Why Bond Prices Go Up and Down

Post on: 20 Апрель, 2015 No Comment

by Annette Thau

With bond investing, prices go up and down in response to two factors: changes in interest rates and changes in credit quality. Bond investors tend to worry a lot about the safety of their money. Generally, however, they tie safety to credit considerations. Many bond investors do not fully understand how changes in interest rates affect price. Since the late 1970s, changes in the interest rate environment have become the greatest single determinant of return on bond investments. Managing interest rate risk has become the most critical variable in the management of bond portfolios. In this article, well see why.

Interest Rate Risk

Interest rate risk, also known as market risk, refers to the propensity bonds have of fluctuating in price as a result of changes in interest rates.

All bonds are subject to interest rate risk.

If nothing else makes an impression, but you learn that all bonds are subject to interest rate risk, regardless of the issuer or the credit rating or whether the bond is insured or guaranteed, then this article will have served a useful purpose.

The principle behind this fact is easy to explain.

Let us suppose you bought a 30-year bond when 30-year Treasuries were yielding 4%. Further suppose that you now wish to sell your bond and that interest rates for the same maturity are currently 10%. How can you convince someone to purchase your bond, with a coupon of 4%, when he can buy new issues with a 10% coupon?

Well, there is only one thing you can do: You mark down your bond. In fact, the price at which a buyer would buy your bond as readily as a new issue is that price at which your bond would now yield 10%. That would be approximately 30 cents on the dollar, or about $300 per bond.

But, you will object, if I sell my $1,000 bond for $300, I have lost $700 per bond!

That is precisely the point.

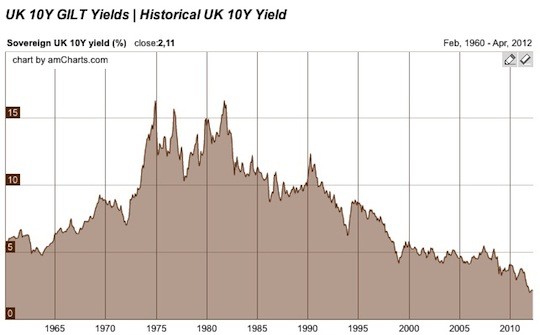

In the bond investing area, significant changes in the interest rate environment are not hypothetical. During the past decade, swings of 1% (100 basis points) have occurred on several occasions over periods of a few weeks or a few months. During the late 1970s and 1980s, rates moved up and down, in sharp spikes or drops, as much as 5% (500 basis points) within a few years. Between September of 1998 and January of 2000, interest rates on the Treasurys long bond moved from a low of 4.78% to a high of 6.75%, almost 200 basis points. If you held bonds during that period, you will remember it as a period when the returns on bond investments were dismal.

With bond investing, the basic principle is that interest rates and prices move in an inverse relationship. When interest rates went from 4.78% to 6.75%, that represented an increase in yield of over 40%. The price of the bond declined by a corresponding amount. On the other hand, when interest rates decline, then the price of the bond goes up.

Bond Investing: Managing Risk

What can you do to protect your money against interest rate fluctuations?

The best protection is to partake in a bond investing program that buy bonds with maturities that are either short (under one year) or short-intermediate (between two and seven years).

While all bonds are subject to interest rate risk, that risk is correlated to maturity length. As maturity length increases, so do potential price fluctuations. Conversely, the shorter the maturity of the bonds you invest in, the lower the risk of price fluctuations as a result of changes in interest rate levels.

To illustrate, lets look at Table 1. This table shows what would happen to the price of a bond selling at par ($1,000), with a 7% coupon, for several different maturities, under three different scenarios:

- Interest rates rise modestly by 50 basis points, to 7.5%;

- Interest rates rise by 100 basis points, to 8%;

- Interest rates rise steeply, by 200 basis points, to 9%.

Table 1 shows that if interest rates rise modestly, by 50 basis points, the price of the two-year bond changes very little. But even that modest rise results in a decline of 3.5% ($35) for the 10-year bond and 5.9% ($59) for the 30-year bond. For the 30-year bond, the decline of 5.9% wipes out almost the total amount of interest income for the entire year. If a much sharper rise in interest rates occurs, from 7% to 9%, declines become correspondingly larger. Clearly, if interest rates go up, the holder of bonds with shorter maturities would be less unhappy than the holder of bonds with long maturities.