Why Alternative Investments and What are Alternative Investments

Post on: 11 Май, 2015 No Comment

Posted on November 15, 2011 by admin

Alternative investments or alternative assets have become more popular because returns for the stock market have been well below the long-term averages. Yet most investors and retirement plan owners do not own or have exposure to alternative investments. In addition, we don’t have a good definition of alternative investment strategies for everyday investors and retirement plan owners.

The first question is, “What are alternative investments?” Let’s start with the Wikipedia definition:

“An alternative investment is an investment product other than the traditional investments of stocks, bonds, cash, or property. The term is a relatively loose one and includes tangible assets such as art, wine, antiques, coins, or stamps [1] and some financial assets such as commodities, private equity, hedge funds, venture capital, film production [2] and financial derivatives.”

This is a fine definition, but one that still leaves most of us in the cold for several reasons. Hedge funds, private equity and venture capital funds are restricted to high-net-worth investors called accredited or qualified investors. According to Investmentnews.com. in 2010 91% of investors did not meet the accredited or qualified investor requirements. In addition, the definition does not define what constitutes a viable alternative investment for IRAs or retirement plans. This kind of broad definition and the limited access to these funds are some of the reasons alternative investments can be intimidating or confusing for IRA and retirement plan owners.

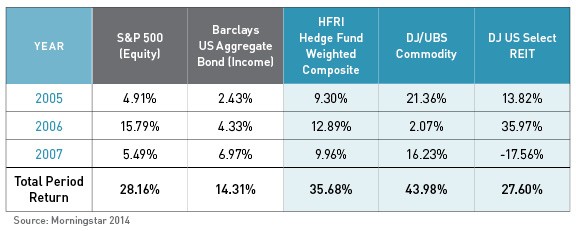

Next is, “Why alternative investments” or “Why use alternative investments”? What is the benefit of alternative investments anyway? Viable alternative investments provide one main and very important benefit, and that is, returns that are uncorrelated with or do not track the broad stock market indexes. Good alternative investments reduce the risk to our portfolio by lowering exposure to the stock market. That is the primary advantage and a very big benefit. If a so-called alternative investment, alternative ETF or alternative fund tracks the stock market and goes up and down with the stock market, then the investor has gained very little, if any, benefit.

The next issue is fees. Hedge funds typically charge a 1% to 2% flat fee and a 20% percentage of profits. These charges result in effective fees being in the 3.5% to 4% range. These high fees limit performance for hedge funds and can cause hedge fund returns to lag the market, especially in the good years. Mark Kritzman published “Portfolio Efficiency with Performance Fees” in Economics & Portfolio Strategy. Kritzman found that with the traditional 2% flat fee and 20% of profits almost no money should be allocated to hedge funds. However, if these alternative investments charged a 2% flat fee and no other fees, then 74% of a portfolio should be in hedge funds and 26% allocated to index funds.

The lesson for us is finding and adding alternative investment strategies in which the fees are in the 2% range with no additional percentage of profits.

Another issue is access for everyday investors. The accredited investor rule states that investors must meet the following requirements: have a net worth of $1 million excluding their house; or earn $200,000 for single investors and $300,000 for married investors in the two most recent years. Again, this leaves out 91% of investors. In addition, hedge funds have many other less-than-desirable characteristics, which you can read more about by downloading Chapter 3 from Less Risk, More Return from the home page.

And last is, for true diversification, we need alternative investment strategies that do something different from traditional buy and hold investments We need strategy diversification so that our alternative investment strategy is doing something different than the rest of our portfolio. This gives us a chance at real diversification, which can lower our overall risk.

Putting these criteria together provides a more useful definition for what a viable alternative investment looks like:

- Not require accredited investors status to invest

- Flat fees in the 2% range or less

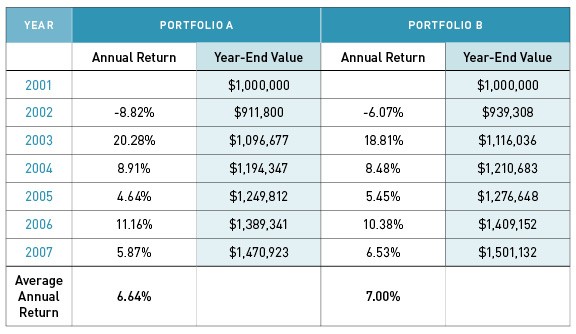

- Provide positive returns during periods of poor performance of the stock market (1999-2008 is a great example). This is the primary benefit we are looking for.

- Use everyday investments like stocks, bonds, mutual funds or ETFs that can be held in an IRA or retirement plan.

- Not use a buy-and-hold strategy as traditional portfolios do.

Investments that meet these five criteria have tremendous value for investors and retirement plan owners. Remember, the 9% of the population who can use these kinds of investments are using them with great success. According to the Institute for Private Investors, ultra-high-net-worth investors have over 40% of their portfolios in alternative investments. Super Endowments like Harvard and Yale have over 50% of their portfolios allocated to alternative investments.

So, the answer to “Why alternative investments?” is they reduce risk, increase our returns and can increase the odds that we will hit our investment or retirement goals on time.

I could not identify a good name for this kind of alternative investment and will leave that to someone else. If someone can come up with a great name for this kind of alternative investment, they will win a $25.00 gift certificate to www.amazon.com. Email the name to me at lee.hull@lessriskmorereturn.com and put “alt investment name” in the subject. I will post the winning name for this kind of investment in another blog post.