC)

Risks & Other Considerations

Investors should consult their financial advisors and tax professionals before investing in any stocks, bonds, ETFs or mutual funds. Certain international stocks may involve unusual tax consequences or legal implications, while individual small cap stocks can entail greater risk than large cap stocks by nature. Finally, investors should consider their overall portfolio mix and how these stocks may fit into it in order to ensure maximum diversification.