Why Bond Investors May Benefit from Actively Managed Mutual Funds and ETFs

Post on: 7 Апрель, 2015 No Comment

Key TAkEAWAyS

- Passive index investment strategies are designed to mirror the composition and performance of a benchmark index. In contrast, active strategies can differ from the index in the pursuit of better returns.

- Active bond funds and ETFs have the potential to outperform passive index funds, using intentional approaches for selecting bonds or setting sector weights.

- Investment firms with deep resources can support the efforts of fundamental research, quantitative analysis, and expert trading, all of which may help actively managed funds outperform their benchmarks.

- Several additional active strategies for bonds may also increase opportunities for total return in excess of the benchmark, in a variety of interest-rate, volatility, and credit environments.

Bond funds can offer income, diversification, and liquidity to an overall portfolio important features when investors are considering the right mix of assets for achieving their investment objectives. This article describes how experienced managers of active bond mutual funds and exchange-traded funds (ETFs), drawing on expert research and trading support, can add value by discovering attractive investment opportunities caused by bond market inefficiencies. Moreover, active bond fund managers can choose bonds from a wider opportunity set (i.e. range of potential investments) than a passive index fund can, and may employ other investing strategies that may contribute to improved overall performance. These advantages exist in a variety of market environments, including when interest rates are on the rise.

Experienced active managers, supported by research and trading experts, seek to earn excess returns (returns greater than those of the benchmark index). In contrast, passive investment strategies seek only to match a benchmark index, by attempting to mirror the characteristics of the underlying index and by generally limiting the field of potential investments to securities that meet the indexs inclusion criteria. Active managers can consider a much broader spectrum of potential investments, and can act on informed assessments and market outlooks, constructing a portfolio that may differ from that of a passive strategy. Over the past five years, these advantages have allowed the majority of active managers in various bond fund categories to outperform fixed-income benchmarks (see Exhibit 1 ). Because passive strategies also charge a fee, the performance differential of actively managed bond funds and ETFs relative to passive may be even greater than the differential between an active strategy and the benchmark.

A large and diverse bond market is inefficient, and offers the opportunity to add value

Pricing inefficiency refers to the possibility that the market price of a security may not match its intrinsic value. Active managers may seek to capitalize on market inefficiency by buying bonds that they view as being underpriced and selling bonds they deem overpricedin other words, buying low and selling high.

Another potential source of inefficiency stems from the bond markets size and complexity. According to the Securities Industry and Financial Markets Association (SIFMA), the U.S. bond market had an aggregate value of $35 trillion as of June 30, 2014, a notable increase from $21 trillion ten years earlier (see Exhibit 2 ). Note also that the proportions of various sectors within the bond market have changed significantly over the past 10 years. For example, U.S. Treasury bonds have grown from 18% of the market to 34%.

In such a large market, a wide variety of borrowers issue bonds, and these securities can differ by sector, sub-sector, credit quality, seniority, collateralization, payment structure, coupon, coupon type, maturity, optionality, and expected secondary market liquidityeach of which can affect the market price of a bond. Indeed, the market values of many of these factors are not pre-determined; they are subject to the markets evaluation, and can change over time. Experienced active portfolio managers can use fundamental and quantitative research to make qualitative assessments about security selection, which may lead to outperforming the benchmark index.

An active bond strategys holdings are informed and intentional

One important quality of active bond funds and ETFs is that the composition of investments is intentional. In contrast, the composition of a passively managed portfolio is intended to replicate the exposures and the performance of a benchmark index, which may not reflect an active fund managers assessment of intrinsic value.

How important might this intentional composition be? As an illustration, consider the sector-level dispersion of returns in Exhibit 3. shown as a range around the annual return of a generally representative and widely used index, the Barclays U.S. Aggregate Bond Index. Over each one-year span, different sectors of the bond market have had a range of returns relative to the aggregate market overall. An active portfolio manager may seek to generate excess return by overweighting (buying more of) sectors the manager perceives to be likely to generate better returns, while underweighting (buying less of) the remaining sectors. 1

In contrast, a passively managed portfolio would be expected to maintain sector allocations that closely mimic that of its benchmark index. In other words, the sector allocations of a passive index fund are based on the current proportions of various sectors within the benchmarkwhich is related primarily to which sectors have issued the most debtrather than on an active assessment of the merits of any one sector relative to another.

Like that of the overall bond market itself, an indexs composition by sector may change over time, which can have a meaningful impact on the performance and characteristics of the index. Consider Exhibit 4. which shows the ten-year change in sector proportions of the Barclays U.S. Aggregate Bond Index, an index intended to be broadly representative of taxable U.S. investment-grade bonds. Notice, for example, that U.S. Treasury bonds have expanded from 24% of the index in 2004 to 35% in 2014, a significant shift in sector weighting that is not connected to whether that sector has become overvalued or undervalued relative to the general market. A passive index strategy would try to follow that change in proportion, likely changing the return and risk expectations of the portfolio over time. In contrast, an actively managed fund or ETF can determine which sectors are most likely to maintain an optimal balance of risk and return.

An active manager has a much larger opportunity set

The Barclays U.S. Aggregate Bond Index is a widely used and well-respected benchmark that strives to be representative of the overall investment-grade fixed-income market. However, even though this index contains more than 8,000 securities, it represents just a subset of the broader bond market. As noted earlier, SIFMA estimates that the U.S. bond market had an aggregate market cap of $35 trillion as of June 30, 2014. In contrast, the comparable value for the Barclays U.S. Aggregate Bond Index was $15 trillion (see Exhibit 5 ). Therefore, an actively managed portfolio could have an opportunity set that is much larger than that of a passively managed portfolio benchmarked against the Barclays U.S. Aggregate Bond Index.

This difference in opportunity sets arises from the inclusion criteria that Barclays applies to its index (see Exhibit 6 ). These criteria are firmly (and appropriately) adhered to by the benchmark index, and also by the passive portfolios that attempt to mirror it. Maintaining clear criteria supports the transparency and usefulness of the index, contributing to its popularity as a benchmark. However, the wider opportunity set for active managers can allow active bond funds and ETFs to hold investments that resemble those within the benchmark but, due to higher yields or pricing inefficiency, have greater potential for return. 2

The benefit of fundamental research, quantitative analysis, and trading expertise

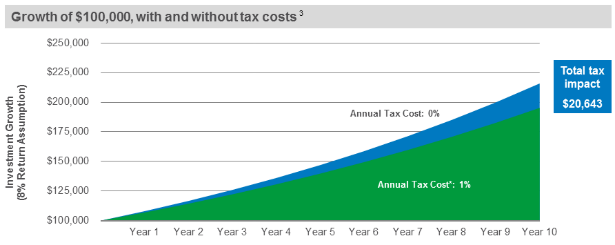

Because the opportunity set is so wide, an active bond strategy can benefit from broad and deep expertise. We have discussed how the size of the bond market and its complexity can present an advantage to active managers who can identify and invest in bonds that the market may have undervalued. However, the extent of this advantage is partly determined by the quality and quantity of fundamental research and quantitative analysis used to find investment opportunities, and by the trading expertise a fund can bring to bear. The fees that active managers charge are typically higher than those of passive index funds, which is often necessary to build and maintain the research, analysis, and trading capabilities intended to augment returns. 3

The Role of Research Analysts

Fundamental analysts are charged with developing informed views of the issuers, industries, and sectors that they follow. This fundamental research can help assess whether a bond is undervalued or overvalued by the market. Quantitative analysts develop sophisticated models that help assess risk relative to potential return and to manage risk in an overall portfolio. With input from both types of analysts, an active portfolio manager can assess how to invest fund assets to try to increase returns while maintaining an intentional level of risk.

The Role of Bond Traders

Experienced and well-resourced bond traders may also play an important role, because the majority of the bond market trades over the counter (i.e. pricing is determined on a case-by-case basis), often requiring that buyers and sellers negotiate. Specialized trading experts covering all sectors of the bond market can help an active fund manager stay informed of up-to-the-minute market valuations and trends, and can help ensure that the quality of trade execution remains high. Also, expert traders can monitor the flow of trading and find opportunities for purchasing specific bonds opportunistically (such as when, for various reasons, other investors may be required to sell).

Active strategies have additional tools to generate excess returns and manage risk

In the current bond market environment, many investors see low yields and the specter of higher rates as a threat to returns from bond allocations. However, active bond managers can use many strategies to help investors generate returns and manage risks, even within a rising-rate environment. The key concept is that active managers have the flexibility to change some important characteristics of the portfolios they manage, and can also benefit from trading opportunities.

Because of the dynamic nature of the holdings of an active bond fund or ETF, active managers can use a toolbox of strategies with the potential to enhance total return (the return generated from both interest income and capital appreciation), in a variety of different market environments. In particular:

For a more detailed discussion of these strategies, see the Leadership Series article Actively Pursuing Total Return in Bond Funds (June 2014). The general point, however, is that active bond funds have many ways to help generate excess returns, even in an environment of rising interest rates that some bond investors might consider unfavorable.

Investment implications

Many investors seek exposure to bonds for three key characteristics: income, portfolio diversification, and liquidity. How they achieve this exposure should be consistent with their overall objectives. Passive index funds offer the ability to invest in a set of bonds chosen to be representative of the benchmark indexboth the risk and the return of a passive fund are expected to be congruent with that of the benchmark. In contrast, active bond funds offer investors the potential for returns exceeding those of the index. Active managers can take advantage of pricing inefficiency, a wider opportunity set of possible investments, and the flexibility to make qualitative judgments about the weighting of various bond sectors within a funds holdings. For well-resourced active bond funds, fundamental research and quantitative analysis may help to identify undervalued and overvalued bonds, while expert traders may help to negotiate better prices. In addition, various active strategies can augment total returns for active bond funds and ETFs, even in a rising-rate environment. Overall, many different types of investors may benefit from including active bond funds and ETFs in their portfolios.

Why some investors choose passive bond funds

Passively managed bond funds and ETFs have seen dramatic inflows since they were first introduced in the 1970s and in 2002, respectively. For certain investors, some passive index funds may be more appropriate for their objectives.

Index funds offer constrained sets of portfolio holdings, making them good building blocks for investors seeking precise exposures to different sectors or different maturity ranges within the bond market. Also, the volatility of the monthly returns experienced by a passive strategy should closely match that of its benchmark; active strategies, in the pursuit of higher returns, may experience higher volatility. Given that index funds seek to match their benchmarks rather than outperform them, they might employ fewer analytical resources, which may lead to lower operating expenses and lower fees. Moreover, because many index funds do not buy and sell securities as frequently as do actively managed funds, they tend to incur lower trading costs. In addition, limited trading activity might make index funds more tax efficient for some investors.

Overall, passive bond strategies allow investors to realize returns that closely approximate those of a benchmark index (minus fees) in all market environments, with risk profiles very similar to those of the benchmark.

Choosing the right active bond fund or ETF