Why commodities ETFs are right for your portfolio now

Post on: 16 Март, 2015 No Comment

JohnPrestbo

Bloomberg

If you believe in buying when prices decline, you might want to think about adding commodities to your portfolio, either for the first time or enlarging your existing position.

Commodities are regarded as a single asset class but they aren’t a single market, as are stocks and bonds. Rather, each commodity’s price responds to its own unique supply and demand factors, even for those markets that are related — crude oil and gasoline, for example. While some overarching developments such as rising interest rates can affect them all, commodities by and large are independent of each other.

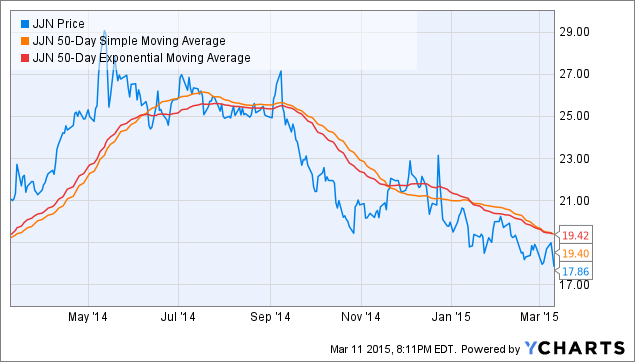

This year’s performance roster is littered with minus signs. For example, United States Oil ETF USO, -1.81% is down 28% since June (through Nov. 14). Meanwhile, iPath Dow Jones UBS Grains Total Return ETN JJG, +0.00% has dropped 26.7%. SPDR Gold Trust GLD, +0.25% is off 14% since March and United States Copper CPER, +0.40% has lost 10.7% since Dec. 31.

The few in the plus column haven’t sustained their best gains. The iPath Dow Jones UBS Coffee Total Return ETN JO, -1.37% for example, soared 96% this year into April, but then fell by 14% and closed on Nov. 14 with a 67% net gain so far for 2014. The iPath Dow Jones UBS Cocoa Total Return ETN NIB, +0.00% jumped 24% into September but fell back 18% to close with a net gain of less than 2%.

Investors have a lot to be thankful for this year

Marketwatchs Chuck Jaffe tells MoneyBeat host Paul Vigna that investors have plenty to be thankful for this year. Photo: iStock/DNY59.

So, the stage is set for investors to get into commodities at a discount from recent levels. But why should they? Many are wary of diversification because they remember the debacle of 2008, when markets of all types plunged.

Yet study after study shows that adding commodities modestly to a portfolio both reduces volatility and boosts returns over long periods. Investment researcher Morningstar found that a portfolio with 40% bonds, 32% stocks and 28% commodities outperformed one with a 60% stocks/40% bonds allocation from 1991 through 2010 — which includes the Great Recession.

I believe these studies because (1) 20-year performance is more telling than an 18-month trauma, (2) the stock market won’t keep setting records forever, and (3) the bond market will at some point decline in the face of rising interest rates.

Now may not be the perfect time to add commodities — prices could slide further — but perfection is visible only in hindsight. Meanwhile, commodities’ rudimentary economic principles start to work: Lower prices increase demand, which eventually stimulates production that takes a while to catch up.

Deciding whether to add commodities to your portfolio, or add to the commodities already in it, is the easy part. Far more confounding is figuring out exactly how to go about doing that.

We non-experts should opt for exchange-traded vehicles that include a variety of commodity markets.

There are 153 commodity exchange-traded products out there, according to etf.com. Most are exchange-traded funds and some are commodity-linked notes. They are typically based on indexes of futures prices, but a few are actively managed and others, also few, hold the actual commodity, such as gold bars in London vaults.