Why are mortgage rates increasing all of a sudden

Post on: 16 Март, 2015 No Comment

Read and share of this what you will. It’s a bit of a synopsis of how mortgage rates got so low, why they’re recently going up and where they’re going in the near future. All personally written.

So, what’s going on with mortgage rates?

Rates have seen a very nice period of decline in the past 6 months. We’ve seen rates hit as low at 3.75% on a 30 year Fixed – truly at historically low levels.

Lenders have sustained very low rates (around 4%) for much of this entire period, up until the last 10 days.

In mid 2008, the Federal Reserve put together an “asset buying” program in the amount of $1.3 Trillion. Much of these funds were used to purchase the financial vehicle that has direct impact on long term mortgage rates –named Mortgage Backed Securities (MBS). Contrary to common belief, banks don’t control mortgage rates, the Fed doesn’t, mortgage companies don’t, the President doesn’t, etc. The only thing that impacts (par/base mortgage rates) is market demand (purchasing) of Mortgage Backed Securities (MBS).

This is what caused mortgage rates to significantly come down during much of the last 18 months.

As evidenced from this (above) two-year chart of Mortgage Backed Securities below (Green/Up is rates going lower. Red/down means rates going up). You can see how in November ’08, rates were falling fast. We went from rates being close to 6%, dropping down to 5% within a very short period.

So, needless to say, the $1.3 Trillion buying program worked. And it worked well.

You can see from this chart (left, same 2-year timeframe as previous chart), rates continued to decline once again in April of this year (2010). Poor economic news, stock selloffs, Foreign countries on the verge of going bankrupt (read Greece) were among the reasons for mortgage rates continued decline. 30 Year Fixed rates went from about 5.0% down to our unbelievably low levels of the upper 3’s% (3.75%)

This chart (above) is showing a shorter time-frame of the most recent 6 month time-frame. You can see designated Arrow 1, showing the start of the run up of demand of Mortgage Backed Securities (MBS) giving the low historical rates. This past 6 to 7 months sure have been a wild ride with rates coming down steadily.

Then note designated Arrow 2. This is at the top of the market (lowest rates), the date was November 4th.

From this day, for about the next 10 days, it has sent mortgage rates higher than we’ve seen in 3 to 4 months! Since the 4th of this month, mortgage rates have increased about .375% to .625% depending on the product. 30 Year Fixed Rates today are around 4.25% to 4.375%.

So, what happened on November 4th to cause rates to increase?

As you may have heard in the news, the Fed recently rolled out a NEW asset buying program called “Quantitative Easing 2” or also known as “QE2”. Remember the $1.3 Trillion buying program in mid 2008 I mentioned earlier? Yes, this is version two, with a few slight changes. Only this time, the Fed announced an amount of $600 Billion, which was a bit more than the market had expected so it was received pretty well (for those that supported the influx of money into the system). The purpose of this injection of funds, among many things, is to basically increase the liquidity of money supply and further stabilize our financial markets. One by-product of doing this is that there will be additional purchasing of some Mortgage Backed Securities, to further stabilize or raise their prices and thereby lower long-term interest rates. The Fed sees the housing market being a foundation to continue an economic recovery and wants to keep rates low and not lose momentum with homebuyers.

But wait a minute…why did rates go up this time instead of rates going down like they did last time the Fed did this?

Great, great question, I’m glad you asked. Not to reduce the answer to one simple question, but it pretty much does the trick. One word: Inflation. (Well, more accurately – perceived inflation.) There hasn’t been any true hard data showing inflation – so at this point, it’s mainly with the concern of inflation, rather than factual reported data.

Poor economic news is generally (again generally) good for long term mortgage rates. Bad economic news, stock market falls, bonds (MBS) go up, mortgage rates go down. Just the opposite happens when good news is announced in the market. The one “bad news” that is the exception is, you guessed it: Inflation.

Mortgage Backed Securities (MBS), among other treasuries…hate…loathe inflation. Without going too far into inflation, it basically devalues the bond, making it worth less. Thus the market doesn’t want to buy them and this sends rates higher.

Inflation = higher mortgage rates!

During the previous $1.3 Trillion Fed stimulus program, there was as much talk about deflation as there was inflation (deflation of course is the opposite of inflation). So this pretty much balanced out the “inflation scare,” this time it’s different. Inflation, in the recent 10 days, has been a significant concern to the marketplace, thus causing a legitimate increase in mortgage rates. Yes, having the exact opposite effect the Fed intended.

So, where are rates going now?

Ahh, yes…the million dollar question.

If the new QE2 and natural market purchase Mortgage Backed Securities (MBS), we’ll see rates stabilize or go back down.

If we see improved market/economic news and QE2 not doing its’ job, we may not see them improve much at all. One interesting thing to add, yesterday morning, renowned investor Warren Buffet basically says he thinks there is a “Bond Bubble”. He says that buying bonds and treasuries (again, that included Mortgage Backed Securities) is a bad investment. He says, “I think short-term and long-term bonds are a very poor investment at the present time.” Of course, this is only one man’s comments, but a man that understands U.S. markets very well. These comments may end up moving the market and discouraging the purchasing of this product. You can read his full article here if you want to read more into it.

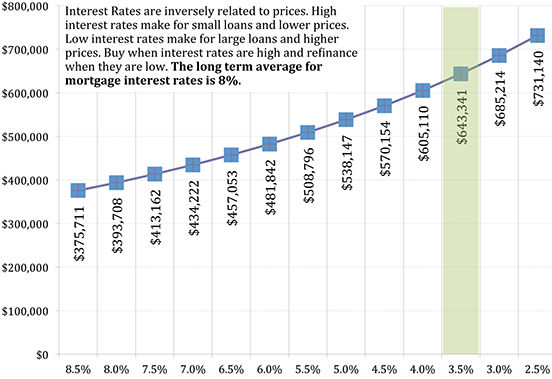

In the end, we need to encourage our buying clients that now is the time to buy. Rates are at a point now that many analysts are saying can’t go any lower. Encourage your clients to read this to give them an understanding that rates, at this point, are more likely to go higher, than go much lower.

Let us know if your clients need anything regarding lending or mortgage services. Please feel free to send this to your clients or other agents in your office. Also, we are scheduling office speaking times for next month – let us know if your office could benefit from it.