Why FX carry trades aren t performing The Tell

Post on: 27 Апрель, 2015 No Comment

Some investors have gotten past the market turmoil that erupted when Ben Bernanke first hinted that the Federal Reserve might scale back its bond buying later this year. Not those who play the carry trade in the currency market.

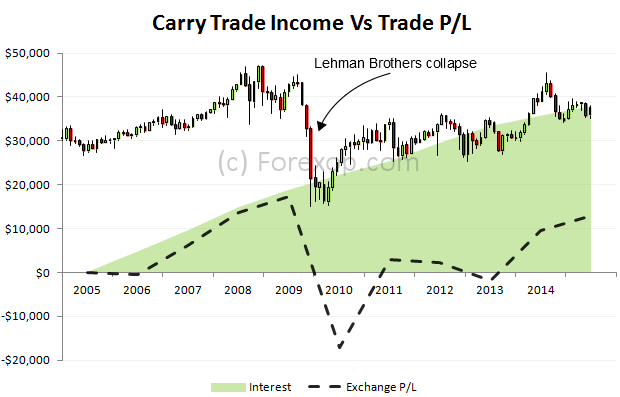

The foreign-exchange carry trade is a way for investors to profit from differences in interest rates by borrowing currencies with low yields and using them to buy assets denominated in higher-yielding counterparts. This had been done with the low-yielding yen for many years.

But when concerns that the Fed would slow its monthly asset purchases of $85 billion started surfacing in May, the trade fell apart. Bernanke “exacerbated” these fears when he told members of Congress in May that the central bank could begin slowing its purchases “in the next few meetings ,” Nomura’s Ankit Sahni and Jens Nordvig wrote in a note.

Late May into the first half of June was an especially bad period for carry trades based on shorting the yen because Fed fears coincided with a fall in the Nikkei and a rise in the yen against the dollar, said Nordvig, global head of G10 FX Strategy, in an interview. A short on the yen is a bet that its value will decline.

“Increasingly, market expectations were built around a reduction in the pace of asset purchases later in 2013. This resulted in a level shift higher in perceived risk and volatility, causing significant underperformance of these carry trades. But the size of the drawdown diverged significantly among assets,” the Nomura analysts wrote.

Look at the chart below to see the gap between the performance of carry trades with emerging-market currencies (gray line) and U.S. high-yield bonds (magenta line), based on indexes constructed by the firm. The high-yield trade involves buying high-yield debt and shorting investment-grade debt:

In time, many of the carry trades measured by Nomura began to perform again. The fixed-income and equity carry trades have made up at least half of their losses caused by the Bernanke-inspired turmoil. The index constructed for high yield recovered 79% of its losses from that period through July 30 and the equity index recovered 57% of its losses.

But that has not been the case for G10 and emerging-market carry trades in foreign exchange. The index constructed for G10 currencies has made up just 15% of its Fed-fueled losses, and the emerging-market currency index has recouped nothing. The carry indexes are constructed so that they will outperform if currencies with high interest rates like the Aussie or Kiwi dollars outperform, Nordvig said.

“This divergence between FX and fixed income carry trades is notable, and different from the norm,” they wrote.

One factor has been slower Chinese economic growth. Forecasts for China’s 2013 GDP growth declined to 7.5% in mid-July from 8.1% in mid-April, they wrote. Another is the current account deficits in emerging-market countries. This makes sense in an environment of uncertain capital flows given the policy guidance shift from the Fed, making countries with large current-account deficits more susceptible to currency weakness,” they wrote.

And theres no guarantee that the FX carry trades are going to recover.

I think we’re in a bit of regime shift where some of those economies that have been relatively resilient in the crisis and are actually showing some signs of weakness, said Nordvig. If that’s right, we’ll be in an environment where FX carry isnt going to deliver strong returns at all.

Nomuras conclusion:

“The carry divergence between FX and fixed income is uncommon and notable. Nevertheless, we think it could persist for now. We believe the China growth factor is likely to stay important, as our China economic forecasts remain below consensus with further downside risks. In addition, the relevance of current accounts is another continuing theme, in our view, as the Fed policy shift is in motion and unlikely to reverse suddenly.”

Saumya Vaishampayan