Why are TIPS Yields Negative

Post on: 16 Июнь, 2015 No Comment

You can opt-out at any time.

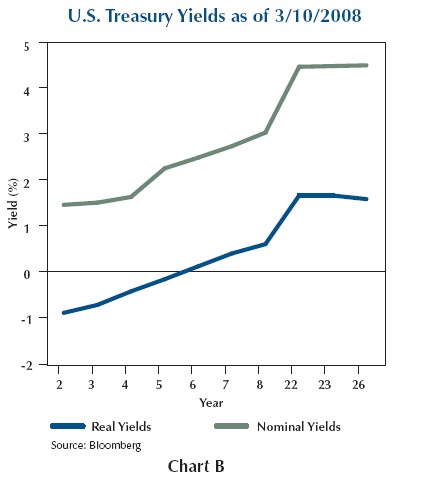

Beginning in late 2010, Treasury Inflation Protected Securities (TIPS) began trading with a negative yield – meaning that investors were paying the government for the privlege of holding its debt, rather than the other way around. For example, on July 17, 2012, the 5-year TIPS had a yield of -1.21% while the 10-year stood at -0.64%, the 20-year at -0.01%, and the 30-year at 0.37%. How can this be? And why would investors accept a negative yield?

The answer is that the yield on a TIPS bond is equal to the Treasury bond yield minus the rate of expected inflation. As a result, when standard Treasury bonds are trading at yields that are below the expected inflation rate – as has been the case since late 2010 – TIPS yields will fall into negative territory.

Let’s look at July 17 again as an example. On that day, the 10-year Treasury note was yielding 1.49%. However, based on the comparative yields of TIPS versus plain-vanilla Treasuries, investors were expecting inflation of about 2.13% in the next ten years. If you subtract this 2.13% from the 10-year yield of 1.49%, the result is a negative number for the 10-year TIPS: -0.64%. As long as Treasuries continue to offer yields below the rate of expected inflation, TIPS will remain in negative territory.

Why Would Investors Accept Negative Real Returns in Treasuries?

Investors’ quest for safe investments amid concerns about the debt crisis in Europe drove the yield on plain-vanilla Treasuries below the rate of inflation. In other words, safety has been such a high priority that investors have been willing to accept a negative real (after inflation) return on Treasuries in exchange for a guaranteed return of principal.

Why Would Investors Buy TIPS at a Negative Yield?

Investors continued to purchase TIPS at negative yields for three reasons: 1) their strong price performance in the recent years (and the expectation that it will continue), 2) safety of principal, and 3) expectations that the Federal Reserve’s stimulative monetary policy (highlighted by its quantitative easing initiatives) will cause inflation to accelerate in the years ahead. If inflation does indeed accelerate at a rate higher than the market expects, investors could still earn a positive return on TIPS despite their negative yields because TIPS’ principal adjusts upwards with inflation. Looked at another way, a buyer of the 10-year TIPS at -0.64% expects that the inflation adjustment on TIPS will be more than 2.13%, which would allow he or she to come out ahead of the 2.13% on the 10-year plain-vanilla Treasury note.