Why Are Japanese Still Dumping Foreign Bonds

Post on: 16 Март, 2015 No Comment

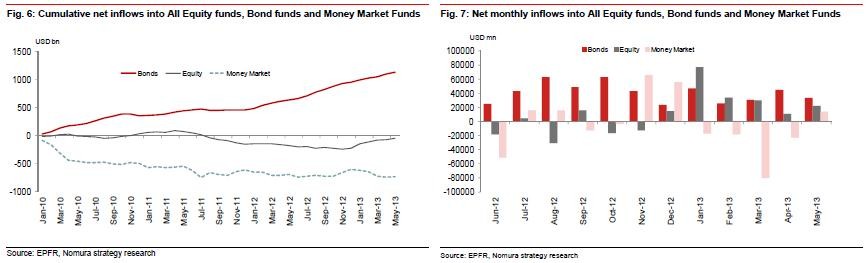

There are great expectations that Japanese companies flooded with liquidity will pour some of it into foreign bond markets, but latest capital flow data published on Thursday tell a different story.

Japanese institutions were net sellers of foreign bonds for a sixth straight week, selling 862.6 billion yen ($8.7 billion) in overseas debt for the week ended April 20, according to weekly data from the Ministry of Finance, more than double the net 331.9 billion in the previous week.

The country’s latest $1.4 trillion monetary stimulus program has raised hopes among investors that Japanese liquidity will now be used to buy foreign assets like bonds, but this has yet to happen in a big way.

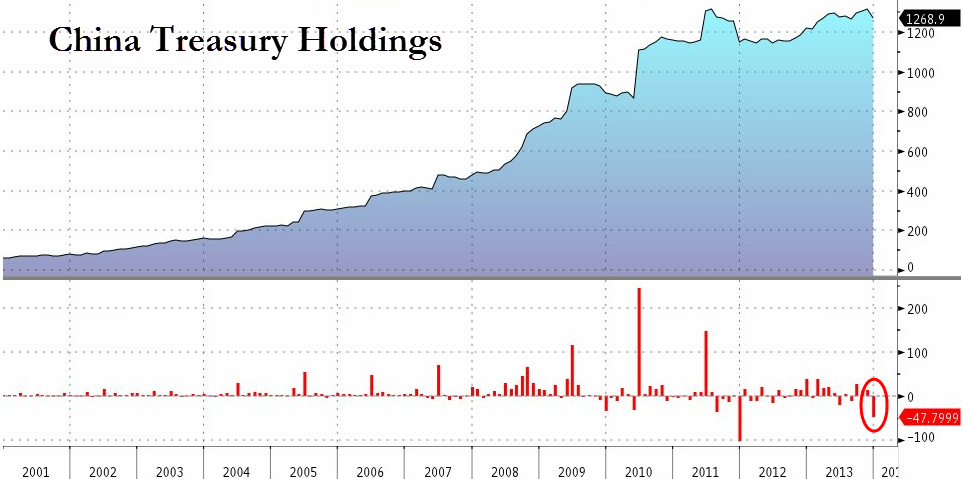

And a large driver behind this, according to market watchers, is Japanese firms taking advantage of the recent fall in U.S. Treasury yields — which move in the opposite direction to prices — to sell U.S. bonds and repatriate funds back home.

The steep deprecation in the yen also makes it the right time to repatriate overseas investments, said experts.

Tomohiro Ohsumi | Bloomberg | Getty Images

They are making gains from the fact that bond prices are picking up, and with the yen depreciating. The profit there is too good to turn down, Evan Lucas, market strategist at IG markets told CNBC.

The yield on the benchmark U.S. 10-year Treasury note has fallen from above 2 percent in March to 1.7 percent. While, the yen has depreciated over 7 percent against the U.S. dollar since the beginning of last month.

However, it may not be long before Japanese institutions turn into net buyers of foreign bonds, according to Uwe Parpart, managing director at Reorient Financial Markets, who sees this shift taking place by mid-May.

The reason why is that the cumulative effect of bond purchasing by the Bank of Japan will further depress [Japanese government bond] yields, and the actual effect will be such that institutions such as life insurers will be forced out of Japanese bonds and into foreign bond buying and equities, said Parpart.

The Bank of Japan (BOJ) is set to purchase around 70 percent of government bonds issued each month, driving yields lower and crowding out private sector investors. Japanese banks, insurers and pension funds have around three quarters of their securities portfolios in domestic debt, according to Deutsche Bank.

He expects the primary destinations for Japanese liquidity will be U.S. Treasurys, due to their low risk nature and liquidity of the market, as well as Australia’s AAA-rated government bonds.

Japanese institutions that can take on more risk may enter higher yielding European bond markets including that of Italy, Spain or France, he added.