Why Are Dividend Investors Getting Nervous

Post on: 16 Март, 2015 No Comment

Nervous? Me? No. You?

It’s no secret that there is a lot of concern amongst dividend investors these days; it seems that everybody and his dog in the financial press is asking (and then answering) the question: Is it time to get out of dividend-paying stocks? (Some people are even messing with their readers, including Robb, over at Boomer & Echo .)

Generally, their answers are: No, you shouldn’t dump your dividend stocks. Why? Because:

- interest rates may yet stay where they are for some time, so don’t leave the party early; market timing is a mug’s game

- a properly diversified portfolio is already prepared to take advantage of a rise in interest rates if and when it comes

- stock picking and sector rotation are not games that most individuals can win on a consistent basis; it is far better to pick your strategy and stick with it.

That’s all well and good, but that doesn’t answer the question that I’ve heard posed around the water cooler a few times recently: If rising interest rates are ultimately a sign of a healthy economy, why are people worried about dividend stocks falling? Here’s why:

To understand the answer to this question, you have to understand what bonds are, and how they work. Bonds are loans that investors make to companies or governments. The companies or governments pay interest on those loans at pre-determined rates for a pre-determined amount of time, and then the original capital is returned to the investor. Bonds are considered among the safest of investments. If a company goes under, the bond holders are the first to get paid when the company’s assets are divided up. Also, unlike dividend payments, bond interest payments are a legal obligation.

With interest rates so low over the past years, bond investors have been forced to look elsewhere for yield. In terms of predictability and security of income, divendend-paying stocks are only one rung below bonds — a big rung, to be sure – but the next best alternative.

Dividend investors chuffed

The result of all of these new stock investors (i.e. the former bond investors) jumping into the stock market is that the price of many dividend-paying stocks has climbed higher, as there are more and more buyers for these large, liquid, relatively stable companies. This is primarily what has driven the prices of these companies up over the past few years. Many of the people who were in dividend stocks when this started (myself included, I have to admit) have been feeling the thrill of the buy low, sell high investor, as prices have risen ever higher.

Rising prices have attracted traders, pushing prices higher yet. While the party lasted, everybody was having a great time.

The fat lady is just about finished warming up

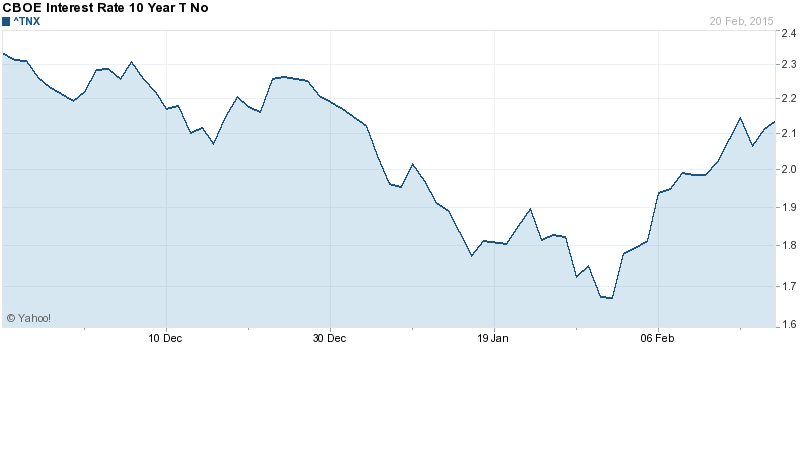

Now that interest rates look set to rise again, bond investors will go back to what they know: safe, secure, regular bond payments. Of course, to invest in bonds, they will have to sell their stocks. Large numbers of people selling large numbers of shares inevitably leads to lower prices. Traders, seeing the writing on the wall, don’t want to get caught holding the bag, so they sell as well, and the result is falling stock prices, like we have had over the past month or so.

To me, it seems inevitable that the recent drops in dividend-paying stocks will continue over the next several months. How far, and how fast prices will fall, I have no idea, but the direction seems sure. The most important thing for dividend investors to remember is to focus on the number that really matters: not the total value of the portfolio, but the amount of money your stocks generate for you.

So, no, don’t sell your dividend-payers.