Which Vanguard Money Market Fund

Post on: 23 Июнь, 2015 No Comment

by Harry Sit on April 10, 2007 27 Comments

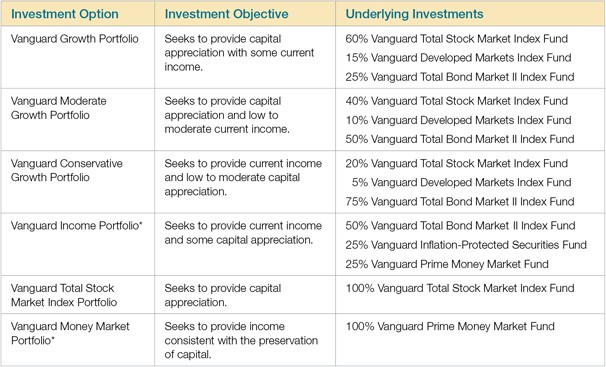

I mentioned in my simplifying finances post that I use a Vanguard money market fund instead of an online savings account for my short term savings. I use a Vanguard money market fund for simplicity and because it gives me a higher yield after tax. Vanguard offers 4 taxable money market funds and 6 tax exempt money market funds. Which one do you choose?

They are all good. The main difference among the 10 Vanguard money market funds is how the funds income is taxed at the federal and state level. Which one will be slightly better than others for you depends on your federal and state marginal income tax brackets, whether you itemize state income tax deductions, whether you will pay the Alternative Minimum Tax (AMT), and the percentage of the funds income derived from private activity bonds subject to the AMT.

The income from money market funds may be called dividends but it is really just interest. It doesnt get the special tax treatment for qualified dividends.

1. Vanguard Prime Money Market Fund (VMMXX). The income from this fund is taxed at both the federal level and the state level.

There is also a Vanguard Federal Money Market Fund (VMFXX). For customers in California, Connecticut and New York, the Federal fund is also fully taxable at both the federal level and the state level, just like the Prime fund. For customers in other states, about 20-25% of the income from the Federal fund is taxed at the federal level but not at the state level; the other 75-80% of the income is fully taxable at both levels.

2. Vanguard Treasury Money Market Fund (VMPXX) and Vanguard Admiral Treasury Money Market Fund (VUSXX). The income from these two funds are taxed at the federal level, but not taxed at the state level. The difference between the regular fund VMPXX and the Admiral fund VUSXX is that the Admiral fund is cheaper by 0.16% and it requires a $50,000 minimum investment versus $3,000 for the regular fund.

3. Vanguard Tax-Exempt Money Market Fund (VMSXX). The income from this fund is not taxed at the federal level, but a majority of it is taxed at the state level. Income from private activity bonds in the fund is subject to the Alternative Minimum Tax (AMT).

4. Vanguard state-specific Tax-Exempt Money Market Funds. There are five of these, for taxpayers in CA. NJ. NY. OH. and PA. If you are a New Jersey taxpayer and you buy the Vanguard NJ Tax-Exempt Money Market Fund, the funds yield is taxed neither at the federal level nor at the state level. These funds are sometimes referred to as double tax free funds. Income from private activity bonds in these funds is subject to the Alternative Minimum Tax (AMT). If you dont live in these five states, then theres no point in buying these. Consider instead the national tax exempt fund Vanguard Tax-Exempt Money Market Fund (VMSXX).

5. AMT Tax-Free Money Market Funds. If you pay AMT, a state specific tax exempt money market fund that doesnt invest in private activity bonds may yield higher for you after tax. Income from these funds is exempt from AMT. Unfortunately Vanguard doesnt offer this kind of funds. Fidelity and Schwab are the only places I know that have them. Fidelity has these funds for four states: CA, MA, NJ, and NY. The minimum initial purchase is $25,000, although you can drop down to $10,000 after the initial purchase. Schwab also has funds for the same four states, but Schwabs funds are in general more expensive than Fidelitys.

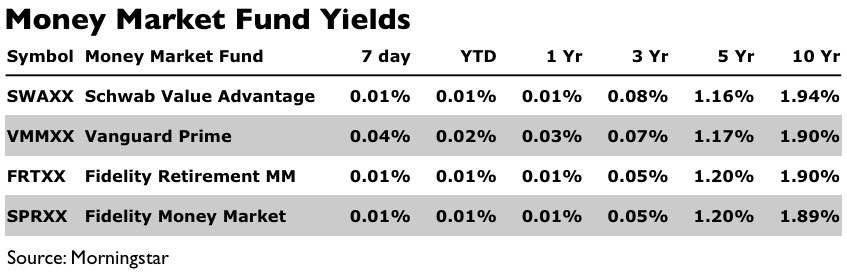

In order to calculate which fund pays the highest yield after all taxes are taken into consideration, first you have to know what the funds pay before tax. Vanguard provides this information on their web site. For example heres a snapshot for the Vanguard Prime Money Market Fund as of April 5, 2007:

The Compound Yield is comparable to how the banks calculate APY. It is a net compound yield, after expenses are taken out dont worry about the expense ratio number listed under the compound yield because it is already included in the calculation for the compound yield.

If you will pay the AMT and you are considering tax exempt funds, you will also need to know the % of funds income from private activity bonds, which is subject to the AMT. Vanguard provides that information in the Holdings section for the fund. For example, heres what Vanguard gave for Vanguard New Jersey Tax-Exempt Money Market Fund (VNJXX):

Fidelity lists the yield for their AMT Tax-Free Money Market funds on their website. You will need the 7-Day Effective Yield % number.

After you gathered all the inputs, its time to crank the numbers. I made a calculator for computing both the bottom line, after tax yield and the tax equivalent yield. The fund with the highest after tax yield puts the most money in your pocket after all taxes are paid. You get to see how much difference your choice really makes (sometimes very small, to the tune of less than $1 per $10,000). The tax equivalent yield is comparable to the APY quoted by bank savings accounts.

Although this post is about selecting among Vanguard money market funds and Fidelitys AMT free money market funds, the calculator is generic. You can use it for money market funds offered by any company. You can even use it for regular bond funds, although selecting a bond fund will involve more consideration than just yield.

If the inline frame doesnt come up for you, please access it directly from the hosting site .

For example, at the time I wrote this post, a taxpayer in 25% federal, 6.37% state tax brackets, itemizing deductions, not subject to AMT, is better off with the Treasury or Admiral Treasury fund.

Who knew choosing a money market fund can get so complex?

See also:

Invest Better

Instant diversification in a low-cost ETF portfolio. Convenient and disciplined with automatic rebalancing. Minimize your taxes. Betterment.com .