Why are 30 year fixed mortgage rates increasing so much over the past month Interest on

Post on: 16 Март, 2015 No Comment

This is puzzling to me considering the economy and peoples need to refinance. You would think that the rates would drop or remain lower in order to encourage more buyers to enter the marketplace. So, why have average rates jumped from 5.75 to 6.50 over the last month? Will they drop back during the spring?

Interest on Mortgage Recommends:

4 thoughts on Why are 30 year fixed mortgage rates increasing so much over the past month?

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D68&r=G /% Linds on February 9, 2012 at 7:20 pm said:

Rates have good up because banks are taking such a loss on the foreclosures. By chraging a higher interest rate to new buyers, and those you refinance they are trying to make up their loses. Dont be suprised if the FED cuts again march 18th, that rates stay the same or slightly drop. I was selling 5.0% in January and the beginning of February, I can not get any rates under 6.25% now. If you are looking to buy or refinance, do it NOW. Purchasing season is coming, and banks will not let the rates be lower knowing people are going to be buying homes since the price of homes are so good, this is how they make their money.

Good article in the wall street journal.

The Fed and You: Dont Wait to Refinance

Why Mortgage Rates May Not Go Lower

What does the Feds move mean for your money?

Simple: If you were planning to refinance your mortgage but you hadnt gotten around to it, do it now.

See a mortgage broker this afternoon or tomorrow morning. Call in sick if you have to. Dont wait.

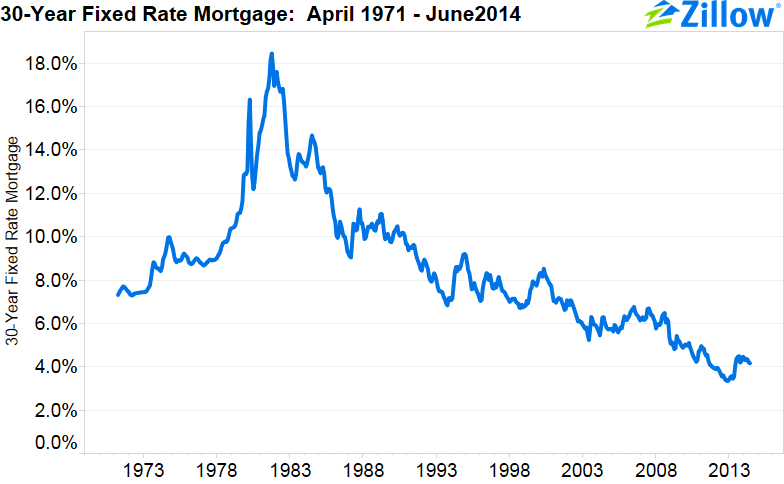

Thirty-year fixed rate loan rates have been on the floor recently, but the response to the Feds move suggests that may not last.

The yield on 30-year Treasurys rose nearly a tenth of a percentage point this afternoon to 4.42%.

(If youre wondering why long-term rates would rise as the Fed is cutting short-term rates the two do not move together, and in fact often move in opposite directions. This is because long-term yields are priced off long-term growth and inflation expectations. If the Fed steps in to boost short-term liquidity, by cutting Fed Funds, the market may fear that that will add to inflationary pressures down the road.)

On its own, todays move in Treasurys isnt huge. But over the past few days the rates have risen noticeably, from a low of just 4.10% late last week. The yield on the 10 year has risen also risen, from a low of 3.28% to 3.71%.

Long-term mortgage rates, ultimately, are priced off of long-term government bonds. If those yields continue to rise, mortgage rates will follow suit.

And theres plenty of reason to think this might happen.

The Fed has shown it is more worried about a near-term slump, and the outside risk of falling prices, than it is about long-term inflation. It was the supposed risk of a serious crash, and maybe even falling prices, that had driven yields on government bonds so low.

The Fed has now slashed its fed-funds rate target to 3% from 4.25% in 10 days. Thats a 30% cut in short-term borrowing costs.

Its hard to see how they can pump this amount of liquidity into the system without adding to inflationary pressures that are already building.

Food and energy prices are being driven much higher by the massive shifts in population and industry in Asia, over which the Fed has no control. Thats why food and beverage inflation is now running at 4.8% a year, twice the rate of the first part of this decade and the highest level since 1990.

Readers need no reminding about energy inflation, which has averaged nearly 7% a year for five years now.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D68&r=G /% DEB A on February 9, 2012 at 7:20 pm said:

I just asked the same question. I am so frustrated with my house still for sale here in jersey, watching the rate climb, yet the banks rates r dropping. Yeah, thatll help the economy!(at least my portion of it!)NOT

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D68&r=G /% John R on February 9, 2012 at 7:20 pm said:

As you know interest rates were inverted last year. The short term rates were higher than the long term rates. This is a sign that those investing in bonds feel better above the short term economy than the long term. Or, they just dont feel good about the long term. The spread in the rates are now correcting. If you look at the Federal Reserve interest reports H-15 (available on line). You will notice that the 10 year bond rate has increased by 35 points in the last 30 days. Mortgages are priced with a spread over the expected long term yield on bonds. So while the short term rates are declining long terms are increasing.

I would not look for much of a drop in rates on mortgages. With discussion of inflation, I expect short term interest rates to drop than start back up by the end of the year.